Investors love guarantees. However, guarantees don’t pay well. If you want a guarantee in investing, you’ll have to lend your money to the U.S. Treasury, and you’ll get somewhere around a 2% interest rate.

An investor could also get a guarantee by investing in annuities – but most annuities are horrible investments with sky-high fees. I’ve discussed how terrible annuities are many times in Wealthy Retirement, including in this piece.

No one would argue that the stock market comes with a guarantee. But for long-term investors, it comes pretty close.

Starting in 1927, if you invested in the stock market for 10 years, you made money in 74 out of 81 rolling 10-year periods – a 91% win rate. The only times you didn’t make money were if you sold during the heart of the Great Depression or Great Recession.

Even if you bought at the top of the dot-com boom in 2000, rode out the dot-com bust and then weathered the Great Recession, you still were profitable over 10 years.

Historically, you have to sell in the middle of a momentous market collapse to lose money over 10 years.

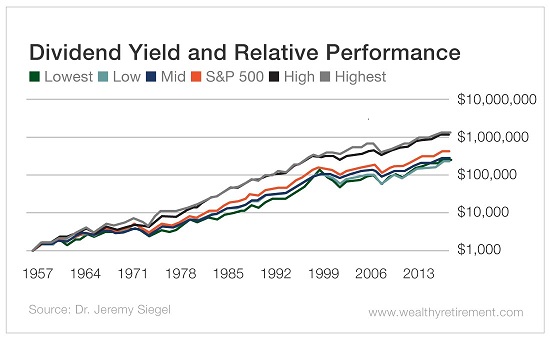

If you invested $1,000 in the S&P 500 in 1957, you would have achieved a total annual return of 10.3%, and your nest egg would be worth $271,337 as of the end of 2018.

That’s pretty darn good.

But you can do better. You can follow a strategy that’s both simple and actually safer than investing in the broad market.

Invest in stocks that pay dividends.

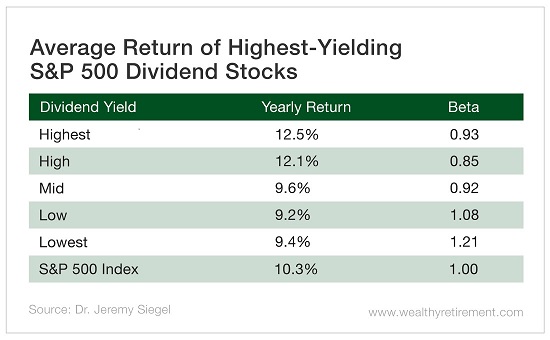

As you can see from this chart, S&P 500 stocks that had the highest dividend yields outperformed the broad index. Remarkably, they were safer too.

The highest-yielding S&P 500 stocks generated a sensational 12.5% average annual total return and turned $1,000 into almost $1.3 million – nearly four times the S&P 500’s total.

And those stocks were 7% less volatile than the S&P 500. The second-highest-yielding stocks were 15% less volatile than the broad market.

Does that mean you should run out and buy the highest-yielding stocks you can find? Of course not. Very high yields often come with very high risk – yet the highest-yielding S&P 500 stocks have generated outstanding returns over the long term and tend to be a bit safer.

Here are the five highest-yielding stocks in the S&P 500.

CenturyLink (NYSE: CTL) – 8.8% yield. This one has a little hair on it. Sales are declining, though the company still generates tons of cash.

Macerich (NYSE: MAC) – 8.6% yield. This owner of malls saw tenants’ rents and sales increase in the first quarter even though one of its tenants, Sears, is in bankruptcy protection.

Iron Mountain (NYSE: IRM) – 7.5% yield. The business software company has a 98% retention rate, but expenses have been rising and margin has been falling.

Macy’s (NYSE: M) – 6.8% yield. The retailer has been struggling to right its ship for several years. SafetyNet Pro rates its dividend safety at “D,” so be careful.

Altria Group (NYSE: MO) – 6.4% yield. The company known for cigarettes now owns 10% of Anheuser-Busch InBev (NYSE: BUD) and also makes money from vaping products, cannabis and wine.

There’s a lot of fear about investing right now. Many people still bear the scars of the Great Recession. Others are worried about buying at the top.

While there are no guarantees in the stock market, for long-term investors, owning strong high-yielding dividend stocks should deliver you outsized returns.

Good investing,

Marc