Dividend Riches: Marc Lichtenfeld’s Income Investing Video Series

Marc Lichtenfeld, Chief Income Strategist

To read transcripts of these videos, follow these links: Part One: Lock In Monthly Passive Income | Part Two: Good Dividends vs. Bad Dividends | Part Three: Structure Your Income Portfolio for Maximum Returns | Part Four: How to Make Money Even if a Stock Goes Down | Part Five: How to Minimize Taxes on Your Dividends | Part Six: Turn a 2% Dividend Yield Into as Much as a 20% Yield

back to top ↑

Part One: Lock In Monthly Passive Income

Imagine this…

You’re relaxing on a boat off the Florida coast. The water’s calm, and you’ve got a cool drink in your hand. Or maybe you’re volunteering with an organization that’s important to you. Or playing a round of golf on a course you’ve always wanted to play.

You don’t have a care in the world. No meetings to attend. No overdue bills. No stress.

And the best thing about this is you’re getting PAID to relax and spend time doing what YOU want.

Because you made the decision – today – to start investing in dividend stocks.

You’ve built up a massive portfolio of companies that pay YOU every single month.

Today, you’ve taken the first step in achieving this dream lifestyle.

Hi, I’m Marc Lichtenfeld. Welcome to Dividend Riches, my income investing video series.

Over the next five videos, we’ll dive into the incredible power of dividends.

You’ll see how to build a passive income portfolio where YOU get paid without having to do any work.

First off, what is a dividend?

A dividend is a sum of money that a company pays to its shareholders.

It’s a way of saying, “We are making so much money that we can’t possibly spend it all… so we’ll pay YOU for your support.”

Today, I’ll show you why dividend investing is not only one of the most lucrative and uncomplicated ways to invest, but also one of the easiest investing strategies to learn and use.

One principle that I believe many investors have forgotten is that they are investing in a business.

They’re not just three- or four-letter ticker symbols that you enter into Yahoo Finance once in a while to check on the stock price.

When you buy a share of Norfolk Southern (NYSE: NSC), you actually OWN a piece of the railroad company.

Or JPMorgan Chase (NYSE: JPM). You become a bank owner the moment you buy a share.

If you buy shares of Apple (Nasdaq: AAPL), every time someone buys an iPhone or Mac, they are making YOU richer.

So why dividend stocks?

There are THREE main reasons I love dividends:

One, you get paid by the world’s top companies without doing any work.

Dividends can be used to set up a passive income stream with checks coming in quarterly and even monthly…

Most companies pay quarterly dividends. And international stocks that pay dividends pay shareholders twice a year.

You can even set up an entire portfolio that provides monthly payments. Subscribers to my monthly newsletter, The Oxford Income Letter, have access to the retirement cash calendar where we keep track of which companies are paying out their dividends each month.

Two, dividend payers beat the stock market… big time.

Study after study proves that investing in dividend payers can build FAR more wealth than investing in regular stocks.

For example, Ned Davis Research found that companies that didn’t pay dividends tripled in value from 1972 to 2018. However, they managed less than 12% of the overall S&P 500’s 27-fold gain during that same time span.

Dividend payers, on the other hand, achieved 52-fold gains from 1972 to 2018, outperforming the S&P by 90%.

Three, reinvesting dividend stocks can build massive wealth… even when stocks go down, as I’ll show you in minute.

Reinvesting dividends means you buy shares with your dividends rather than pocketing the cash. Now, this can be done automatically in your brokerage account so you don’t even have to think about it!

And the result can be very powerful…

If you’d invested $100 in the S&P 500 at the end of 1929, it would have grown to $13,623.04 on price appreciation alone – a gain of 13,623%.

However, if you’d reinvested the dividends on that same $100, it would have grown to $311,871.65 by September 2020. Reinvesting dividends was all it took to boost the overall return by $298,248.61. That’s more than 22 times the amount you’d have made on price appreciation alone.

Typically, a company with an established trend of increasing its dividend will raise it again the next year and the year after that and the year after that.

I call these companies Perpetual Dividend Raisers, and they come in more than one variety.

I’ll cover the best kind of dividend stocks in the next episode. I’ll also let you in on some of the things you should look out for.

Until next time, good investing.

back to top ↑

Part Two: Good Dividends vs. Bad Dividends

Hello, welcome back to Dividend Riches. Once again, I’m Marc Lichtenfeld. Today, I’ll be showing you how to select the very best dividend stocks.

Not all dividend-paying stocks are created equal… Some consistently raise their dividends year after year.

As I mentioned in the last video, I call them Perpetual Dividend Raisers. But there’s a hierarchy among Perpetual Dividend Raisers, and Dividend Aristocrats are at the top.

A Dividend Aristocrat is a company that is a member of the S&P 500 and has raised its dividend every year for at least 25 years or more.

These are primarily blue chip companies with long histories of growing earnings and dividends.

These companies typically want to retain existing shareholders and attract new ones by growing their dividends each and every year.

That makes Dividend Aristocrats some of the best providers of consistent and rising income in the market.

That said, if your investing goals are to impress your friends at cocktail parties with your knowledge of brand-new technology and to brag about the millions of dollars you will make on the companies behind those technologies, well, Dividend Aristocrats aren’t for you.

Most people don’t find a company like Genuine Parts (NYSE: GPC), which makes auto replacement parts, to be terribly exciting. I’m not even sure Genuine Parts’ CEO is all that excited about replacement parts.

I’m kidding. Of course he is. I’m sure he is.

But this auto parts company makes a ton of money – $621 million in 2019 – and it has increased its dividend every year since 1956. That is pretty exciting.

The last time Genuine Parts did not increase its dividend, President Eisenhower was in the White House.

The Dividend Aristocrat Index is currently made up of 65 companies and is rebalanced every year.

Dividend Aristocrats represent the bluest of the blue chips – big, solid companies with dividend-raising track records of 2 1/2 decades or longer.

However, with 65 stocks included in the index, we need to expand our universe – especially because not every Aristocrat has a decent yield.

The dividend yield is the percentage of the share price that you are paid in dividends each year. For example, if a stock is trading at $20 and pays a $0.25 per share quarterly dividend, which comes out to $1 annually, your yield is 5% because 1 divided by 20 is 0.05, or 5%.

Just because a company has raised its dividend for 25 years in a row doesn’t mean it has an attractive dividend yield.

The yield could have started very small and grown at a minuscule pace. Or the stock could have gotten hot, running up in price and decreasing the yield.

For example, Aristocrat Sherwin-Williams (NYSE: SHW) has raised its dividend for 42 consecutive years but still yields only 0.75%.

Therefore, we need to look in other places for companies with juicy yields that have a history of growing the dividend. And for that, we need to look for a Dividend Champion.

Dividend Champions are Perpetual Dividend Raisers that are similar to the Aristocrats in that the companies have raised their dividends every year for at least 25 consecutive years. However, they are not required to be part of the S&P 500.

I love the name Champions because it reminds me of my favorite sport, boxing, and that a person doesn’t need to be 6 feet, 3 inches tall and 240 pounds to be a successful professional athlete.

I’ve seen men who weigh 125 pounds walk into an arena and get the same respect (or even more) from an adoring crowd as a heavyweight champion of the world.

Some of the small stocks on the Champions list also prove that you don’t have to be big to be successful. More than a few have market caps of under $1 billion yet are still terrific income investments.

Dividend Aristocrats are always Dividend Champions because they’ve raised their dividend for 25 years in a row – but a Dividend Champion might not be a Dividend Aristocrat if the stock is not in the S&P 500.

At any given time, there are usually only 50 to 60 Dividend Aristocrats and roughly 100 to 150 Dividend Champions. The exact totals at this moment are 65 Aristocrats and 136 Champions.

Although 136 stocks sounds like a lot, keep in mind that, like the Aristocrats, not all Dividend Champions have attractive yields. Despite annual raises, many still have yields below 3%. I also consider stocks with shorter track records of annual dividend hikes. Today’s company with a 10-year history of yearly boosts to its dividend could be tomorrow’s Dividend Aristocrat.

As you research Perpetual Dividend Raisers, you’ll find plenty of companies that don’t have much trading volume but have long histories of dividend increases. And while the fund managers at Fidelity and Vanguard will have to pass them up because the stocks are just too small, you can easily buy any of them yourself.

Now that you know what to look for, in the next video, I’ll cover how to structure your income portfolio to minimize your downside and optimize your upside. Stay tuned.

back to top ↑

Part Three: Structure Your Income Portfolio for Maximum Returns

Hello, welcome back to the Dividend Riches video series. Once again, I’m Marc Lichtenfeld.

You’ve heard the well-worn saying “Don’t put all your eggs in one basket.” That’s why most financial professionals recommend you diversify your investments across a variety of assets.

A portfolio of dividend stocks should be treated similarly. Although it may be tempting to load up on dividend payers with 10% yields, high yield often means high risk.

There’s nothing wrong with sprinkling a few of those into a well-diversified portfolio to boost your income, but if all you are holding are stocks with double-digit yields, you are taking on way too much risk.

Generally speaking, you want to diversify your dividend-paying stocks across different yields and sectors.

You’ll want stocks in sectors like industrials, technology, energy (often master limited partnerships, or MLPs), real estate investment trusts (REITs), healthcare, consumer staples and a host of other sectors.

You’ll constantly have some groups in the market outperforming and others underperforming. So by diversifying, you are trying to ensure you always have exposure to a group that is performing well.

If consumer stocks are weak, perhaps healthcare will be strong. When the economy is starting to show signs of recovery, industrials should work.

There will always be a group on the rise, either because of the cyclical nature of stocks and the economy or because a certain sector gets hot.

If Warren Buffett suddenly announces that he is buying large pharmaceutical companies, you’ll want to have already bought into that sector because those companies are likely going to take off for a few weeks or months.

Deciding to get in once Warren Buffett proclaims that he likes those stocks on CNBC will be too late. The market will have already reacted, and the price of those stocks will be significantly higher a second after the Oracle of Omaha utters those words.

But if you have a diversified portfolio where you already own some large pharmaceutical stocks, when Buffett says he likes Big Pharma, your shares of Bristol Myers Squibb (NYSE: BMY) and Abbott Laboratories (NYSE: ABT), which you bought two years ago for 15% lower, will take off.

And your yield will remain the same, which is important for dividend investors. It doesn’t matter what the stock price is today… It matters what you paid for it.

Here’s what I mean. If you bought a stock at $20 and receive a $1 dividend, your yield is 5%. A couple of years later, the stock jumps and is trading at $50. If it still pays a $1 dividend, your yield is still 5% because YOU paid $20. Someone who looks it up on the internet will see a 2% yield because one divided by 50 equals 0.02, or 2%. But that’s the yield on the current price. Again, YOU paid $20, so YOUR yield is 5% – and you have a big gain in the stock as well.

Now that you know what to look for and how to structure your portfolio, it’s time to explore some of the benefits of investing in dividend-paying stocks.

In the next video, I’ll show you how to make money even if a stock goes down. Stay tuned.

back to top ↑

Part Four: How to Make Money Even if a Stock Goes Down

Hello. Once again, I’m Marc Lichtenfeld and welcome back to Dividend Riches. In this installment, I’ll show you how to make money even when an individual stock goes down. And no, I am not talking about risky shorts or fancy options plays.

You can make money even when a stock is declining all thanks to – you guessed it – dividends.

Namely, dividend-paying companies aren’t short-term plays. Ideally, you’ll never sell these stocks. And even if one or all of them take a dip in share price, you’re still making money.

If you’re looking to build a wealth-creating portfolio for the long term, then as long as you keep it diversified, you should have little to no fear of short-term dips in share price or even bear markets.

That’s why you need to pay attention to a stock’s dividend growth rate.

The stock market is all about growth. Investors buy stocks whose earnings and cash flow are growing. Income investors want rising dividends. CEOs try to grow their sales and margins. Investors pay higher prices for companies that are growing. If a company stops growing, its stock price usually gets hammered.

A key component in the formula for building wealth with dividend stocks is dividend growth. Without it, the dividend will lose its buying power because of inflation. Even with low inflation, over the years, the money won’t buy as much as it used to.

A company that raises its dividend by a meaningful amount every year – aka a Perpetual Dividend Raiser – typically has rising earnings and cash flow. It’s a sign of a healthy business and, just as important, shows that management understands its fiduciary duty to shareholders.

The historical average dividend growth of the S&P 500 is 5.5% per year. That’s not bad, considering the average inflation rate of 3.4%. Using historical averages, that means investors are getting 2.1% more buying power each year. So investing in the S&P 500 has kept investors ahead of inflation and preserves their buying power.

But we want to be way ahead of inflation. Inflation isn’t always going to stay low. In some areas of the economy, it’s already pretty darn high. Healthcare, food and college tuition are just a few segments where prices seem to rise significantly every year, no matter what government statistics say.

Therefore, we want strong (but sustainable) growth in our dividend every year.

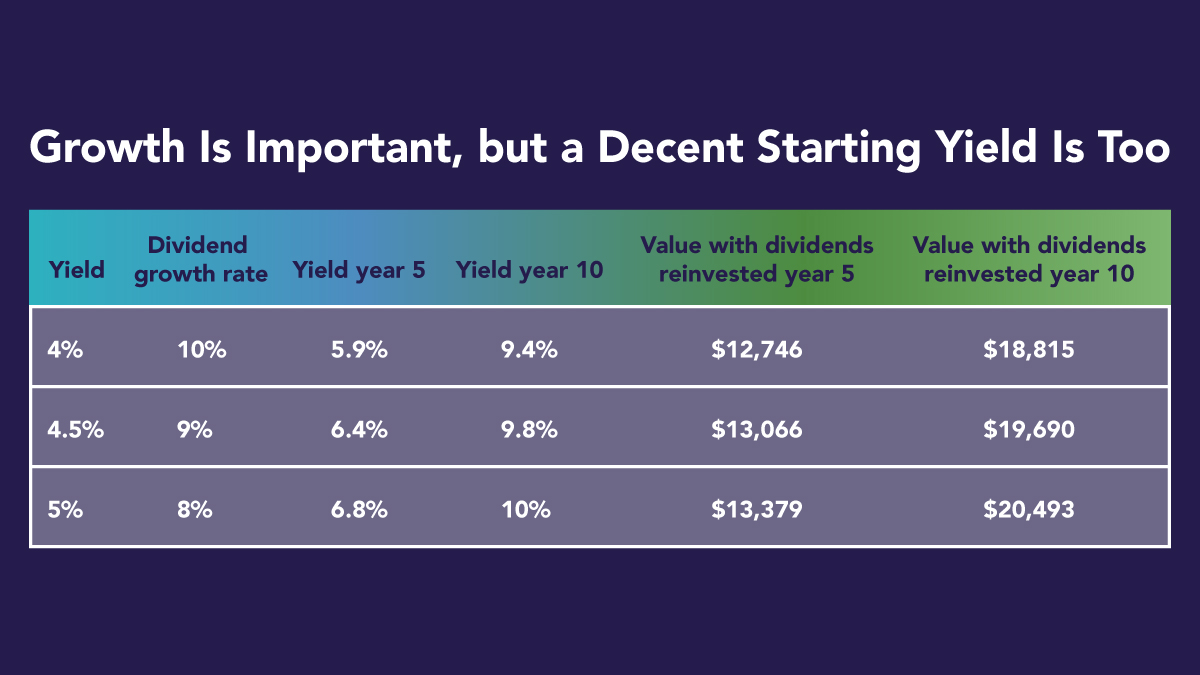

Take a look at what happens if we increase the starting yield but lower the growth forecast. We’ll assume we invested $10,000 and the stock price never moves. Near term, higher starting yield wins out.

As you go further out to 15 and 20 years, the stocks with higher growth rates catch up or surpass those with higher starting yields and lower growth rates.

Also, it’s interesting to note that reinvesting dividends for 20 years achieves the same results with a 4% starting yield and 10% dividend growth as a 5% starting yield with only 8% growth.

So in this case, higher dividend growth made up for the lower starting yield. And it certainly did when you don’t reinvest dividends and simply look at what the yields turn into by compounding the growth rate.

Which brings me to my main point… how you can make money even if a stock goes down.

If you’re invested in dividend-paying companies and reinvesting your dividends, a decline in share prices can work in your favor.

In fact, a bear market could be your best friend.

So let’s say you own shares in Company X. It has a price of $100 per share and pays a $5 annual dividend, giving it a yield of 5%.

If there’s a recession and all major indexes take a hit, your stock will likely not be spared. But assuming it continues paying its dividend (which is most likely it will) and you’re reinvesting your dividends, you can buy more shares at a higher yield during the slump.

Remember, yield is calculated by dividing the annual dividend payout by the share price.

So shares of Company X may drop to $50, but as long as it remains fundamentally strong and keeps paying its $5 dividend, your new shares purchased with reinvested dividends yield 10%, boosting your yield on the entire position.

When the price of the stock drops, if you’re reinvesting your dividend, you’ll add even more shares, which generates even more dividends, which buys more shares, which generates more dividends and so on.

So you might be thinking, “Great, my yield doubled to 10%, but my shares slashed by 50%.” Remember, we’re investing in these stocks for the long term. And we know that markets go up over the long term. Over rolling 10-year periods going back to the 1930s, the market is higher 91% of the time.

Even better, Dividend Aristocrats, which have been around since 1990, have never lost money over rolling 10-year periods.

Even if you bought in 2000 at the top of the dot-com bubble and sold in 2010 not long after the financial crisis bottomed, you still made money.

So in our example, even if the stock got hammered, as long as the company’s fundamentals are solid and it is paying and raising its dividend, who cares where the stock price is today if you don’t plan on selling it for years? Just keep collecting or reinvesting those higher dividends year after year. Your stock will be just fine.

So far, we’ve covered how to lock in monthly income with Perpetual Dividend Raisers, what to look for in dividend-paying companies, why you should diversify your income portfolio and how a drop in share price can work in your favor.

But don’t worry, there’s still plenty to come in the Dividend Riches series. In the next video, I’ll dive into how to use dividend-paying companies to stick it to the taxman – legally, of course.

back to top ↑

Part Five: How to Minimize Taxes on Your Dividends

Hello, welcome back to Dividend Riches. Once again, I’m Marc Lichtenfeld, and in this episode, I’ll be diving into everybody’s favorite topic: taxes…

Now, I know everyone hates taxes, but they are important to pay attention to, otherwise you’ll pay more than you need to. And today, I’m going to show you how investing in dividend-paying stocks may help you stick it to the taxman.

Here’s what I mean…

For most people, the tax rate on dividends is a flat 15% right now. There are exceptions to this, so if you have any questions, you should always seek the advice of a tax professional.

And depending on changes in the tax code, the current tax rate could be higher or lower in the future. But regardless of the tax code at any given time, there are a few things you can do to cut your own taxes.

For regular dividend stocks, such as Perpetual Dividend Raisers, consider holding them in a tax-deferred account, such as an IRA or 401(k). That way, the dividends and reinvested dividends will grow tax-free until you retire.

Look at the difference growing the money tax-deferred makes.

Let’s assume you have an IRA and you’re reinvesting your dividends. The portfolio starts with a 5% yield and averages 8% dividend growth and 7.5% annual appreciation, which is about the historical average gain for the S&P 500. In 10 years, an account that started with $100,000 will be worth more than $339,000 if you reinvest the $96,000 in dividends that you received.

If those same stocks were in a taxable account where you were paying 15% taxes on those reinvested dividends every year, you’d have had to shell out almost $15,000 in taxes. To do that, either you’d have to sell some shares, which would slow down the compounding machine and lower your return to a total of $314,000, or you’d have had to come up with the cash.

In the end, though, you’d lose more money to taxes than you need to. While you had to pay more than $14,000 in taxes, because of that money is not compounding, it actually cost you $25,000. And with the IRS already taking its fair share of your money, why give it more?

Of course, you’ll have to pay taxes on the tax-deferred account once you tap into the money that’s in it, but you also don’t necessarily have to withdraw all of the money at once, allowing the majority of the funds to continue to grow tax-deferred.

Additionally, if you are no longer working, theoretically your taxable income will be lower, so your tax rate may be as well.

So in general, you should try to keep dividend-paying stocks in your tax-deferred accounts.

As with any rule, though, there are some important exceptions.

If you’re collecting income from master limited partnership (MLPs), you’re usually better off holding those stocks in your taxable account.

When you own a master limited partnership, you are a partner, not a shareholder. As a result, you receive distributions, not dividends. These distributions usually are made up mostly of return of capital.

A distribution or dividend made up of return of capital is tax-deferred anyway, so there is no advantage to keeping it in your tax-deferred accounts. In fact, it will be a disadvantage if it replaces another income-producing investment that will be taxed as a result of being forced to reside in a taxable account because there’s no room in the tax-deferred account.

Certain REITs, BDCs and closed-end funds are also better off held in a taxable account if most or all of their dividend is considered a return of capital. REITs are real estate investment trusts – companies that invest in real estate. BDCs are business development companies. These are companies that invest or lend money to other companies. And closed-end funds are like mutual funds but trade like stocks on the stock exchange.

Another exception to the rule is foreign stocks. You should keep those in your taxable accounts.

Foreign tax authorities, with the exception of those in the U.K., take taxes out of your dividends before you receive them.

If the stock is held in a taxable account, you are eligible for a foreign tax credit from the IRS. However, if the stock is held in a tax-deferred account, you lose the foreign tax credit but still have foreign taxes taken out of the dividend before you receive them.

If tax law changes and dividends are taxed at your ordinary income level, you should talk to your tax advisor about ways to defer taxes on those dividends. You really want those dividends to compound tax-deferred over many years. Legally protecting them from the taxman for as long as possible is going to put thousands (quite possibly tens or hundreds of thousands) more dollars in your pocket.

Tax law has tons of variables and nuances, so once again, I urge you to talk to a tax professional if you have any questions.

Okay. So far, I’ve shown you what to look for, how to structure your income portfolio and the benefits of investing in dividend-paying stocks. In the next video, I’ll show you how to increase your yields. Stay tuned.

back to top ↑

Part Six: Turn a 2% Dividend Yield Into as Much as a 20% Yield

Yield is a critical component of investing in dividend stocks. In this video, I’ll walk you through several steps to significantly boost your yield.

Obviously, for any stock you buy, even if it’s for income purposes, you’ll buy because you think that, over the long haul, its price will increase.

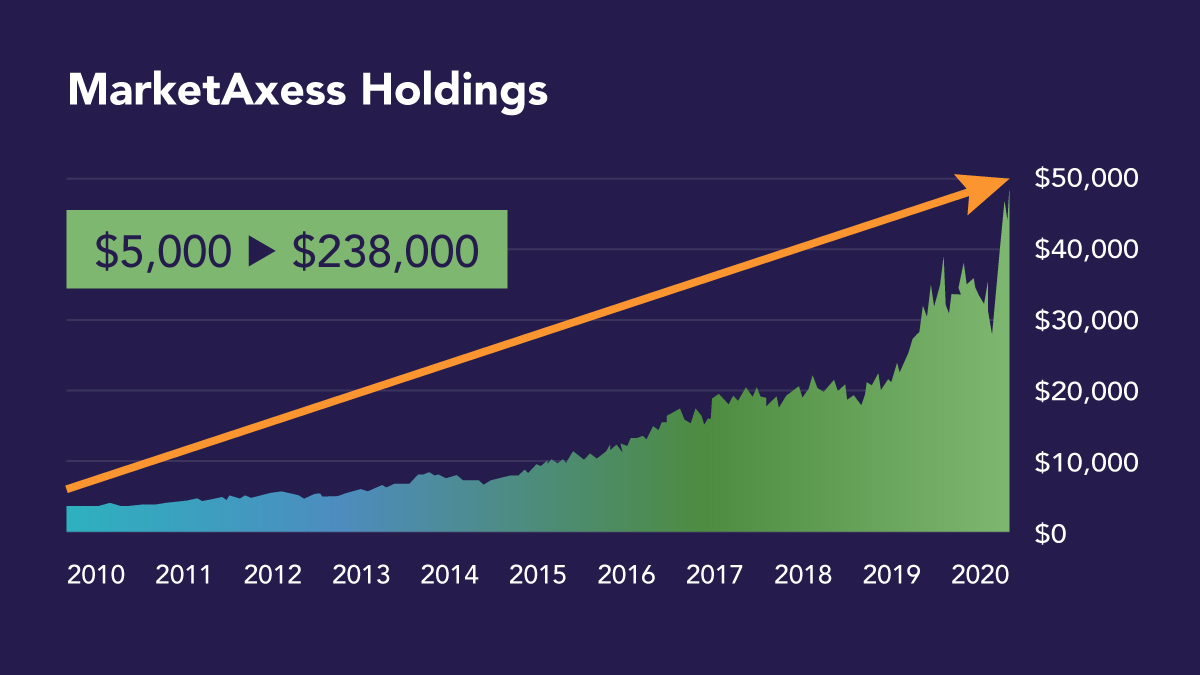

For example, consider MarketAxess Holdings (Nasdaq: MKTX).

When it started paying out a dividend in November 2009, it yielded just 2%.

That sounds small.

But here’s where things get exciting…

If you locked in and reinvested that 2% yield, your equivalent yield today would be more than 19%!

And every $1,000 invested that day would now be worth $47,648…

And $5,000 would be worth $238,000!

Here’s another example…

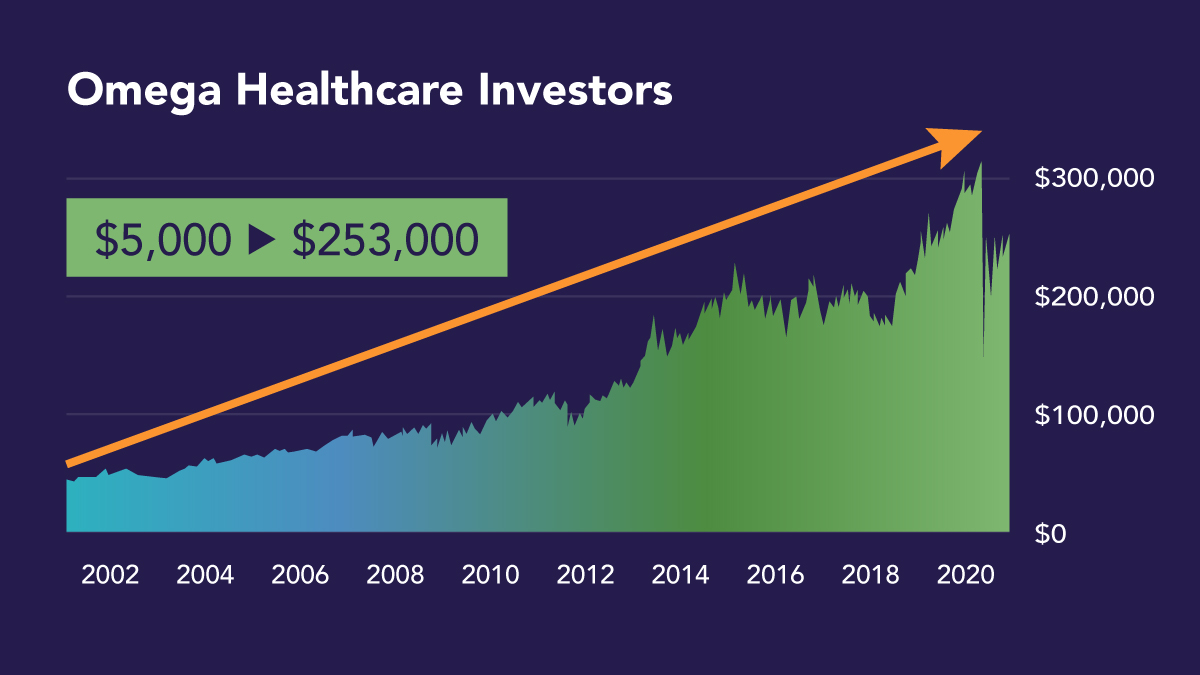

Omega Healthcare Investors (NYSE: OHI).

If you bought it at beginning of 2010, your yield today would be 14.5%.

If you bought it at beginning of 2001, your yield would be 71%.

And if you had great timing and bought in April of that year, your yield would be as high as 198%!

So you’re banking triple the amount of money you invested… every single year.

Every $5,000 invested in April 2001 would be worth $253,000 today… And you’d be collecting around $15,000 every single year.

That’s the extreme power of dividends.

For a compounding machine like this to gain momentum every year, the dividend needs to grow. If the company can’t maintain dividend growth and has to slash the dividend, that derails the train (and likely the stock price). You’ll most likely have to sell your stock at a lower price and start over with a new one.

So the second step to maximizing your return is to monitor the payout ratio to make sure that your yield is safe.

By looking at a company’s payout ratio, you can usually avoid many of the problem stocks that could lead a portfolio off the rails.

The payout ratio is the ratio of dividends paid to earnings or cash flow. If you look up the payout ratio on some of the free stock market websites, they use earnings. I use cash flow because it’s a more accurate gauge of a company’s ability to pay dividends.

To calculate payout ratio using cash flow, simply divide dividends paid by free cash flow.

Generally speaking, I want to see payout ratios (based on cash flow) of 75% or less, unless the stock is a BDC, REIT or MLP. In those cases, payout ratios can be as high as 100% of cash flow since many of them have policies to pay out all or nearly all of their cash flow and use different metrics than free cash flow that are unique to their industries.

But for most companies, the 75% payout ratio guideline is probably the one you want to stick to the closest, because we’re talking about the stability of the dividend. If you go outside the boundaries on yield or dividend growth and things don’t work out right, you may make a little less money than you thought.

But if the dividend is cut, chances are your stock is going to fall, maybe significantly. And you probably won’t want to be invested in it anymore and may sell for a loss.

So the reliability of the dividend is a very important factor. And if you’re relying on dividends for income, you may not be able to afford a cut.

Of course, if you find a stock with a payout ratio of 50%, you have plenty of margin for error. Even if business stinks and earnings fall, there should be plenty of cash to continue to pay the dividend.

Should that happen, keep a close eye on the payout ratio. Management may be reluctant to cut the dividend, especially if the company has a long track record of raises. But if earnings are on a downtrend and the payout ratio is increasing, management may eventually be forced to lower the dividend paid to shareholders. If the payout ratio starts moving higher, it may be a hint that a cut or a halt to the raises is coming.

This is so important that I’ve created a proprietary database for Oxford Income Letter subscribers called SafetyNet Pro. SafetyNet Pro grades the dividend safety of more than 800 companies and predicts dividend cuts with stunning accuracy. Using this tool can help take the guesswork out of creating and maintaining an income-generating portfolio.

Finally, to maximize your yield, you’d like to be invested in a company with sales, earnings and especially cash flow that are on the rise. A reasonable payout ratio gives management plenty of room to continue to increase the dividend.

Don’t get bent out of shape if the company has a bad year or two, particularly if the payout ratio is low enough that the dividend isn’t threatened. But if a company has year after year of negative sales, earnings or cash flow growth, you might want to start looking elsewhere. It’s not going to be the healthiest company, even if the payout ratio is low and the dividend continues to grow.

In a perfect world, I’d like to see 10% or more annual growth in sales, earnings and cash flow, but that’s not always easy to find, particularly in mature, stable companies that have a long history of dividend growth. So be sure to keep an eye on the company and look for at least some growth in those areas.

Follow those rules and you’ll be able to boost your dividend yields into the double digits and stay well ahead of inflation while ensuring your income stream is safe.