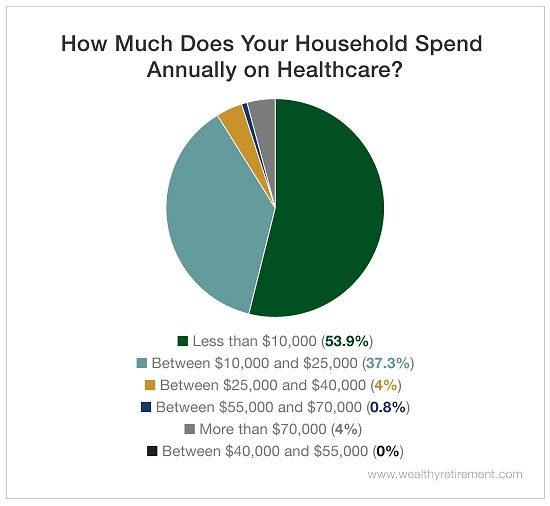

This week, we asked Wealthy Retirement readers how much they spend on healthcare each year. Given the dramatic increases in retirement healthcare expenses today, we were surprised at some of our results.

While the average healthy couple retiring in America in 2019 will spend $285,000 on healthcare expenses, the majority of our respondents indicated that they spend $10,000 or less per year.

About 37% of our readers spend between $10,000 and $25,000 per year on health-related expenses, and a slim – but significant – 4% of our respondents indicated that they spend $70,000 or more.

Some of this divide may stem from the fact that many respondents did not factor insurance coverage into their totals. Some differences may also stem from variations in medical needs.

For example, the more than one-fourth of American seniors who have diabetes are likely to spend the amount on healthcare that seniors who don’t have the disease will.

Routine cataract removal procedures, which are ubiquitous among aging Americans, can cost up to $6,000 per eye before insurance is factored in.

Even an otherwise healthy senior who has rheumatoid arthritis, an autoimmune disease causing joint inflammation, can expect to pay up to $2,500 for a single dose of the medication Remicade, which is not covered by Medicare.

That’s precisely why Duke University anticipates that Americans will need 130% of their current income in retirement: Currently, seniors are woefully underprepared.

According to Gallup, 7.5 million seniors in the U.S. are unable to afford their prescription medications, and for 80% of those seniors, these medications are necessary to treat serious health conditions.

On an even larger scale, the U.S. continues to rank last among Western nations in both affordability of healthcare and quality of health. (It has held this title for 15 years.)

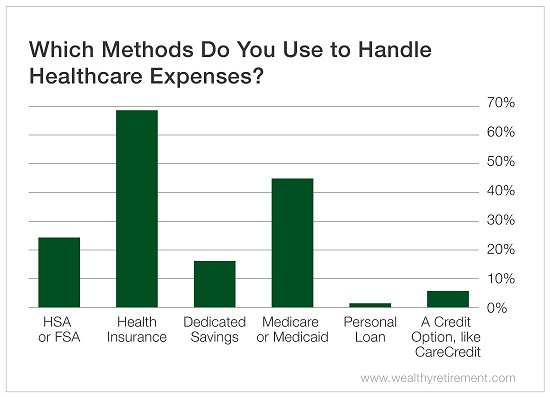

In fact, soaring costs lead many Americans to rely on multiple (and sometimes unconventional) resources to pay for their healthcare.

We asked our readers which methods they use to pay for healthcare. While about 70% indicated that they relied on health insurance for at least some of their expenses, more than 15% relied on dedicated savings outside of an HSA or FSA.

High costs forced 5% of our respondents to turn to financing options like CareCredit, and a small percentage of our readers took out personal loans.

While up to 45% of our respondents relied on government support through Medicare or Medicaid, nationwide, 65% of seniors hold the government partially to blame for high health costs. Seventy-five percent of seniors believe that the government isn’t doing enough to make healthcare affordable.

Regardless of who’s responsible, Americans must focus on supplementing their income using passive strategies, or this dynamic healthcare landscape will continue to prove itself unaffordable.

This weekend, pay special attention to which investments you rely on to generate retirement income. Like up to 40% of our readers, you may find yourself putting not just your comfort, but also your health, in their hands.

Good investing,

Mable