Smoking, alcohol, chocolate, even Facebook – these are all common things that Americans give up for Lent, which started on February 14 and runs through March 29.

Forty days without your vice of choice demonstrates admirable willpower. But chances are that when Easter Sunday rolls around, you’ll find yourself elbow-deep in a bag of Hershey’s or enjoying one too many glasses of bourbon (neat, of course).

As with those long-forgotten New Year’s resolutions, our “good” behavior rarely lasts once Lent is over.

It’s because we give up things that don’t affect us that deeply. Sure, never eating chocolate again might keep your waistline slimmer. And logging off of social media might free up more time to finally join that book club. But let’s be honest – for the most part, those are wants, not needs.

So this year, focus on something you actually need: financial freedom.

Here are five of the worst money habits you might be guilty of having – including some you might not even be aware of. Give one (or all) of these up over the next 40 days.

Trust me, your wallet will thank you.

1) Waiting to have more money before you invest

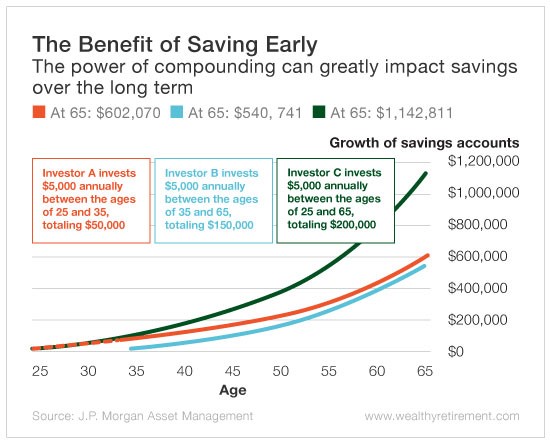

ANYONE can be an investor, no matter how much (or how little) you have in your bank account. And the longer you wait, the more you miss out on compounding, which can grow your original investment exponentially. Just look at the chart below.

2) Not setting goals

You want to save for retirement. That’s great – but it’s also very vague. How much do you want to have saved by the time you’re 55? 65? 75? How much will you put aside every year? The more specific your goals are, the easier it’ll be to create a plan that will help you achieve them.

3) Spending impulsively

If you’re all too familiar with buyer’s remorse (you know, that sinking feeling you get in your gut after you blow too much money on a new set of golf clubs), it may be time to re-evaluate your spending. Habits like setting a budget or paying with cash can help keep serial swiping in check.

4) Relying on your credit card

Credit cards are great when making big purchases like a new 4K TV or a weekend trip to Naples. But if you’re carrying a balance month after month (hello, 15% interest!) or frequently able to make only the minimum payment, you’re living beyond your means… and on the fast track to serious debt.

5) Ignoring your 401(k)

Would you turn down free money? Well, you are if you aren’t contributing to your employer’s retirement plan. After all, most companies match employee contributions up to a certain amount, so even if you can’t afford to set a lot aside, any amount is better than nothing.

Hopefully, these new habits will stick – and I have no doubt they will after you realize how beneficial they are to your financial health.

But even if they don’t – even if you go back to not-so-savvy saving – at least you gave it a shot… and you got to enjoy copious amounts of chocolate and booze along the way.

Your turn: Tell us your worst money habit below in the comments section below. Promise we won’t judge!

Good investing,

Amanda

P.S. Need a little help making your new money habits stick… without living like a pauper? My colleague Marc Lichtenfeld’s new book will do just that.

You Don’t Have to Drive an Uber in Retirement: How to Maintain Your Lifestyle without Getting a Job or Cutting Corners is an insightful guide to helping you plan for those golden years. You’ll learn exactly how much you need to retire and how to get there through generating new income, optimizing your portfolio and maximizing your savings.

Order your copy today. Not only will you learn tools and strategies for boosting your bank account, but you’ll be able to live life the way you want while you’re at it.

Hello, cruise to the Bahamas…