Next Sunday isn’t just any other Sunday – it’s Father’s Day.

It’s a day to celebrate the men who have shaped us into the people we are today.

And while I have my dad to thank for my stubbornness and love of cheap beer (pass the Bud Light, please), I’m especially grateful for the valuable advice he’s given me over the years.

Besides teaching me how to change a tire, he also taught me how to manage my money… and why saving part of each paycheck was worth giving up a Starbucks latte every morning.

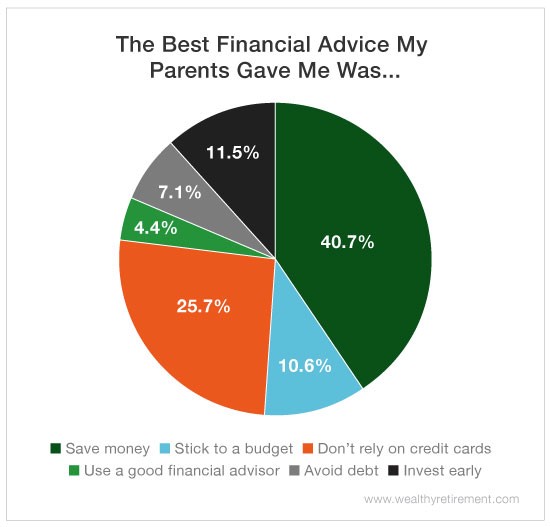

Apparently, I’m not the only one who learned a thing or two about finances from my dad. In honor of the holiday, we asked you, our Wealthy Retirement readers, for the best money advice you ever received from your parents.

And after reading all of your answers, I’d say that most of your parents deserve a HUGE thank you.

The overwhelming majority were taught to save first, spend later – as I was. And many recommended putting that money to work in the market as soon as possible. After all, the earlier you start investing, the more time your account has to grow thanks to the power of compounding.

Another valuable piece of advice many of you received was to always live within your means and avoid racking up credit card debt. The best way to do that? Pay for big purchases with cash. And if you don’t have the money on hand, well, then you shouldn’t be buying it.

There were a lot of other insightful responses. Here are some of our favorites:

“If you want money, go work for it.”

“Budget for the basics (food, house, car) first, then put 10% a week in savings.”

“Buy bonds when you’re young. When I got my first job, I started purchasing bonds. By the time I got married, we had enough for a down payment on our first house.”

“If you ain’t got the money, don’t buy it!”

What’s the best financial advice your parents ever gave you? Share in the comments!

Good investing,

Amanda