One of the most requested stocks for me to look at in the Safety Net column is New Residential Investment Corp. (NYSE: NRZ). Its fat 11.5% yield is very attractive to income investors.

But can a yield that high be trusted?

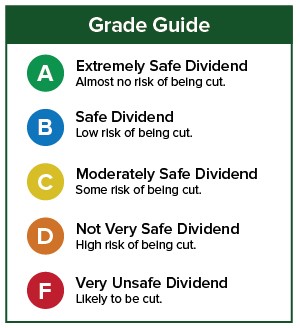

I last looked at the stock in March. It received a surprisingly high rating of B for dividend safety because its net interest income (NII) more than covered its dividend.

I say “surprisingly” because stocks with double-digit yields are often not safe. The high yields often reflect low stock prices because the company’s fundamentals are weak.

That’s not the case here.

New Residential Investment Corp. is a mortgage real estate investment trust (REIT) that borrows money short term and lends it out long term. NII is the best way to measure a mortgage REIT’s performance.

A year ago, NII was $704 million, so the company is growing tremendously in 2017.

When I analyzed the stock in March, the payout ratio was forecast by Bloombergto be 59% this year.

The company is now projected by Bloomberg to generate $1.06 billion in NII while paying out $466 million in dividends.

That’s a low payout ratio of just 44%. What inspired this adjustment? Analysts’ estimates for NII rose by nearly $300 million.

By the way, if you’ve ever wondered why I have so little faith in analysts, this is a perfect example… They underestimated the company’s NII by nearly 50%.

Next year, NII is projected by Bloomberg to come down $82 million, which isn’t what we want to see. But the dividend will still be comfortably covered, even at the lower NII number.

Not Much History

New Residential has a short but solid dividend history. It began paying a dividend in 2013 and has raised it every year.

Even with the lower NII, it could boost the dividend again in 2018…

New Residential’s dividend appears safe for now. Next year’s lower NII shouldn’t affect it much. But if declining NII becomes a trend, the stock will be downgraded.

Dividend Safety Rating: B

If you have a stock whose dividend safety you’d like me to analyze, leave the ticker symbol in the comments section below.

Good investing,

Marc