Preferred stocks are the best of both worlds…

They’re both a debt and equity investment.

They are debt issued by a company that has specific provisions about the payment of dividends. They are preferable to ordinary stocks in that dividends cannot be paid to common shareholders before preferred shareholders.

But preferred shareholders don’t have voting rights. Preferred stocks trade in the market like stocks and have the potential for significant price appreciation… or depreciation.

Many companies issue preferred shares, but they are more common in the financial sector. They are a quick and easy way to raise capital. And they can be paid off in a variety of ways, making them more flexible for the issuer than bonds and less of a liability.

(Bondholders usually have a claim on the company as secured holders of debt, whereas preferred shareholders don’t have as much of a commitment to their investment.)

Companies that issue preferred stocks must pay the dividend according to the obligations set forth in the prospectus. Some preferred shares can be called away early, and others have no “early call” provisions. But the right to call them early or not to call them lies with the issuer and not the shareholder. The only way you can cash out is to sell the shares in the market.

Historically, as interest rates fall, preferred stocks trade at a premium to their original issue or call price. As rates climb, they trade at a discount.

Preferred shares pay a much higher dividend than common shares – to the tune of 6%.

Because preferred shares trade like common shares, there are opportunities to be opportunistic. During the Great Recession, many bank preferred stocks were hammered, much like the common shares. It was not unusual to pick up preferred stock in megabanks with yields that climbed as high as 24.3%, in the case of Bank of America.

However, it was short-lived. The market soon repriced the shares. And the savvy buyer locked in capital appreciation (as the shares rebounded) and a high yield.

Much like bonds, when preferred shares fall in price, their yields go up. When they rise in price, their yields go down.

Here’s what you shouldn’t do when it comes to investing in preferred shares… Don’t buy individual preferred stocks. While they’re not super risky, there is a better way to invest in these securities while someone else does all the work.

You won’t give up much in the way of fees since many preferred exchange-traded funds (ETFs) have low fees. And you won’t have the risk of owning shares of just one or two companies. These preferred ETFs own dozens of companies, reducing the risk from any single default.

With interest rates rising, preferred ETFs have sold off. That sell-off should continue as rates rise. However, in my opinion, we are maybe 12 to 18 months from the top of the rate cycle. So it’s time to set your sights on the assets you want to buy to lock in higher yields.

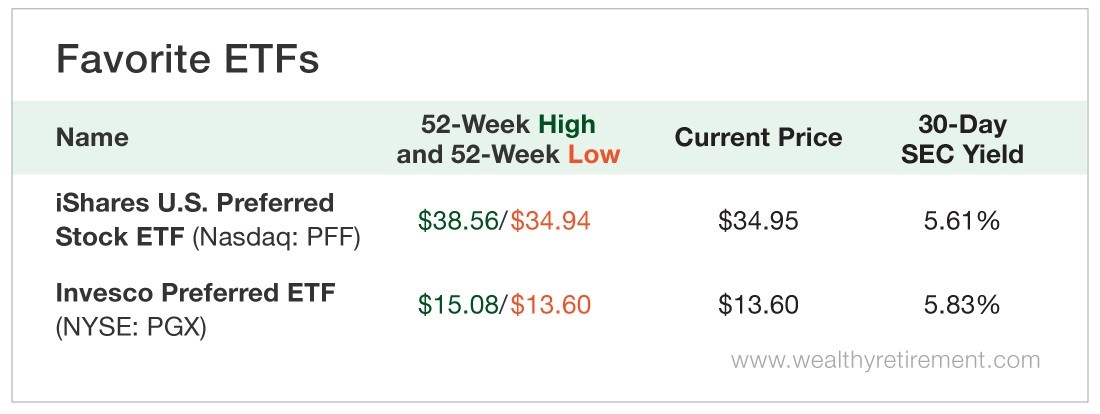

Here are my two favorite ETFs…

Both have similar characteristics in that they own preferred shares. The difference is in management style and how aggressive they are in their selections. As with most investments, the higher the yield, the higher the risk.

Both are on the lower end of the risk spectrum.

As rates rise over the next few months, put both ETFs on your list and look for opportunities to add higher yields to your portfolio.

Good investing,

Karim