When I first moved into my current apartment, I was obsessed with cost-efficiency. I tried to be organized and strict with my spending so that I’d be able to save for dance classes and travel.

My efforts to budget backfired when, in a post-Thanksgiving sale, I bought a whole turkey… and pledged to eat it as my sole protein source to save on groceries and help me abstain from eating out.

(You know where this is going.)

There’s only so much of a dent you can make in a bird which (disassembled!) is more than one-tenth your size before deciding the whole thing is hopeless and going out for stir-fry.

For me, this breaking point was about a month and a half in.

Even when a financial goal “adds up,” sometimes the path we take to execute can be a bit uncomfortable.

While finding the right execution is often a learning process, setting a plan is a crucial first step.

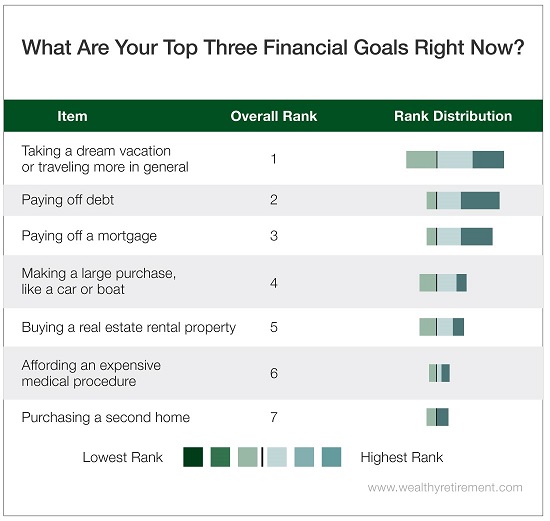

For this reason, this week we asked Wealthy Retirement readers to list their top three financial goals. Most of our respondents indicated that they were saving for traveling, paying off debt or paying off a mortgage.

Budgeting for travel is a popular concern. Fifty-six percent of Americans worry about the cost of taking a trip, and 1 in 4 are forgoing a vacation this year for budgeting reasons.

(Yet according to a OnePoll study commissioned by Travelex, we spend nearly a full year of our lives dreaming about travel.)

Based on our survey, the hurdles that prevent us from making those travel dreams a reality are paying off debt and finishing mortgage payments.

We’re not surprised…

According to a survey by the Center for a Secure Retirement, 80% of boomers currently hold debt, and while more than 50% plan to enter retirement having paid it off, only 25% are successful.

Of those who still hold debt, one-fourth of mortgage holders age 65 and older have more than 20 years remaining on their obligations. Worse, 17% of all Americans are unsure if they will ever pay off their mortgages.

While debt – and particularly mortgage debt – is a popular and vexing problem, there is a clear road out of the woods.

Debt holders who successfully pay off obligations and execute savings strategies share a few key qualities that are also cornerstones to our thinking here at Wealthy Retirement. Practicing those habits can put us one step closer to our dream vacations, boats or second homes – whatever financial goals serve as the symbols of the lifestyles we hope for in retirement.

Living Below Our Means

This isn’t a popular one – but it doesn’t mean that you, too, have to commit to one fowl for the foreseeable future. Living below our means can be as simple as checking monthly bank statements, eliminating lingering subscriptions we no longer use, eating out a bit less often and spending with intention.

Paying Ourselves First

Automating savings – whether by automatically deducting for a retirement account, like an IRA or 401(k), or by transferring money directly after a paycheck to a dedicated savings account – can lessen the sting of setting the money aside. It’s “out of sight, out of mind” at its finest. Committing next to making consistent payments to resolve our debts will decrease the amount we owe to interest and lessen our financial stress in the long run.

Generating Income

Generating passive income streams by investing our savings in stocks, bonds, options or real estate can make a significant difference in our budgeting. Particularly, Perpetual Dividend Raisers enable investors to grow their savings while generating consistently increasing income at the same time.

Sticking to the Plan

In order to find a plan that works and is personal to your goals, it’s important to ask yourself this: What does a wealthy retirement look like to you?

If you see yourself escaping for 10 days to Santorini, how much will it cost to get you there? When do you plan to take off, and how much will you need to dedicate monthly to make it happen? Consider if you will need to adjust your spending or boost your income. Commit now, and you’ll tell yourself “efcharisto” later.

For what it’s worth, I did finish that turkey – in late February, thawing the last frozen Ziploc three full months after baking the bird. While I will never make that decision again, I’m grateful for the lesson that going to extremes isn’t nearly as effective as committing to a workable plan.

Forty-five sandwiches for $0.25 each sounds excellent on paper – but a consistent savings plan and committed, realistic budget are what will really get you to dance class in the end.

Good investing,

Mable