It seems that nearly every day the stock market is reacting to tweets or news about the trade war.

Whether it’s responding to made-up stories about China placing a couple of phone calls, real negotiations or breakdowns in talks, the market’s reactions to trade-related events have been strong.

Considering the world is more connected than ever, it’s hard to find stocks that shouldn’t be badly affected by a trade war or tariffs.

However, today I have three all-American, relatively tariff-proof companies for you that have safe and solid dividend yields.

All-American Dividend Champion No. 1: AT&T

Investors have shied away from AT&T (NYSE: T) because they think it’s a dinosaur. They couldn’t be more wrong.

The stock, which is recommended in The Oxford Income Letter, is trading near 52-week highs and yields a whopping 5.8%.

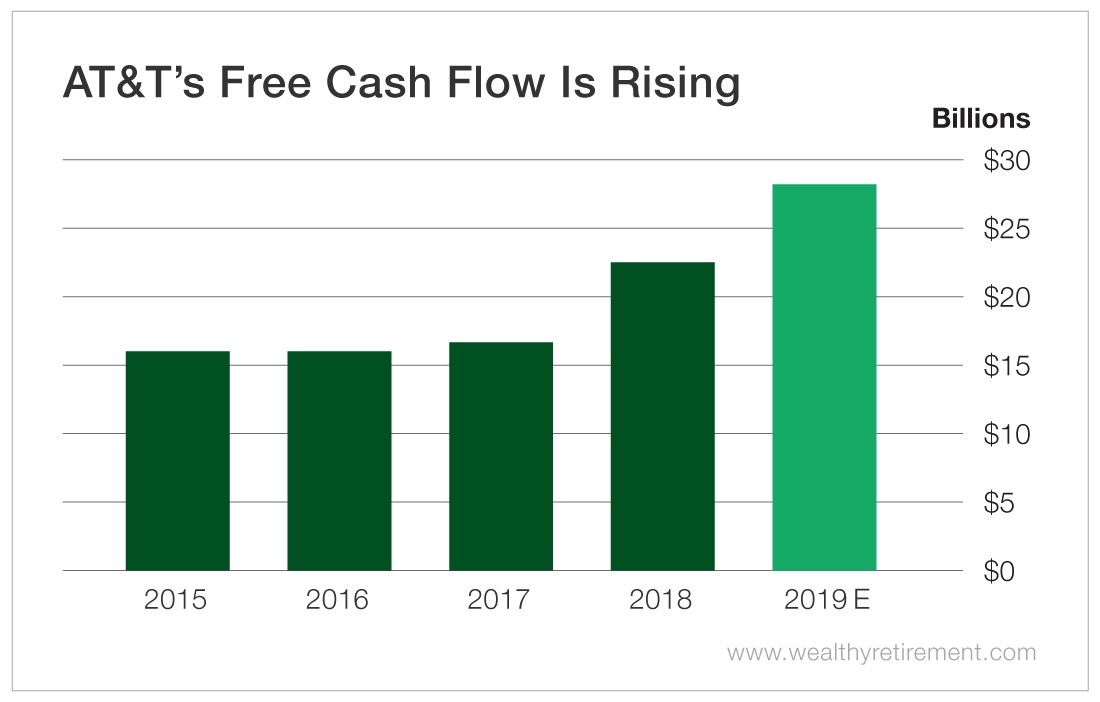

Free cash flow has been rising sharply, and AT&T pays just over half of its free cash flow in dividends. That gives the company the ability to continue to boost its dividend payout every year, as it has since 1985.

Ninety percent of AT&T’s revenue comes from the United States, making it an all-American Perpetual Dividend Raiser that should be fairly immune to any further intensification of the trade war.

Dividend Safety Rating: A

All-American Dividend Champion No. 2: CVS

Healthcare giant CVS (NYSE: CVS) is uniquely American. The retail pharmacy recently expanded into the pharmacy benefits management business – an arguably necessary evil – in an attempt to keep a lid on the high cost of drugs.

The company gets all of its revenue from the United States. This year, free cash flow is expected to soar 25%, more than double last year’s growth. CVS’ payout ratio (based on free cash flow) is just 30%.

The stock yields 3.3%, and the company has not cut the dividend in the 22 years it has paid one. In fact, it has raised the dividend many times (though not in the past two years), including in 2008 and 2009.

CVS is another company that should not be affected by a trade war.

Dividend Safety Rating: A

All-American Dividend Champion No. 3: Preferred Apartment Communities

The last company in this list is a real estate investment trust (REIT).

Preferred Apartment Communities (NYSE: APTS) owns apartments and retail centers in 12 states. Its properties include…

- Conway Plaza in Orlando, Florida

- Founders Village in Williamsburg, Virginia

- Retreat at Greystone in Birmingham, Alabama.

All of its properties are in the United States and, like CVS, 100% of its revenue comes from the USA.

The company’s funds from operations (FFO), a measure of cash flow for REITs, have nearly quadrupled in the past four years.

In 2019, Preferred Apartment Communities is expected to pay 72% of its FFO to shareholders in the form of dividends.

The stock pays a robust 7.7% dividend yield and has raised the dividend every year since it began paying one in 2011.

Dividend Safety Rating: A

Continue to Bank On American Business

These three companies should allow dividend investors to breathe easy no matter what news comes out of Washington, Beijing or anywhere else in the world.

With a portfolio featuring all-American winners like these, you can rest secure in the knowledge that your dividends are safe.

Good investing,

Marc