Everyone can invest.

But not everyone is good at it.

Successful investing all comes down to picking the right stock… at the right time. Which is easier said than done, especially in a market that moves up and down unpredictably.

Not to mention that sifting through all the pages of company filings and analyzing every news report to figure out whether a stock is a good buy can be overwhelming.

The Wall Street Journal might give a company a favorable rating and you’re all set to buy – but then Bloomberg publishes contradictory stats.

So how do you choose the stocks that will give you the best bang for your buck?

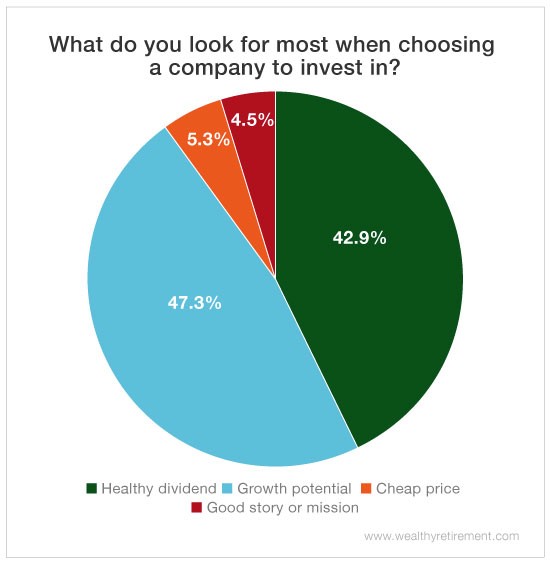

According to our survey, our readers believe a company’s growth potential and dividend are the two biggest indicators of future success.

Things like positive earnings and cash flow, a growing market cap, or a reliable dividend make a stock more attractive to investors. On the other hand, a decreasing bottom line or a sudden dividend cut are signs that trouble is brewing.

All of those factors are very important.

But what’s more important than looking at ONE thing is having a system in place… and removing any emotion from your trading.

It’s something Marc talks about a lot: In order to be successful at picking stocks and making trades, you have to stick to whatever system or strategy you choose. You can’t let fear or greed get in the way of rational decision making.

Good investing,

Amanda