Shame on you… but most of all – shame on us.

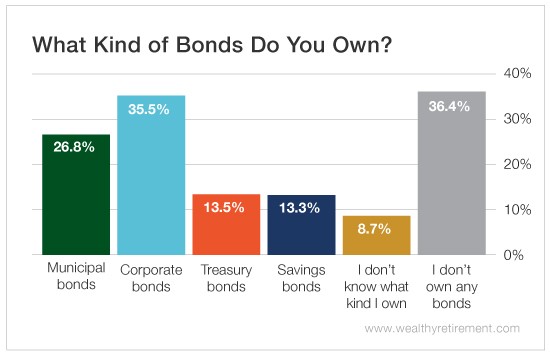

More than 36% of respondents to our latest poll said they don’t own any bonds.

I’m sorry to say it, but we’ve clearly failed you… Your portfolio isn’t diversified.

And if your portfolio isn’t diversified, you risk losing everything in the next market crash.

We talk a lot about the importance of diversifying your assets.

Remember, diversification doesn’t just mean to invest in the stocks of different companies in different industries. Diversification means that you need to build a portfolio that has some stocks, some bonds and some early-stage investments.

It looks like a big chunk of you skipped the bond option. That’s not good…

Most Wealthy Retirement readers are over the age of 50. Frankly, if you’re invested only in stocks, you don’t have enough time to weather the storm of a market downturn, let alone come back from one.

A stock market crash is coming. It’s merely a matter of when.

We’re currently riding out the longest bull market in history. I hope it lasts a lot longer, but we all know it’ll eventually fizzle out.

And if the downturn happens right before your planned retirement, well, your plans may have to change.

That’s why you don’t want all of your retirement savings tied up in the stock market.

You need some stable investments that are loosely correlated to the stock market. You need an asset class that will fluctuate less and recover faster during an inevitable bear market downturn.

And if you’re trying to grow your wealth, cash doesn’t cut it.

Let’s face it, cash returns from bank returns are lousy. The average interest rate on savings accounts is a paltry 0.08% average percentage yield. That’s less than 1%!

The “earnings power” of a savings account doesn’t come close to keeping up with today’s 2.7% inflation rate. Putting your money in a savings account will actually lose you money!

That’s where corporate bonds come in.

Corporate bonds are a more defensive asset class than stocks, but they have higher returns than cash.

The safest bonds (rated Aaa by Moody’s) yield, on average, around 4% a year. That’s more than four times the interest you can expect from a savings account and 1.5 times the rate of inflation.

Bonds historically beat stocks when the economy heads south. And they help smooth out the volatility in the stock market. You need both.

Good investing,

Kristin