Editor’s Note: As Kristin writes in today’s Stat Sheet, not everyone needs to consult a traditional advisor in order to manage their finances effectively. In fact, an increasing number of people prefer the freedom that comes with “having it their way” and seeking guidance on a case-by-case basis.

If you’re just starting out on this route to financial empowerment, take a look at Wealthy Retirement’s Financial Literacy archive. Every week we publish pieces aimed at promoting self-reliance, and we’re always on the lookout for reader questions to address in upcoming articles.

If traditional financial advising doesn’t appeal to you, leave us a comment with any questions you may have. We’ll do our best to fill in the gaps and equip you with the skills to take charge of your money.

– Mable Buchanan, Assistant Managing Editor

Not all that long ago, an elite group of stock brokers, traders and professional investors controlled the financial markets. If you wanted to invest, you had to buy your way in by paying for “financial advice.” For the most part, though, you were just paying a broker or fund big bucks to buy and sell on your behalf.

Not anymore…

The internet has leveled the playing field. Today, all it takes is a computer and an internet connection to buy or sell a stock.

The way we get our financial advice is changing too.

Now financial advice is all around us. With websites, investment apps, newspapers, magazines, books, blogs, podcasts, etc., your options for consuming financial information are abundant.

That’s why I wasn’t surprised to learn that many Wealthy Retirement readers are bypassing traditional sources of financial advice. Many of them aren’t getting it from financial planners, friends and relatives, or insurance agents anymore.

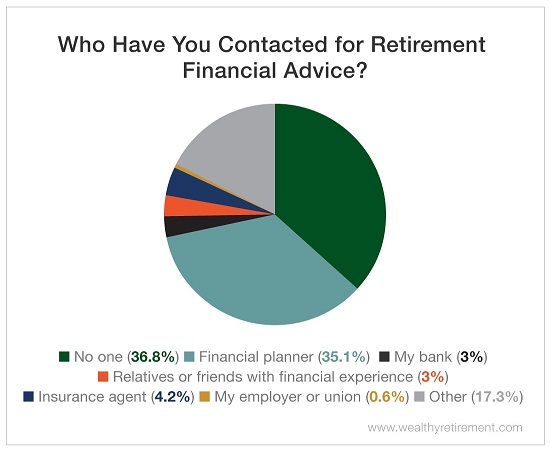

A recent survey found that nearly 37% of respondents haven’t contacted anyone for financial advice. Although about 35% still turn to a financial planner for retirement advice, just a smattering of those surveyed said that they’ve contacted their bank, experienced relatives or friends, an insurance agent, or employers for help with their retirement financial planning.

It’s probably because they don’t need or want to hire a professional. Today, the internet is a veritable buffet of financial planning tips.

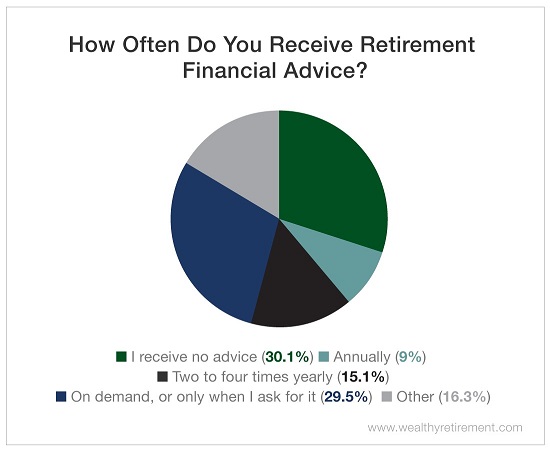

So it’s hardly surprising that those who like to receive financial advice like to get it on their own terms. More than 29% of readers prefer their advice “self-serve.” That means they seek out financial counsel when they want it rather than on a set schedule.

With the wide range of financial resources available, it’s no wonder so many respondents prefer to have it their way. Less than a quarter of respondents said they receive scheduled retirement advice. Many of them are skipping the traditional annual, biannual or quarterly calls with their financial planners, brokers and agents.

But about 30% of our readers said they never receive retirement financial advice. At first glance, this may seem like a scary statistic; however, when you think about it, it’s really not.

There are plenty of people out there who don’t need traditional financial advice from a professional if they don’t want it.

People who have worked in the finance industry or love studying the markets and the construction of a well-balanced portfolio don’t need a third party involved in their retirement planning. Likewise, someone who’s been automatically investing in Perpetual Dividend Raisers probably doesn’t need a professional advisor. Finally, if you’re lucky enough to have a pension that comfortably covers your retirement expenses, you may not need a financial advisor either.

The investment market is rapidly changing – but in this case, it’s changing for the better. Technology is making retirement planning and investing easier to understand and more accessible to the average person. All you have to do to get started is help yourself.

Good investing,

Kristin