The rules of investing are simple: Buy low and sell high. That’s how you make money.

But the methods investors use to choose which stocks to buy and which to sell are where it gets complicated. There are dozens of ways to select investments.

Luckily, most of these stock-picking criteria can be classified within two camps.

Fundamental analysts study a company’s financials. They look at income and cash flow statements and the competitive environment to decide if a stock price will go up or down.

Technical analysts study stock price charts. They look at the trading history of a stock to predict its future price.

Most Wealthy Retirement readers fall into the former camp. They don’t use technical analysis to pick stocks.

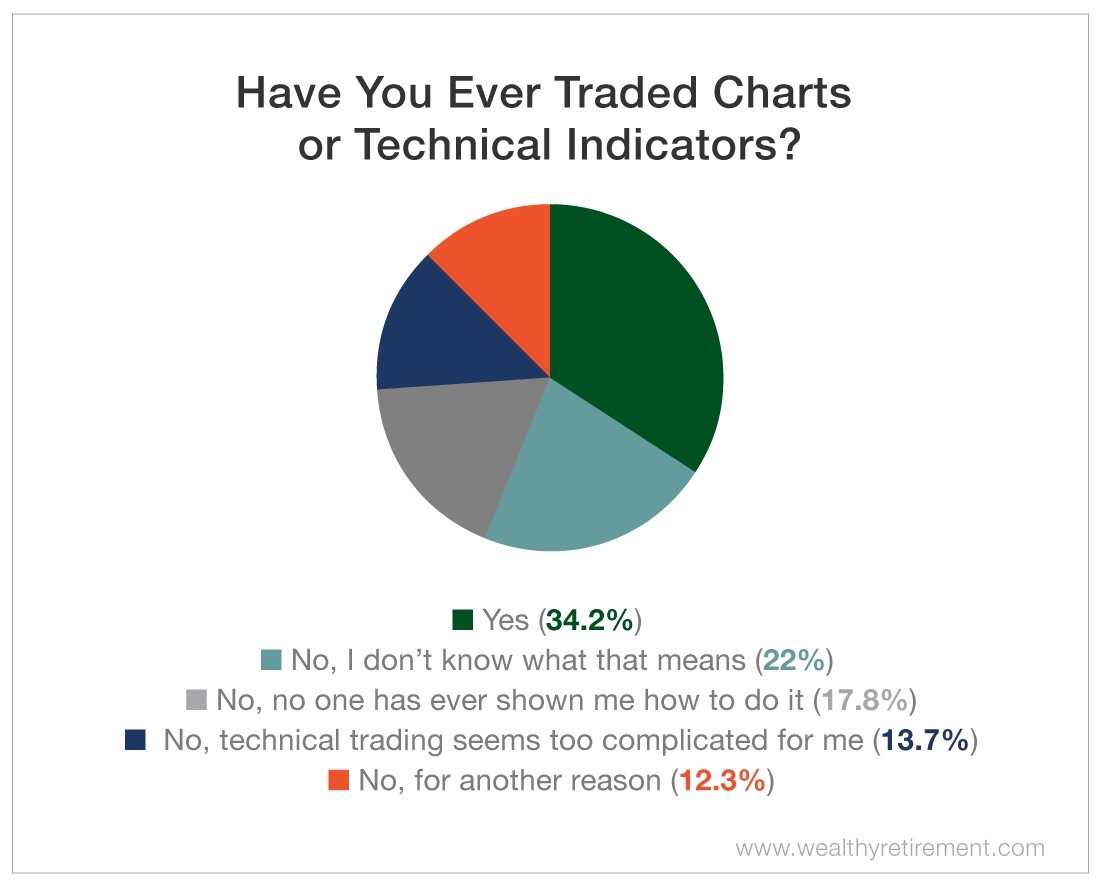

According to a recent survey, just 34% of readers trade stocks on charts or technical indicators.

Of those surveyed, 22% said that they don’t know what technical trading entails. Another 18% stated that no one has ever shown them how to do it, and about 14% said that technical trading seems too complicated.

That’s too bad. Technical analysis is an important tool in any investor’s toolbox because technical indicators can help anticipate stock price movements.

Professional investors use technical indicators to profit from short-term movements.

You should too.

Wealthy Retirement’s Chief Income Strategist Marc Lichtenfeld is an expert technical analyst. He studied technical indicators before he studied fundamental ones.

In fact, Marc started his career as an assistant on a trading desk. There, he learned how to read the markets by watching the “tape.”

Marc studied how stocks moved throughout the day, and he eventually turned to technical analysis to explain why they moved the way they did.

He was soon an enthusiastic convert. He joined and then became vice president of the Technical Securities Analysts Association of San Francisco. He also published papers on chart patterns.

Keep in mind, technicals alone aren’t as effective when it comes to successful longer-term investing. That’s why Marc recommends using both technical and fundamental analysis.

Marc honed his fundamental investing skills when we worked together at the contrarian research firm Avalon Research Group, and The Oxford Club tends to be more focused on fundamentals. That said, Marc still uses technical analysis to help him evaluate trading risk.

Technical indicators do a great job predicting short-term stock price movements. Fundamental analysis works well over the medium to long term.

Both strategies are effective and profitable methods of stock selection. That’s why investors should always consider both.

Good investing,

Kristin