There’s one thing many of us have in common this holiday season, no matter where or what we celebrate…

We like to gather with family and friends and give gifts to our loved ones.

For this reason, you may be familiar with the carol “The Twelve Days of Christmas.”

But just like the generous “true love” in that famous carol, you may have found yourself overspending this holiday season – or committing a host of other financial errors.

For this reason, Wealthy Retirement continues to celebrate the holidays with an inventory of common financial missteps to check for in your own habits.

If any of these common investing mistakes sound familiar, don’t worry. There’s always time to adjust your strategy, and you may see a difference sooner than you think.

12. You’re not getting the biggest bang for your buck. Failing to take advantage of undervalued stocks can limit your returns by putting a cap on your growth potential.

Then, like a band that needs 12 drummers to make a discernible beat, your portfolio may have a harder time hitting its crescendo.

Instead, consider adopting a value investing technique. Look for opportunities to buy at a discount when companies with upcoming catalysts and strong fundamentals are trading at low price-to-earnings (P/E) and price-to-book (P/B) values.

The current P/E and P/B averages for the Nasdaq are 21.05 and 3.23, respectively. Finding competitive ratios can help you recognize value. But remember, if a company doesn’t have strong fundamentals, its low valuation is likely merited.

11. You follow the crowd. Eleven pied pipers piping might be enough prompting to lead you into a bad decision, like panic-selling when a stock takes a momentary downturn.

Instead, try a contrarian strategy. Buying when the market looks bleakest is the strategy that earned Warren Buffett his fame (and legendary returns).

And on the flip side, remember that sometimes investor glee can be a bad omen.

Take it from Michael Burry of The Big Short fame – shorting the subprime mortgage market in 2007 earned him $100 million.

10. You’ve put off trying options trading. If you’ve been looking for an opportunity to boost your income (beyond Perpetual Dividend Raisers and blue chip bonds), there are multiple strategies that can limit your risk while maximizing upside.

Consider trading Long-Term Equity Anticipation Securities (LEAPS), writing covered calls, selling puts or creating a bull spread.

Options trading may have your portfolio profits a-leaping.

9. You’ve left the finances to the men. There’s still a gender gap when it comes to financial education, but investing is far from a boys’ club today.

In fact, more than one-tenth of fund managers are female, and mixed-gender portfolio management teams perform better than all-male ones.

If you’ve been putting off taking the reins of your finances, consider visiting a fiduciary financial advisor or browsing Wealthy Retirement’s Financial Literacy section.

Regardless of gender, financial independence can provide enough peace of mind to set you (and eight of your closest friends) dancing.

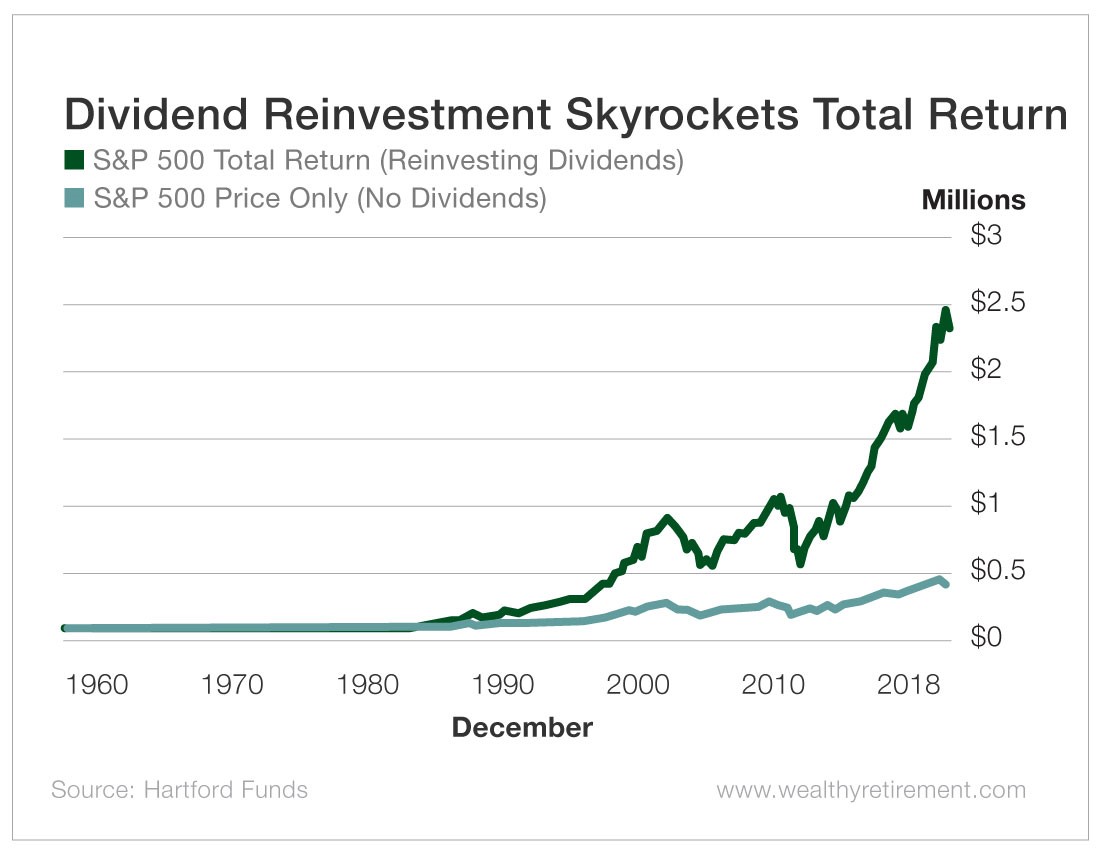

8. You’re investing only for price appreciation. As Marc has written before, employing a dividend reinvesting strategy yields dramatic results.

The following chart says it all: An initial $1,000 investment in 1960 would have netted you almost $2.5 million today with dividends reinvested, but less than $500,000 without dividends.

To really milk the most from your investments, turn to Dividend Aristocrats.

7. You’re always worried about the next black swan event. Keep long-term investing wisdom in mind: “Follow the trend lines, not the headlines.”

The market returns nearly 10% on average. While bear markets sell the most papers, staying in the market – and managing investing anxiety – will ensure that you maximize your return.

Hang in there and take the stress out of the decision. The Oxford Club recommends setting trailing stops at 25% to avoid emotional trading while still protecting your principal.

Like our seven swans a-swimming, your portfolio is most likely to stay afloat if you give the market time to recover from momentary lows.

6. You’ve left your nest egg vulnerable to taxes. Consider opening a tax-advantaged account, like a 401(k), IRA, Roth or 529, depending on your investing goals.

Then, remember that each investing vehicle carries different tax implications. Master limited partnerships, for example, are already tax-advantaged, and dividends carry a lower tax rate than the national average.

Save space in your tax-advantaged account for the investments that need it most. It’ll help you lay a healthy nest egg.

5. You hold too many precious metals. Precious metals (even gold rings) shouldn’t represent more than 5% of your total assets. You can also do better than secure but paltry payouts from government bonds in a low interest rate environment.

Remember, Alexander Green’s Gone Fishin’ Portfolio recommends holding 30% of your core portfolio in U.S. stocks and 30% in foreign stocks.

It also recommends holding 10% each in high-grade bonds, high-yield bonds and inflation-adjusted Treasurys.

The final 5% are allocated to real estate investment trusts (REITs). These, like precious metals, provide balance to the portfolio. Do not count on them for income or appreciation.

4. You try to time the market. Consider this: Investors who time the market underperform those who stay invested for the long haul.

This is because some of the market’s biggest leaps come right after a downturn, when all of the “calling birds” have cut their losses and sold.

In fact, market timing nearly cuts your yield in half.

According to a study conducted by Dalbar, investing in the S&P from 1995 to 2014 would have earned you a 9.85% annual return – but even missing 10 of the market’s best (and most unexpected) days would have dropped your return down to 5.1%.

Not to mention, market timing makes you a target for short-term capital gains taxes.

3. You’ve overlooked international stocks. If so, it’s high time you added some “French hens” to your portfolio.

Contributing Editor Aaron Task recently wrote that investors should consider broad indexes, like the MSCI World Index, or exchange-traded funds (ETFs), like the Vanguard FTSE Emerging Markets Index ETF (NYSE: VWO).

These global portfolios are currently competitive with our record U.S. bull market. What’s more, some individual countries – especially those in emerging markets that will see dramatic growth over the coming years – are currently undervalued.

2. You’re worried about a dovish Fed. A declining interest rate doesn’t mean that a recession is near – even when the yield curve is inverted, as we saw earlier this year.

Even if we do see inflation in the coming years as a result of the Fed’s current policy, you can dovetail a two-step inflation management plan.

- Augment your portfolio with Perpetual Dividend Raisers and short-term bonds.

- Get any borrowing done while rates are low.

1. You’ve put off saving for retirement. There’s no time like the present to plant the seed. Open a tax-advantaged account if you’re still working, or take advantage of catch-up contributions if you are 65 or older.

For help judging where you are in your planning, try our free five-minute Retirement Readiness Calculator.

Work toward a future where you can sit pretty in the shade of a retirement you planted yourself. Make sure you establish an income stream independent from Social Security before you retire.

Get Back on the Nice List

Each of us is guilty of one (or more) of these investing faux pas. As the new year approaches, consider ways you can replace any financial bad habits in 2020.

Build a retirement where you have enough income to give your “true love” whatever you want.

Good investing,

Mable