Recent posts on ESG (environmental, social and corporate governance) investing have received mixed feedback from Wealthy Retirement readers.

Some see ESG investing as a positive source for social change. Others believe it’s a left-wing, anti-capitalist conspiracy.

My goal in writing about ESG is not to take sides or make a political statement. The bottom line is the bottom line. If you want to make money, you need to be aware of ESG issues, which are becoming increasingly important to the world’s biggest investors.

According to the Edelman Trust Barometer, 84% of institutional investors say “maximizing shareholder returns can no longer be the primary goal of the corporation.”

This echoes the Business Roundtable’s new Statement on the Purpose of a Corporation and statements by Larry Fink. Fink is the CEO of BlackRock (NYSE: BLK), the world’s largest investment firm, with nearly $7 trillion in assets under management.

In short, just making money is no longer enough. The mega-money movers are judging corporations on how well they treat their employees, suppliers, local community and the planet.

ESG, or “sustainable,” investing assets hit $30.7 trillion at the start of 2018, according to the Global Sustainable Investment Alliance. That’s a 34% increase versus 2016.

Bank of America predicts another $20 trillion will flow into ESG funds over the next two decades, calling it a “tsunami of assets.”

This “tsunami” started a long time ago as a small ripple in the investing seas.

ESG is the latest incarnation of “socially responsible investing” (SRI), a trend that began in the 1970s and ’80s.

At first, SRI often focused on industries to avoid, notably nuclear power after the 1979 Three Mile Island accident. Oil and gas companies came under scrutiny after the crash of ExxonMobil’s (NYSE: XOM) Valdez oil tanker in 1989.

That disaster coincided with growing concern about global climate change, which today is top of mind.

This week, Goldman Sachs (NYSE: GS) announced restrictions on the services it will provide the fossil fuel industry.

Specifically, Goldman “ruled out direct finance for new or expanding thermal coal mines and coal-fired power plant projects worldwide, as well as direct finance for new Arctic oil exploration and production.”

These restrictions are the strongest among major U.S. banks, and I expect other U.S. financial firms to follow suit.

Still, Goldman “lags behind its leading global competitors,” notably big European investment banks like Barclays (NYSE: BCS), UBS (NYSE: UBS) and Credit Suisse (NYSE: CS).

But ESG investing is not “just” about environmental issues. The “S” and “G” components focus on issues such as corporate board diversity.

For example, State Street Global Advisors, which has nearly $3 trillion of assets under management, launched the “Fearless Girl” initiative in 2017.

The company says 423 firms have responded by adding female directors, and others committed to do so in the near term.

Starting in 2020, State Street will start voting against all board members at companies where it has long-standing concerns about gender diversity and are unable to engage in “productive dialogue” with management.

Similarly, many ESG investors believe it’s important for firms to have separate chairman and CEO roles. In theory, shareholders benefit when a single individual’s powers are limited and there is some oversight on the CEO.

The ABCs of ESG Investing

If you’re convinced ESG investing is not a “fad,” you’re probably wondering: How do I invest in it?

On Wall Street, every investing trend brings new products to market. ESG is no exception. There is a dizzying array of ESG and “sustainable” vehicles available for investors, with more arriving by the day.

The good news is you can slice and dice “ESG” every way imaginable. For pretty much any strategy you can imagine, there’s a mutual fund or exchange-traded fund (ETF) – and typically more than one.

Here is a list of ESG-focused ETFs, including several country-specific funds.

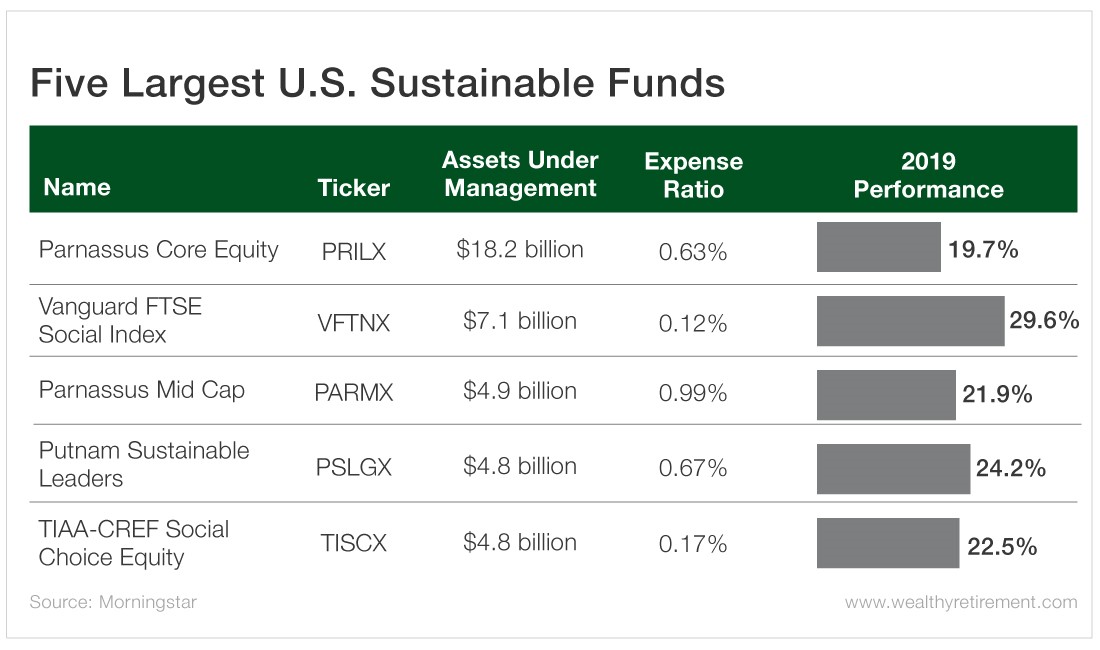

If you’re just starting to invest through an ESG lens, my advice is to stick to the largest funds with the broadest exposure. Via CNBC, here is a list of the largest U.S.-based “sustainable” funds.

Note that the list includes two funds from Parnassus Investments, one of the oldest firms focused on sustainable investing. Since its inception in 1982, the Parnassus Core Equity Fund has outperformed the S&P 500 by about 100 basis points.

Parnassus is not alone in showing ESG investing doesn’t mean subpar performance. And there’s mounting evidence that ESG investing leads to outperformance.

According to Morningstar, 48% of large cap sustainable funds are beating the S&P 500 this year. By comparison, only 26% of overall large cap funds are beating the market.

If you prefer individual companies, the Dow Jones Sustainability World Index is a good place to start your search.

Top 10 holdings include healthcare companies like UnitedHealth (NYSE: UNH) and Abbott Laboratories (NYSE: ABT), as well as tech giants like Microsoft (Nasdaq: MSFT) and Cisco Systems (Nasdaq: CSCO).

One caveat: Technology companies often have high ESG rankings because their impact on the environment is lower than that of companies in many other industries. But ESG investors also focus on shareholder rights – the “G” in ESG.

Megacap tech companies like Facebook (Nasdaq: FB) and Google’s parent company, Alphabet (Nasdaq: GOOG), have dual classes of stocks where individual shareholders effectively have no voting rights.

So you need to be aware of how individual companies fare on ESG ratings, such as those MSCI uses in the iShares MSCI USA ESG Select ETF (NYSE: SUSA). The $1.1 billion ETF holds about 100 U.S.-based companies with the highest ESG ratings.

Whatever approach you take, know there’s still time to get on board the ESG “train.” But rest assured it’s leaving the station and will hit full steam in 2020 and beyond.

Good investing,

Aaron