Every time I speak about options trading at an investment conference, at least five or six people ask who is on the other end of the transaction. They want to know who I’m selling to or buying from. It’s a valid question.

Whenever you buy or sell an option, the answer is the same: a market maker.

Big help, right?

To grasp the concept, you first need to understand that an option on a stock has absolutely nothing to do with the underlying company itself. The company doesn’t create the options, nor does it have any control over how many options trade or at what prices they trade.

But someone has to control those things, right?

That someone is the market maker. Market makers are firms that issue options, and they’re usually tied to a major Wall Street brokerage house like J.P. Morgan or Fidelity.

The firms act as a go-between for the buyer and seller. You can think about it like this…

The go-between is basically a bookie. They take on the risk of an option moving in a particular direction in hopes that they can make a little bit of money each time they’re involved in a trade.

It can be a dangerous game or a very profitable one.

They either hit it out of the park or get dinged big time. If they get dinged, they can make it up on volume by getting involved in additional trades to offset the loss. But either way, they’ve got to be really smart and nimble… at the same time.

They apply for permission from a given exchange (there are several) to create a market to trade a particular option.

For example, take options on XYZ stock. A market may or may not exist. If it does, the bookie will join the other market makers trading XYZ options on that exchange… If it doesn’t, voilà! With a little paperwork, you now have an options market created out of thin air.

Remember, an option is a derivative of an underlying instrument. If the instrument doesn’t exist, then neither can the option.

It’s kind of like betting on a game. If there is no game, there is no bet.

Trade Like a Market Maker

There can be multiple market makers for an option. They’re playing against each other and against you.

But what are they playing for?

To pocket the “spread” between the buyer and seller every minute of every day the market is open.

The spread is created by the simultaneous purchase and sale of options on the same stock, but with a different strike process and/or expiration dates.

Take a stock like IBM (NYSE: IBM) for example. The market maker knows IBM trades a lot of volume. They also know that there are people who want to bet on IBM’s direction without having to fork over $150-plus per share to buy it.

They are the options buyers or sellers.

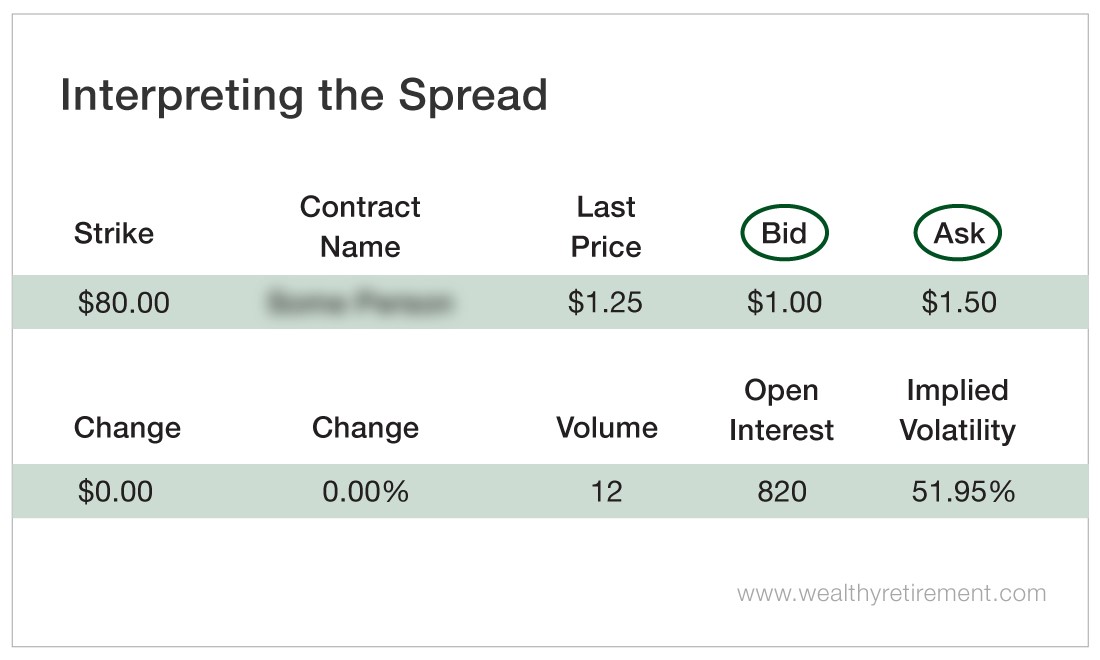

Let’s say that the IBM option is trading for $1 on the “bid” but $1.50 on the “ask.” Both are listed in your brokerage account like this…

(The bid price is the highest price the market is offering to buy the underlying stock, and the ask price is the lowest price the market’s offering to sell the underlying stock.)

The spread would be $0.50. So what does the market maker fantasize about each night?

Buying the option from a seller for $1 and selling that same option to a buyer for $1.50.

That’s a 50% gain from one trade. If they can replicate that all day, there’ll be another yacht parked in the harbor pretty soon.

But there’s also some risk for the market maker…

As the creator of the market, they’re basically creating trading instruments out of thin air. The Black-Scholes options pricing model allows them to create the price.

But they also have to manage the risk. If there are only buyers and no sellers, guess what? They’re selling you something they don’t actually have in inventory.

That’s a lot of risk if the stock moves in a direction that’s bad for them.

They have to offset that risk. They do so by widening the spread so that when the sellers do show up, they offer them a pittance, and the buyers pay a fortune.

If the situation is fluid and there are buyers and sellers, the spread narrows.

Sometimes, they may even have to go out and buy or sell options themselves to offset potential risk.

So it can be a very expensive proposition unless you know what you’re doing. And believe me, options market makers are not stupid or lazy.

Ultimately, the market makers are the ones who make sure that the markets continually operate in a smooth fashion. According to the Securities and Exchange Commission, they are “firms ready to buy and sell stock on a regular and continuous basis at a publicly quoted price.”

The same is true for the options market. That’s not just an idle definition – it’s a guarantee.

Market making can be very, very profitable. It has to be, because the risks are just as large as the rewards.

Good investing,

Karim