Ladder Capital (NYSE: LADR) offers investors a reliable dividend with the attraction of a possible bonus at the end of the year.

The company currently pays a $0.325 per share quarterly dividend, which equals a 7.5% annual yield. That’s pretty good.

However, in 2015 and 2016, it paid special dividends. So there is the possibility that management will pay another special dividend in the fourth quarter of this year.

Ladder Capital finances commercial real estate purchases and, to a lesser degree, takes an equity stake in some properties.

Last year, the company generated $117.5 million in net interest income (NII) while paying out $100.1 million in dividends. So the company generates enough cash to fund its dividend. NII is the best measure of a mortgage real estate investment trust’s cash flow.

Going forward, there are no Wall Street estimates for Ladder Capital’s NII, even though seven analysts cover the stock.

However, they do have estimates for revenue and net income. Wall Street expects revenue to rise 17% in 2018 and profits to boom 64%.

Additionally, in the first half of this year, NII totaled $67 million – an increase of nearly 19%.

So unless something unexpected happens in the remainder of 2018, NII should be up strongly for the year.

Ladder’s dividend history is short but strong. Not including special dividends, it has raised the dividend four times since it began paying one in 2015.

Ladder Capital can afford its rising dividend. NII should continue to climb, and though its track record of paying dividends is short, it’s exactly what we want to see.

The company’s 7.5% looks to be fairly safe.

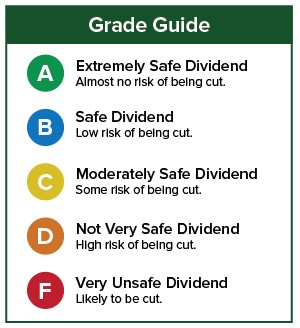

Dividend Safety Rating: B

If you have a stock whose dividend safety you’d like me to analyze, leave the ticker symbol in the comments section.

Good investing,

Marc

P.S. Check out our new, free Retirement Readiness Calculator on Wealthy Retirement. Find out if you’re ready. Take a look here.