I have a love-hate relationship with the financial news media. While I’ve never made a single dollar from advice given on TV, I’ll admit that I do check in with the financial news networks several times a day.

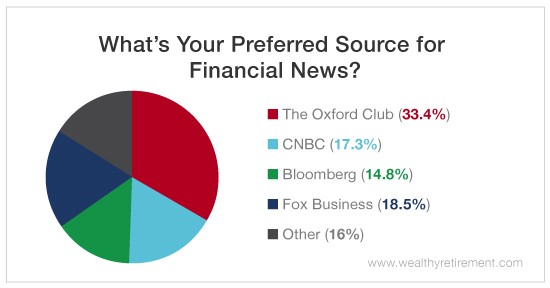

Wealthy Retirement readers are guilty too. More than half of those surveyed turn to business news networks for their financial news.

I know I shouldn’t pay too much attention to network news, but old habits are hard to break.

When I first started trading stocks, breaking news wasn’t as widely available on the internet as it is today. Traders relied on television reporters to tell them the latest.

That’s not the case anymore. Information is now instantly available to all investors on the web. By the time reporters are talking about it, the trade has already been made.

Breaking news is a function of technology now. And frankly, computers do a better job than journalists. Computers are faster.

Reporters are always late. Trading on their “breaking old” news will more often than not cause you to lose money.

That’s why I spend most of my time making computers work to my advantage. That way I can get in before the talking heads on TV start beating the story to death.

I use computer systems to spot market-moving events before the financial media and other investors catch on.

Computer screens take the emotion out of investing. They allow you to block out the noise of TV’s “financial experts” and concentrate on what really counts – making money.

These so-called experts are distracting. And that distraction will take a big bite out of your portfolio returns.

Most of the Wealthy Retirement readers surveyed spend one to three hours consuming financial news each day. That’s probably too much time for the average investor.

The financial media has built a business on economic uncertainty.

They treat every up and down like the end of the world. And even the slightest event demands at least an hour of news coverage. But by the time you see it on TV, the trade will be over.

Watching financial market news all day isn’t productive, especially for long-term investors. It doesn’t help you make better investing decisions, and it can easily hurt your returns.

So like nearly everything else in life, for a healthy and wealthy retirement, consume mainstream financial media in moderation.

Good investing,

Kristin