Marc Lichtenfeld

Marc is the Senior Editor of The Oxford Income Letter, which is based on his proprietary 10-11-12 System. He is a leading member of Oxford Centurion‘s Centurion Advisory Board. He is also the Editor of Technical Pattern Profits, Penny Options Trader and Oxford Bond Advantage.

Marc is the Senior Editor of The Oxford Income Letter, which is based on his proprietary 10-11-12 System. He is a leading member of Oxford Centurion‘s Centurion Advisory Board. He is also the Editor of Technical Pattern Profits, Penny Options Trader and Oxford Bond Advantage.

Marc Lichtenfeld is the Chief Income Strategist of The Oxford Club. After getting his start on the trading desk at Carlin Equities, he moved over to Avalon Research Group as a senior analyst. Over the years, Marc’s commentary has appeared in The Wall Street Journal, Barron’s, and U.S. News & World Report, among others. Prior to joining The Oxford Club, he was a senior columnist at Jim Cramer’s TheStreet. Today, he is a sought-after media guest who has appeared on CNBC, Fox Business and Yahoo Finance.

His first book, Get Rich With Dividends: A Proven System for Earning Double-Digit Returns, achieved bestseller status shortly after its release in 2012 and was named Book of the Year by the Institute for Financial Literacy. It is currently in its second edition and is published in multiple languages. In early 2018, Marc released his second book, You Don’t Have to Drive an Uber in Retirement: How to Maintain Your Lifestyle without Getting a Job or Cutting Corners, which hit No. 1 on Amazon’s bestseller list.

In this report, I’m giving you three safe, healthy dividend plays that should be the backbone of your income portfolio.

My recommendations in this report don’t have gimmicky technology or an eccentric business model. They offer products and services that you can understand.

These three companies are the very epitome of unassuming but important. And because of their inconspicuous nature, they don’t have their value inflated by speculators.

However, you’re getting some of the safest dividend yields in the entire stock market. And these three companies have long histories of growing those yields.

Lastly, these are stocks from my own portfolio. I have owned them for years and expect to own them for many more.

High-Voltage Dividends

Two decades ago, Florida Power & Light Company was nothing special. It was just a large utility company based in Florida.

How things have changed since then…

Since becoming NextEra Energy (NYSE: NEE) in 2010, it has transformed into the world’s largest utility company.

The company operates in 36 states and four Canadian provinces. It even has a few international subsidiaries.

NextEra still owns Florida Power & Light, and thanks to the huge growth in Florida’s population, Florida Power & Light is America’s largest electric utility. It provides electricity to more than 12 million people, producing about $10 billion in operating income.

NextEra, through its wholly owned NextEra Energy Resources, is also the world’s largest producer of green energy.

Generating Green Energy Profits

NextEra was an early adopter of renewables and green energy. And now it is the world’s largest generator of renewable energy from the sun and wind and a world leader in battery storage.

In addition, since the 1970s, NextEra has built and maintained nuclear power plants. It currently operates seven nuclear power plants.

The early investments in clean energy have paid off…

Today, NextEra is a leader in energy storage. Historically, one of the largest problems with solar and wind energy has been what to do when the weather doesn’t cooperate.

The solution to that problem is storing the electricity in batteries similar to the lithium-ion ones found in electric cars. NextEra operates more of these battery storage facilities than any other company.

While many green energy companies are struggling financially, that’s not the case here.

Last year, NextEra brought in a whopping $28 billion in revenue.

NextEra took in $7.3 billion in net income in 2023 and grew its cash reserves to a staggering $2.69 billion. Earnings per share (EPS) were $3.6.

A Long History of Satisfying Shareholders

And the company has a long-term track record of delivering shareholder value. It has far outperformed its competition and the S&P 500.

Its 15-year total shareholder return is 669%.

Over that same time frame, the total shareholder return for the S&P 500 is 255%, and for its industry competitors… the S&P 500 Utilities… it’s only 191%.

The company returns its incredible income to shareholders through a solid – and constantly increasing – dividend of $1.87 per share, which provides a healthy yield of 3%.

And with the money it’s raking in, NextEra is smartly expanding.

It’s constantly building new solar, wind, battery storage and nuclear plants. It won’t overwhelm itself with its expansion, though…

Completed projects are handed to NextEra’s local subsidiaries upon completion. That frees up the company’s cash from operating expenses to further fuel expansion and increase the dividend. And it aims to grow that dividend by 10% per year through 2024.

Its business model, technology, finances and dividend are all top-notch. NextEra will be providing stress-free income for years to come.

Action to Take: Buy NextEra Energy (NYSE: NEE) at market. Place a 25% trailing stop on your position.

Proven and Probable Dividends From This Gold Miner

When it comes to gold mining, there is no doubt that Newmont Corp. (NYSE: NEM) is one of the biggest and best in the business.

Founded in 1916, with headquarters in Denver, Colorado, Newmont has proven and probable gold reserves of more than 135.9 million ounces. In addition, Newmont has substantial holdings of other metals. It has 68 million gold equivalent ounces of reserves from copper, silver, lead, zinc and molybdenum.

In the past five years, Newmont has transitioned from a major player to an industry juggernaut.

- In January 2019, Newmont acquired Goldcorp, a major gold producer. The acquisition positioned Newmont to be the largest gold producer in the world.

- In March 2019, Newmont completed a joint venture with Barrick Gold Corp. (NYSE: GOLD). The two companies combined assets in Nevada to create the largest gold producer in the United States.

- Gold producer GTGold was acquired in May 2021.

- Most recently, in May 2023, Newmont acquired Newcrest Mining, a major copper producer with nearly 50 billion pounds of copper reserves and resources.

With more than 110 years of experience and huge mineral reserves stashed in mines across the globe, the company is a low-risk, high-potential investment.

For gold miners, the profit equation is quite simple. The difference between the price of gold and what it costs to get it out of the ground equals the company’s profit.

If costs rise and the price of gold falls… profits shrink. But if the metal’s price moves higher and costs sink… profits surge.

However, with Newmont, the pathway to profit is much more assured than that of many industry competitors…

- Newmont has a portfolio filled with assets and projects that are ranked as the most favorable in the industry.

- The bulk of its assets are in mining-friendly jurisdictions in the United States, Canada, Mexico and Australia.

- There’s a diversified mix of commodities being mined. Newmont can shift production efforts to the highest-priced minerals and/or the minerals with the lowest costs of production if needed.

This year, the company expects to produce 6.9 million ounces of gold. Each ounce will cost the company about $1,400 to pull out of the ground and get to the market. With gold currently selling for more than $2,000, each ounce sold represents a profit of about $600.

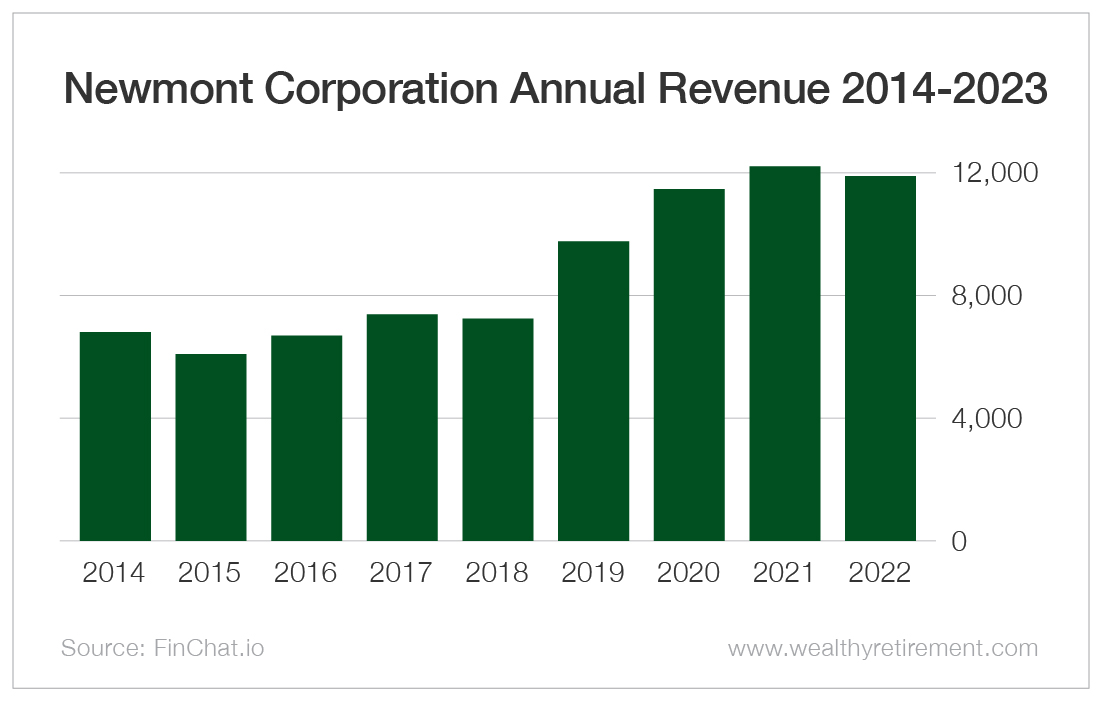

The company has seen its revenue surge in recent years as inflation has made gold a more popular investment.

The more popular gold becomes as an investment, the higher the price of gold will climb… and the bigger the profit margin will become.

For Newmont, that will lead to increasing profits… but it also implies an increase in the dividend to shareholders. Here’s why…

Newmont has established a framework for the dividend payout… and for its increases.

The company will pay a base dividend of $1 per share per year at a $1,400 gold price. The dividend is recalibrated based on incremental moves of $300 per ounce in the price of gold.

The most recent dividend payout was calibrated based on a gold price of about $1,900. The variable component of the dividend is based on the free cash flow generated at the higher gold price.

In the fourth quarter of 2023, Newmont paid a $0.40 dividend. Even without any raises over 2024, that works out to $1.60 per share which provides a current yield of 5%.

With the likelihood of higher gold prices ahead, the dividend should be increasing…

Management has set a goal (with the help of a higher gold price) of achieving a dividend payout range of between $2 and $3 within the next few years.

Betting on the Front-Runner

Eighty percent of Newmont’s gold production is coming from stable mining jurisdictions in North America, South America and Australia. And these are some of the richest and most reliable mining assets on the planet.

Two-thirds of its gold production is from Tier 1 assets (the highest mining industry classification based on potential production, mine life and operational costs). These properties will provide an ultra-reliable stream of cash flows.

Newmont has transformed itself with the Newcrest merger and the Barrick joint venture. It now has the largest gold reserves and the strongest management team in the gold sector.

The new Newmont is now focused mainly on assets with superior costs, long mine lives and high grades.

Last but not least, thanks to its strong balance sheet – $2.87 billion in cash and cash equivalents – and favorable gold prices, Newmont’s base dividend is rock-solid. And a higher gold price will lead to an increasing dividend.

As we know now, the current inflation is not transitory. It won’t be long before gold is once again recognized as the ultimate inflation hedge. That money will flow toward the biggest and safest companies in the industry.

Newmont fits the bill for both.

Action to Take: Buy Newmont Corp. (NYSE: NEM) at market. Place a 25% trailing stop on your position.

Safe, Highly Profitable, Boring, an Increasing Dividend… What’s Not to Like?

This next recommendation is in the industrial sector, which is often overlooked because it lacks the sexiness and glamour of other sectors.

But in this case, low volatility, a high margin of safety, consistent profits and a juicy dividend make up for that.

Founded in 1945 and headquartered in Miami, Florida, Watsco (NYSE: WSO) together with its subsidiaries, engages in the distribution of air conditioning, heating, refrigeration equipment, and related parts and supplies. Watsco is the largest player in the industry.

The firm installs, upgrades and retrofits heating, air conditioning and refrigeration (HVAC/R) products in the United States, Canada, Mexico and Puerto Rico, and on an export basis to Latin America and the Caribbean.

Watsco provides HVAC/R products that are the most technologically advanced in the industry, improving efficiency and dramatically reducing carbon emissions in the process. (More on that in a moment.)

Gosh, It’s Hot Out

Air conditioning is something we rarely think about… until we suddenly need it or, worse, don’t have it! Then we find it hard to think about anything else.

Just ask the residents of Phoenix… They sweated through 54 days of temperatures at 110 degrees or higher in 2023. In 2020, Phoenix had 145 days when it was 100 degrees or more.

And the folks in Austin, Texas, appreciate their air conditioning. They had 80 days of triple-digit temperatures last year.

Investors tend to overlook pedestrian businesses like heating, cooling and ventilation. But the industry is steady and highly profitable.

There’s no better example of that than Watsco.

In 2023, the company established a new record for sales ($7.28 billion), gross profit totaled $1.99 billion, operating income of $768 million, net income of $536.3 million, and EPS of $14.70.

And last year was no fluke…

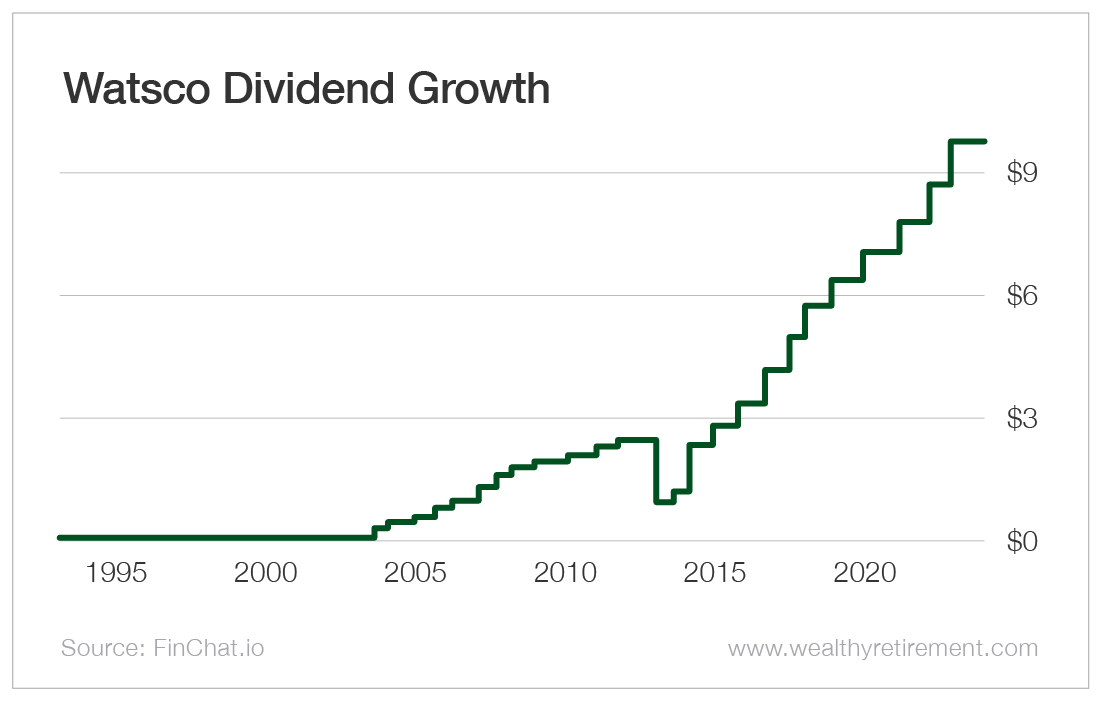

Since 2014, sales and have grown at a compound annual growth rate CAGR of 7%. Over this same period, the dividend has grown at a 21% compound annual growth rate.

From January 2020 to January 2024, the annual dividend rate has increased by 53%!

The annual dividend per share for 2023 is $9.80 per share, an 11% increase compared with 2022’s dividend per share.

As of this writing, the dividend yield is 2.34%. You’d think the yield would be much higher after so many aggressive rate hikes… but the stock has also soared. It’s up nearly 26% over the past year.

And Watsco has paid a dividend for 48 consecutive years! And it has raised the dividend relatively consistently over the past several decades.

And now – thanks to lower carbon emission standards – the industry is ripe for disruption. A huge new opportunity for sales and earnings has emerged.

A Bright Future

The most exciting prospect for Watsco is its new role in providing efficient, low-carbon, smart HVAC/R products.

In response to wide-ranging regulatory requirements that took effect on January 1, 2023, higher-efficiency HVAC/R systems are in high demand.

For example, air conditioning is responsible for roughly 20% of the electricity used by buildings. Electricity generation accounts for about 25% of all greenhouse gas emissions worldwide.

Watsco is happy to help. It’s assisting companies around the world, helping them meet the new standards with higher-efficiency HVAC/R systems.

Albert Nahmad, Watsco’s founder, chairman and CEO, had this to say in the company’s 2023 second-quarter earnings report (it was the second-best quarter in company history):

Looking at the long-term, we remain very enthusiastic about the upcoming product and regulatory transitions that will influence replacement rates and Watsco’s unique technology platforms that continue to see growing adoption among contractors, both of which will positively influence the trajectory of our business.

Don’t underestimate the upside potential of this “boring” business.

Action to Take: Buy Watsco (NYSE: WSO) at market. Place a 25% trailing stop on your position.

The Building Blocks of a Healthy Portfolio

Reliable dividend-paying stocks should represent the base of your investment portfolio because they tend to be stable companies focused on returning money to shareholders.

When those companies are the boring but important kind – making products and providing services the modern world can’t go without – their stocks are especially lucrative.

The three companies in this report not only are reliable dividend payers… but also provide real potential for capital gains.

Now is the time to pick up all three of them and start collecting your share of stress-free income… just as I have.