You’ve probably heard it before, and you’ll likely hear it again: You can’t time the market.

Sure, maybe you’ll get it right once in a blue moon. You might buy and sell your stocks at exactly the right time.

Even a blind squirrel finds a nut every once in a while.

But you probably won’t do it more than once – and if you make market timing your primary investment strategy, your returns will suffer.

Market timing is the practice of trying to beat the returns of the stock market by predicting its movements. Some market timers use technical indicators to make their predictions, and others use economic data like unemployment or inflation rates.

While economic data and technical indicators are important to consider, they don’t tell the entire story. Many market timers ignore company fundamentals, including revenue growth rates and free cash flow generation. That’s why they tend to underperform those who remain invested through the market’s ups and downs.

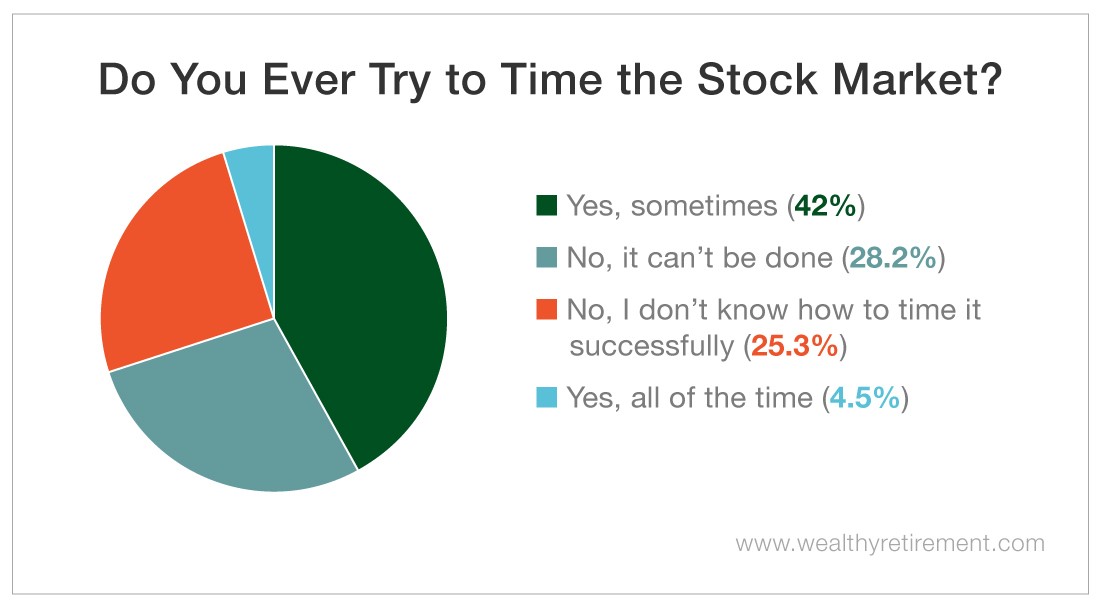

Unfortunately, many investors still try to anticipate market moves. According to a recent Wealthy Retirement survey, 42% of respondents said that they engage in market timing some of the time, while another 4.5% said that they always try to time the market.

Only 28% said that it can’t be done.

So why is it so hard to time the market?

One reason is that the transaction costs of buying and selling stocks over and over again take a bite out of returns.

Taxes are another problem for market timers. All that buying and selling can trigger short-term capital gains taxes, which will also reduce returns.

Perhaps the biggest reason that market timing doesn’t work is that we’re just not good at it.

Investor sentiment changes on a dime – and I haven’t found a magic eight ball accurate enough to forecast Mr. Market’s mood swings.

Even so-called professional investors rarely get the timing right.

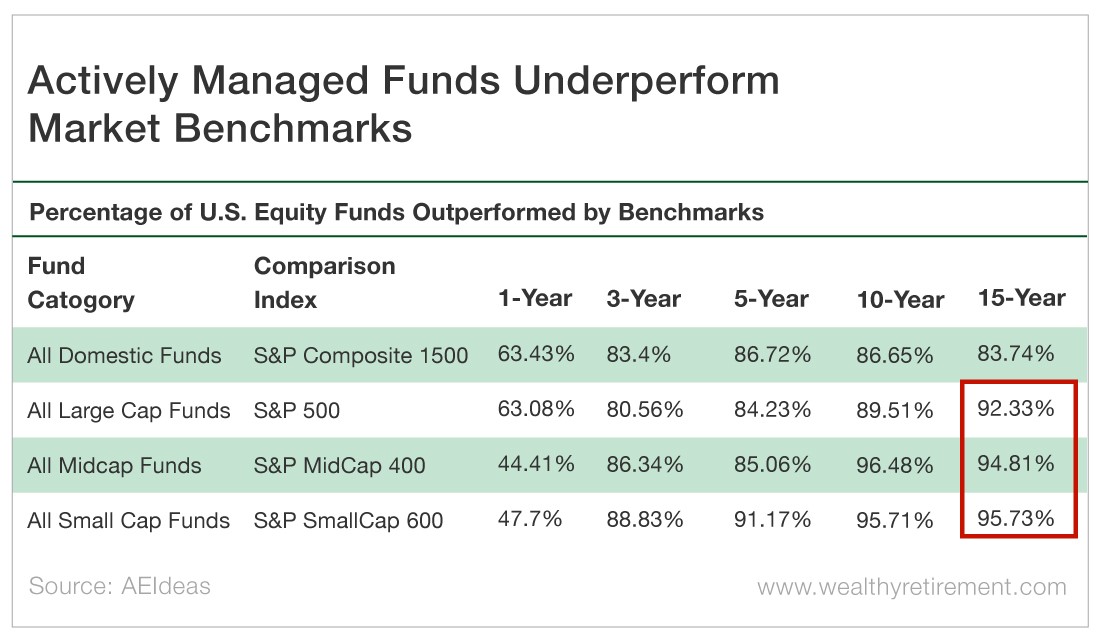

As you can see below, actively managed funds almost always underperform their market benchmarks. The worst offenders, small cap funds, have been outperformed by their benchmark index, the S&P SmallCap 600, nearly 96% of the time over 15 years.

Very few investors are able to consistently beat the market – even if it’s their job!

That’s why income investing can’t be beat. The time is always right to buy the stocks or bonds of financially sound companies and collect income from growing dividends and interest.

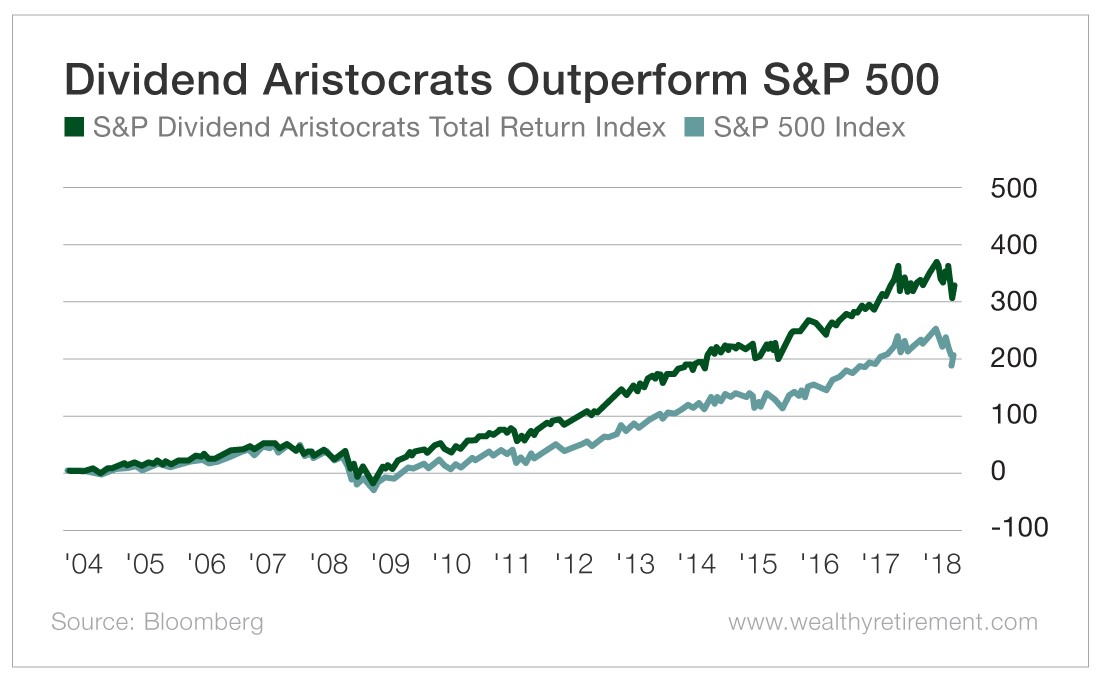

Best of all, it’s a market-beating strategy! The Dividend Aristocrats, a group of stocks that have raised their dividends consistently for 25 years or more, have outperformed the S&P 500 market benchmark by 117.6% over the last 15 years.

Income investing is a lot easier too.

You don’t have to worry about trying to figure out when the market has reached a bottom or top to buy or sell.

Income investing is your ticket to market-beating returns, not market timing. Invest in high-quality companies and reinvest the dividends, and your returns will take care of themselves.

You’ve got to be in it to win it, so do yourself a favor and leave the market timing (and losing) to the professionals.

Good investing,

Kristin