When it comes to taxes, I don’t want to give the government a penny more than I’m legally obligated to.

I’m willing to pay my fair share. The military needs to be funded; policemen, firefighters, teachers and sanitation workers need to be paid; and roads have to be maintained.

But I stuff my tax-deferred accounts with Perpetual Dividend Raisers so that I don’t have to pay taxes on the dividends – at least not for a number of years.

Being the “dividend guy,” it’s no surprise that I have dividend payers in my taxable accounts as well. However, while my report card from kindergarten offers evidence to the contrary, I don’t like to share with others – mainly the IRS. So I like to hold tax-advantaged dividend stocks in my taxable accounts.

Master limited partnerships (MLPs) usually provide tax-deferred income to investors – the kind of income I like.

Here’s how MLPs typically work.

The dividend is called a distribution. It consists mainly or entirely of return of capital. As a result, the distribution is not taxed as a dividend. In fact, the return of capital is not taxed at all. Instead it lowers investors’ cost basis and they pay tax on the capital gain when they sell.

So if you bought an MLP at $20 per share and it paid a $1 annual distribution, at the end of one year, you would not pay tax on the $1 as you normally would with a dividend. Rather your cost basis would now be $19 instead of $20.

If you held the stock for 10 years, collecting $1 each year, you’d essentially have 10 years of tax-deferred income. You can see why these kinds of stocks are appealing to investors.

The majority of MLPs own oil and gas pipelines. Their overhead is low. Pipeline MLPs charge a fee to allow energy products to flow through their pipeline. It’s like being a toll collector on a highway.

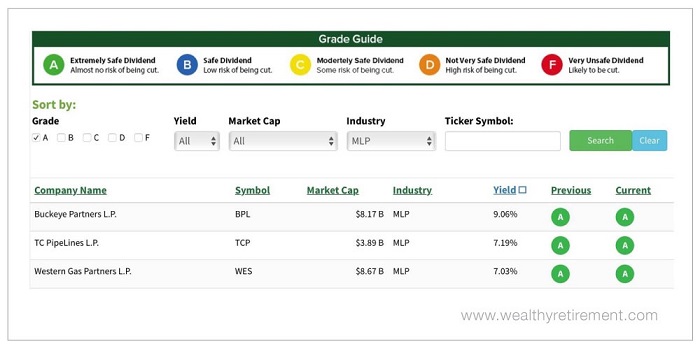

Now that you understand the concept, let’s look at three MLPs with strong yields that are rated A for dividend safety by SafetyNet Pro.

Buckeye Partners (NYSE: BPL) has paid a distribution since 1988 and has never lowered it. The stock pays a monster 10% yield. In 2017, the company generated $731 million in cash and paid investors $726 million in distributions. Buckeye operates oil pipelines and storage facilities.

TC Pipelines (NYSE: TCP) operates natural gas pipelines in the U.S. and Canada.

In the first nine months of 2017, the company generated $238 million in distributable cash flow while paying out $205 million in distributions, easily covering the amount paid to investors. It sports a 7.2% yield.

TC Pipelines has raised its distribution every year since 1999.

Western Gas Partners (NYSE: WES) gathers, processes and transports natural gas in Colorado, Pennsylvania and Texas. Shareholders receive a 7% yield. It has raised its distribution every quarter for the past 33 quarters.

Through the first three quarters of 2017, Western Gas Partners’ distributable cash flow was $696 million. During the same period, it paid out $589 million in distributions, so the company has a large buffer to ensure the distribution continues to be paid and raised.

The high yields that these stocks pay also help investors weather volatile markets like the one we’re in now. Earning a 7% yield goes a long way toward making up for price declines due to corrections in the market – particularly when that 7% yield is tax-deferred.

Look for MLPs with high dividend safety ratings to earn high tax-advantaged yields. Uncle Sam might not be happy, but you and your family will be.

Good investing,

Marc

P.S. Here’s access to our free dividend calculator. It shows you the power of compounding your dividend returns.