A Note from Bond Strategist Steve McDonald: I’m tired of pounding the table…

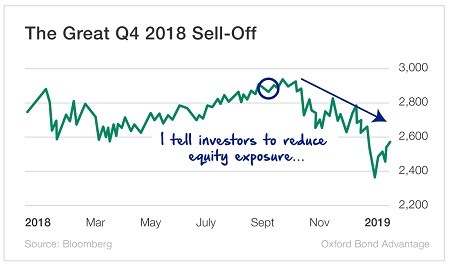

Last September, I told you to quit stocks and shift into bonds. I said the stock market would sell off – and boy, I hope you listened. Just take a look at what happened.

A couple of weeks later, the fourth quarter began and stocks tanked, sending the S&P 500 down 14% and the tech-heavy Nasdaq down 17% for the quarter.

If you had pulled money from stocks at the end of last summer – not all of it, just some, as I advised – and put it into bonds, you would have saved yourself a lot of heartache.

– Steve McDonald

I’m disappointed, to say the least…

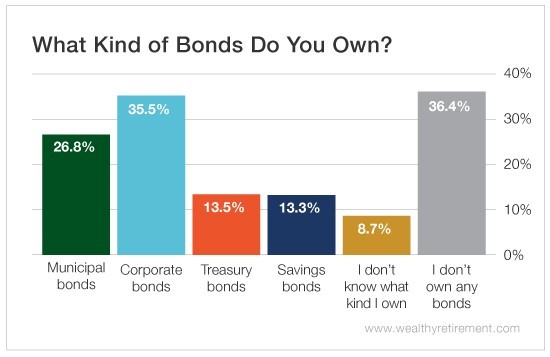

That’s because more than 36% of Wealthy Retirement readers said they don’t own any bonds.

You see, we talk a lot about the importance of diversifying your portfolio.

Remember, diversification doesn’t just mean to invest in the stocks of different companies in different industries. Diversification also means that you need to build a portfolio that embraces a variety of investing strategies and asset strategies.

If your portfolio isn’t diversified, you risk losing everything in the next market crash.

And it looks like a big chunk of you skipped the bond option. That’s not good…

Most Wealthy Retirement readers are over the age of 50. Frankly, if you’re invested in stocks only, you don’t have enough time to weather the storm of a market downturn, let alone come back from one.

A stock market crash is coming. It’s merely a matter of when.

We’re currently riding out the longest bull market in history. I hope it lasts a lot longer, but we all know it’ll eventually fizzle out.

And if the downturn happens right before your planned retirement, well, your plans may have to change.

That’s why you don’t want all of your retirement savings tied up in the stock market.

Bonds: An Essential Part of a Diversified Portfolio

You need some stable investments. You need an asset class that will fluctuate less and recover faster during an inevitable bear market downturn.

And if you’re trying to grow your wealth, cash doesn’t cut it.

Let’s face it, cash returns from banks are lousy. The average interest rate on savings accounts is a paltry 0.09%. That’s less than 1%!

The “earnings power” of a savings account doesn’t come close to keeping up with today’s 1.8% inflation rate. Putting your money in a savings account will actually lose you money!

That’s where corporate bonds come in.

Corporate bonds are a more defensive asset class than stocks, but they have higher returns than cash.

The safest bonds (rated AAA by Moody’s) yield, on average, around 4% a year. That’s more than four times the interest you can expect from a savings account and more than 1.5 times the rate of inflation.

Bonds historically beat stocks when the economy heads south. And they help smooth out the volatility in the stock market. You need both benefits.

Good investing,

Kristin