On Tuesday, Steve revealed seniors’ biggest expense in retirement – housing – and outlined the benefits of early mortgage payoff.

One of the most effective ways for seniors to reduce expenses is to pay off their mortgages early.

This can save an average of $16,000 per year.

For the 40% of Americans who will be unable to afford their regular expenses in retirement, that $16,000 could go a long way.

Like many worthwhile strategies, paying off your home early is not an easy endeavor. It’s especially tough for boomers, who hold more mortgage debt than any generation before them.

While securing debt-free senior housing may be a challenge, our latest survey suggests that Wealthy Retirement readers have made it a priority.

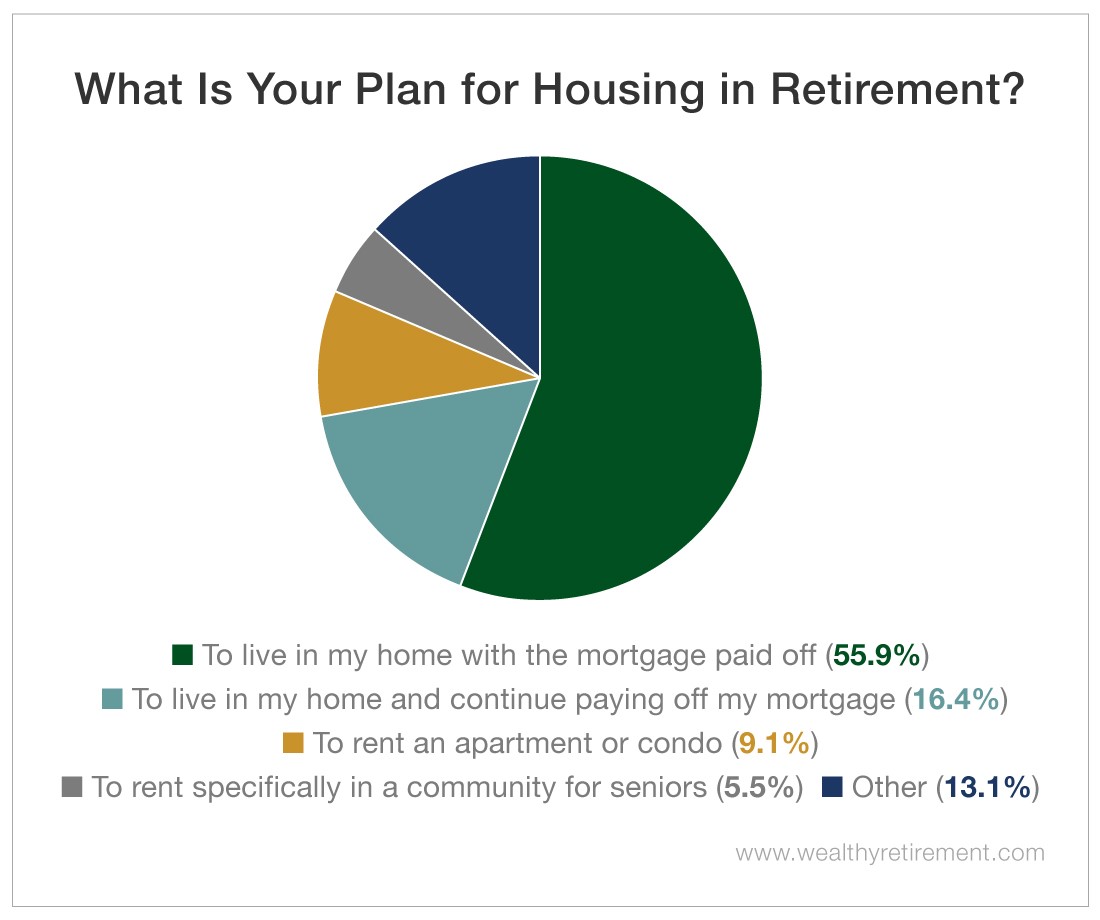

More than half of our respondents plan to live in their current homes with the mortgage paid off. Others responded that they would continue to make mortgage payments in retirement.

Several wrote in to share alternative plans, like owning multiple homes, living in a mobile home or living with children. The remainder of respondents plan to rent an apartment or condo, and some hope to rent from a community designed for seniors.

Finding the Best Options for Senior Housing

Each strategy has its benefits. Early mortgage payoff can save an average of $1,475 per year in mortgage interest and charges. It can also cut down on the emotional toll of carrying debt. This can free up more funds to invest in the meantime, which might earn a higher return.

Renting an apartment or condo lowers housing expenses. It also removes responsibility for outlays like maintenance and upkeep and allows seniors to cut costs by downsizing.

However, renting doesn’t allow seniors to build equity, and some continuing care communities charge entrance fees that start at $40,000 (even though they are often refunded at the end of the stay). Monthly rent in independent living communities ranges from $1,399 in South Dakota to $3,895 in New York.

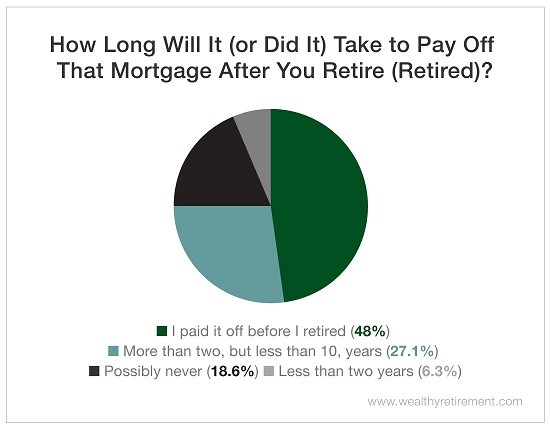

Keeping the original mortgage payoff timeline, or refinancing out of necessity, can create challenges as well. According to our survey from this past February, more than 18% of our readers are uncertain of whether they will ever finish making payments on their mortgages.

Even early mortgage payoff has drawbacks. It forces homeowners to cut expenses to make larger or more frequent payments and doesn’t remove responsibilities like taxes, insurance, upkeep and utilities.

(It also may not be the right choice for homeowners with significant credit card debt, as this debt carries higher interest and should be paid off first.)

Strategies for Early Mortgage Payoff

Paying off your home early doesn’t have to be as rigid of a process as many homeowners believe. Depending on your goals, there are simple ways to make your early mortgage payoff plan flexible.

- Establishing biweekly payments (paying one-half of your monthly expense every two weeks) can increase your total number of full payments to 13 per year. This could be timed according to paychecks if you’re still working. Over time, it could cut a 30-year mortgage down to 24 years.

- Making lump-sum payments whenever you come into extra money, such as a tax refund, can also add up and chip away at your principal. Just be sure to check your loan provider’s policy on making principal-only payments and be aware of any prepayment penalties it might charge.

- Refinancing a mortgage is one option for homeowners who could shift from a longer-term loan to a shorter-term one and net a lower interest rate in the process. However, if it’s not possible to refinance at a lower interest rate, this strategy won’t provide as much of a benefit.

- Increasing payment amounts can speed up the payoff process for homeowners who currently have a low interest rate and would not benefit from refinancing. Paying off a 30-year mortgage in the increments that you would pay off a 15-year one is the perfect example.

Maximizing Value With Senior Housing

If you decide to pay off your mortgage early and continue living in your home debt-free, know that you’re in good company. In fact, feel free to share any cost-cutting or savings strategies that made the process easier for you in the comments.

No one option for senior housing is best for everyone. Consider your budget, timeline and priorities when finding the best strategy for you.

Whichever one you choose, taking simple steps to cut costs and emotionally prepare today will help you get ahead. Then, you’ll be even more likely to feel at home in your golden years.

Good investing,

Mable