Exchange-traded funds (ETFs) are becoming a hot topic with investors.

The number of ETFs worldwide has grown from 276 in 2003 to 4,535 in 2017. That’s an increase of 1,543%!

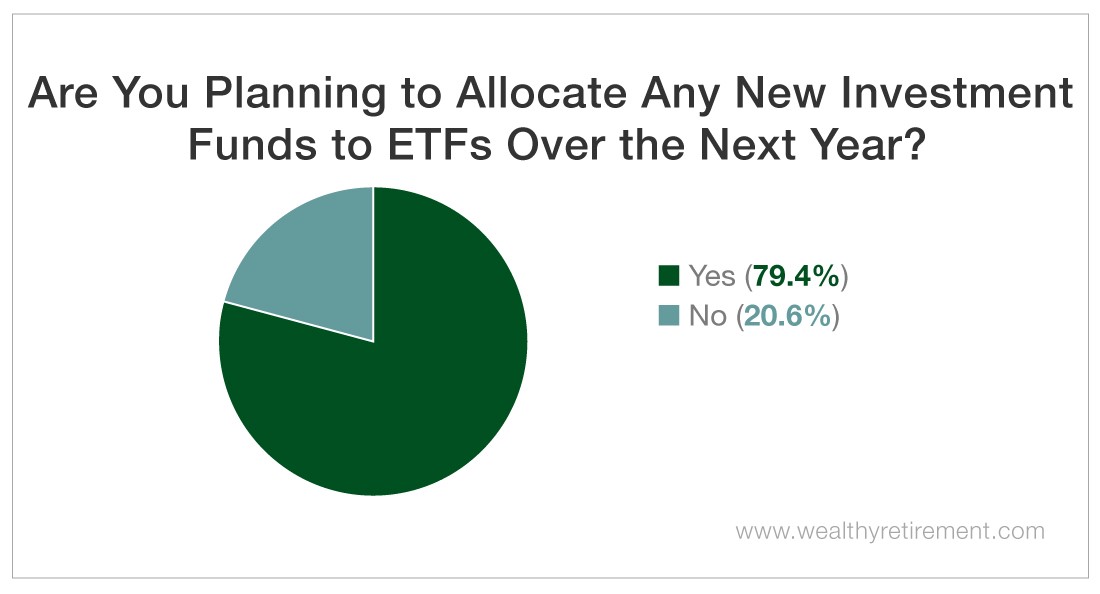

So it’s not surprising that an overwhelming 79% of Wealthy Retirement readers surveyed said that they’re planning to allocate new funds to ETFs over the next year.

But why have ETFs become such a popular investment?

The answer to that question is simple: Because they’re designed to make investing easy.

Here’s how.

ETFs are baskets of stocks that, more often than not, have a common theme. There are ETFs that cover a specific sector and others that track a certain index. The SPDR S&P ETF (NYSE: SPY) is a popular one.

Instead of buying one share of each of the 505 companies in the S&P 500, you’d buy just one fund. As I write this, the ETF is trading at around $270 per share.

The ETF should track the index. So if the S&P rises 15%, the ETF should too.

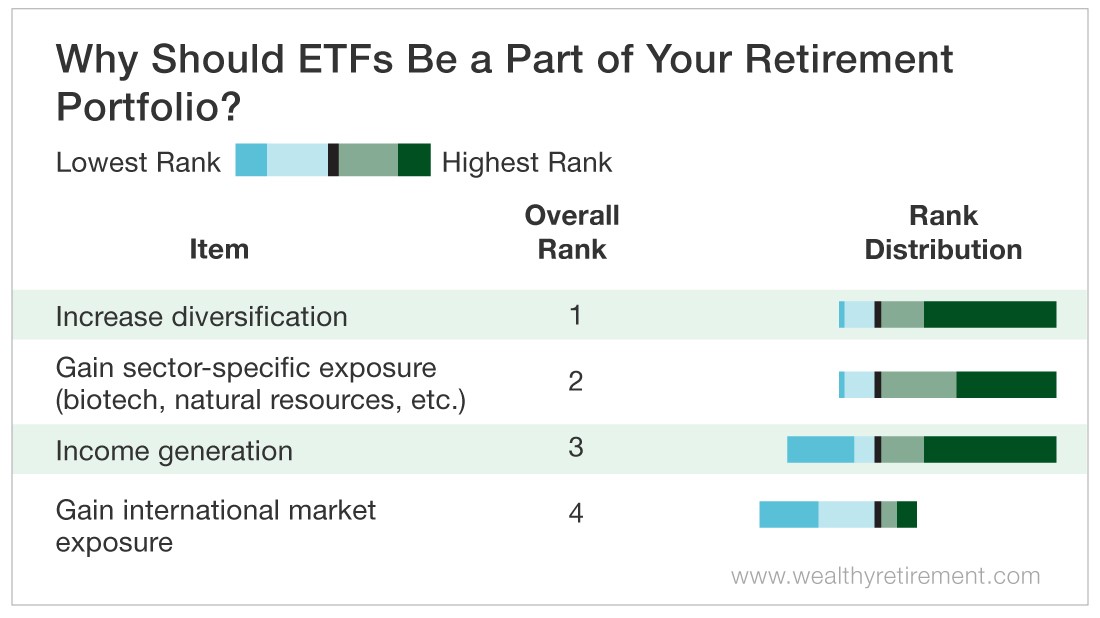

The great thing about ETFs is that they give you the ability to invest in nearly any asset class, sector or geography on the planet. So it’s not surprising that diversification is the No. 1 reason Wealthy Retirement readers believe that ETFs should be a part of their retirement portfolio.

I agree, especially if you’re an investor looking for a more hands-off way to manage your retirement account. Buying ETFs can give investors the opportunity to increase their diversification without having to increase their portfolio management.

I like ETFs a lot better than actively managed mutual funds. That’s because ETFs give you more bang for your buck.

Unlike actively managed mutual funds, most ETFs have tiny expenses. The SPDR S&P 500 ETF charges just 0.09%. That’s a bargain compared with the 1.66% that mutual fund American Century Equity Growth Fund C (Nasdaq: AEYCX) charges.

Worse, actively managed mutual funds often underperform the market. That means you’re paying a portfolio manager for the privilege of making you less money than the stock market as a whole. No, thank you!

But with thousands of ETFs to choose from, picking the right ones for your portfolio can be confusing. Most investors need help getting started.

ETFs can be a time-saving tool in your investment arsenal. You can even add ETFs to your income portfolio.

The O’Shares FTSE U.S. Quality Dividend ETF (NYSE: OUSA) provides its holders with access to a portfolio of large cap and midcap dividend-paying companies.

Keep in mind, Chief Income Strategist Marc Lichtenfeld and I generally prefer individual Perpetual Dividend Raisers to ETFs. That’s because there are fewer fees and higher dividends with individual stocks, and Dividend Aristocrats have outperformed the market over the long term.

That said, if you’re looking for an investment that you can put on autopilot, you may want to consider investing in ETFs. You can hit the easy button now to avoid hitting the panic button later.

Good investing,

Kristin