Mortgage real estate investment trusts, or mREITs, tend to have high yields, often double digits. While double-digit yields excite some investors, when I see one, my guard immediately goes up. I think, “Why is the yield so high when most dividend-paying companies – even those considered high-yield – have yields in the single digits?”

The reason for my skepticism is risk.

When a company pays a double-digit yield, the risk is higher that the stock is going to perform badly or the dividend is going to be cut. It’s not a guarantee that those things will happen, but it is more likely to happen than when the dividend yield is lower.

With that knowledge, let’s find out whether 15% yielder Dynex Capital (NYSE: DX) is in danger of cutting its dividend.

Dynex Capital is a mortgage REIT. It borrows money and then lends it out at higher interest rates. The difference, after expenses, is called net interest income.

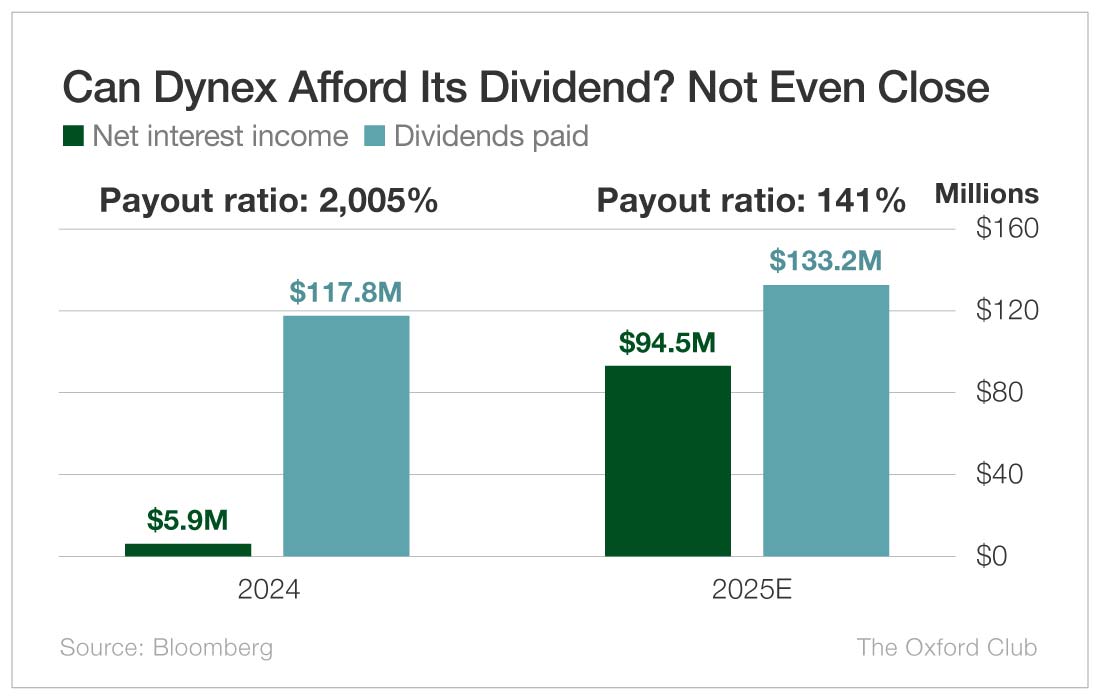

Last year, Dynex generated $5.9 million in net interest income while paying out $117.8 million in dividends. That means it paid 20 times more cash in dividends than it took in.

This year, I expect net interest income to rise significantly to $94.5 million. However, dividends paid are still forecast to be substantially higher at $133.2 million.

The dividend track record isn’t great either. Though Dynex has raised the monthly dividend twice in the past year from $0.13 per share to $0.17, it is still well below where it was 10 years ago.

At the time, Dynex paid a quarterly dividend of $0.72, which is 41% more than the current monthly dividend extrapolated to a quarterly dividend ($0.17 per month equals $0.51 per quarter). That $0.72 per share dividend in 2015 was cut to $0.63 in early 2016, and the company lowered the dividend again in 2017 to $0.54.

Two years later, Dynex began paying a monthly dividend, reducing it again to $0.15 ($0.45 quarterly) in mid-2019 and once more to $0.13 ($0.39 quarterly) in 2020.

So we have a stock that can’t afford its dividend and has cut the payout four times in the past 10 years.

Dynex Capital will very likely cut its dividend again soon.

The dividend is not safe.

Dividend Safety Rating: F

What stock’s dividend safety would you like me to analyze next? Leave the ticker in the comments section.

You can also take a look to see whether we’ve written about your favorite stock recently. Just click on the word “Search” at the top right part of the Wealthy Retirement homepage, type in the company name, and hit “Enter.”

Also, keep in mind that Safety Net can analyze only individual stocks, not exchange-traded funds, mutual funds, or closed-end funds.

Hi Marc

I forwarded your response on dividend Safety to the source who recommended DX and they provided the following response:

Thanks for writing in. I checked in with Brett and he noted that we want to look at the Comprehensive Income to Common Shareholders and compare it against what they paid out in dividends.

From the most recent earnings presentation (https://www.dynexcapital.com/investors/financial-info/financial-results), it was $162M of comprehensive income compared to $71M of dividends paid — so easily covering the payout.

In the Oxford Club analysis, they are right — there have been challenging times for mREITs the past few years which have resulted in dividend cuts, but Brett is looking forward, not backwards — noting we have some fantastic spreads for mREITs to take advantage of.

So, he’s looking forward to more dividend growth and book value growth.

Take a look at ZIM’s dividend

HQL please

DMLP

Please evaluate Western Union (WU)

What about Iron Mountain (IRM)?

Tesla

Please review APA.

Thanks!

Hi Marc – From one of my other ETF/CEF sources:

Talk Dynex to MeMortgage spreads—the difference between the 10-year Treasury yield and mortgage rates—are at manic levels. We’re talking post-Great Financial Crisis panic and 2023 bond meltdown peaks:

A “Generational Buying Opportunity” in Mortgage Spread

We contrarians know that crisis means opportunity. The spread is the engine of profit for Dynex—and the engine hasn’t run this hot since the GFC. Byron and Smriti agree: they are smartly describing this as a “generational buying opportunity” in mortgage-related investments.

Mortgage rates have been coming down all year. They topped above 7%, and have since steadily declined, now below 6.2%. With each tick lower the mortgage market is being unlocked and Dynex’s portfolio becomes more profitable.

The decline will continue because the administration has made lower mortgage rates a priority. Treasury Secretary Scott Bessent is obsessed with moving long-term rates lower and lower. Let’s not fight the Treasury!

Dynex loaded up on cheap “agency” mortgage-backed securities when spreads were peaking. These are government-guaranteed bonds backed by Fannie Mae and Freddie Mac. No subprime surprises or commercial property problems here. Just interest-rate math done right.

The company owns $14.28 billion of these securities. Its “exploit the spread” playbook is simple: borrow short (at lower short-term rates), lend long (at higher long-term rates) and hedge intelligently (because while trends may be strong, near-term volatility can upset the apple cart). As spreads widen, cash flow surges—as well as book value, which drive the price:

Dynex’s Book Value Gains are Dynamit

Dynex’s distributable income covers its fantastic 15.3% payout. Management hasn’t been shy about sharing the mortgage wealth. The monthly dividend climbed from $0.13 to $0.15 in mid-2024, then again to $0.17 this year. That’s confidence.

The Monthly Divvie is Rollin

And Dynex continues to play offense. It grew the portfolio 10% quarter-over-quarter and over 50% year-to-date.

If book value merely holds, the yield alone delivers 15% over the next year, payable in cold hard cash. If spreads tighten and book value rises, upside potential grows past 20%+.

This is the setup we second-level investors live for: wide spreads, monthly pay, disciplined management and an upside catalyst the crowd is sleeping on.

Action to Take: Buy Dynex Capital (DX) up to $14.00 per share.

QVCGP

Hello Mark

Could you please analyze Nvidia for me please?

I love your newsletters by the way.

KEY

Please rate SRV relative to its dividend of .45 a month. Will it last?

Thx,