By Marc Lichtenfield, Chief Income Strategist

This company is a unique investment. It’s not a stock, bond, private company or option.

Rather, it’s an unusual trust that can give you income from America’s artificial intelligence (AI) boom each and every quarter.

In fact, as a trust, this company is legally required to distribute 90% of its income to its investors via special tax-sheltered dividends… That’s money that can go directly to YOU!

And there’s plenty to go around.

This company already has $8.7 billion in annual revenues… and it is set up for incredible growth for the years ahead.

Now, when most investors think of dividend payers, they likely picture enormous blue-chip companies that have been around forever. And while many of those companies do pay dividends, they are hardly the only ones that do so.

And if you know where to look, you can find an entire portfolio’s worth of dividend-paying stocks of all sizes and in all industries… even industries on the bleeding edge of technology like artificial intelligence, or AI.

As you’ll see in a moment, the “AI Income Trust” is a prime example…

See, the modern internet goes far beyond your laptop, phone or wireless router. It requires infrastructure just as any other complex system does.

The infrastructure the World Wide Web uses is less visible than a freeway, airport or train. But the quintillions of bytes of data we produce daily need the virtual equivalent of roads, rails, ports and warehouses.

For example, the data for websites you use daily, like Google, need server space to function. Think of a server as a sort of warehouse for data. There are around 100,000 servers stored in each of the 10,000-plus data centers worldwide (5,427 data centers are in the United States, the most of any country). The servers provide the data to the devices we use every day.

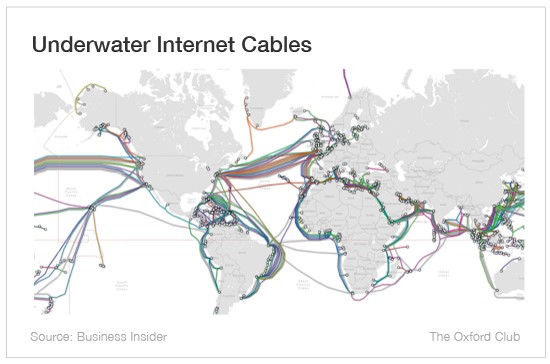

That data needs to move through the internet to the endpoint user, and it does that through cables and wireless routers. They’re essentially the road, rail, port and airport network we use to move physical goods in this analogy.

It’s important to keep in mind that even though we can’t “see” much of the internet, it isn’t an invisible, intangible thing. It’s just as physical as anything else we use. The only reason you’re able to send emails across the sea to Europe or Asia is due to a massive bundle of cables sitting at the bottom of the world’s oceans.

And AI will greatly increase the traffic on that infrastructure network. AI programs like ChatGPT need much more data and internet bandwidth to operate than older websites. But as legacy websites like Google or Facebook integrate AI, their demand on internet infrastructure will also increase.

That’s where the AI Income Trust comes in… It is building our global internet infrastructure and preventing the digital equivalent of a traffic jam or train derailment. It’s collecting tolls (to the tune of BILLIONS of dollars) from its infrastructure and paying them out to its shareholders through a healthy dividend.

It makes money whenever you ask ChatGPT a question or whenever Amazon’s algorithm gives you a recommendation. Its data centers underpin the modern high-speed internet, communicating with one another and then to the phone in your pocket in milliseconds.

It’s called Equinix Inc. (Nasdaq: EQIX) and it’s like the toll collector of the internet…

It should be the foundation of an AI dividend portfolio because it’s forming the bedrock of the next generation of digital infrastructure.

Building Bridges in Cyberspace

Founded in 1998 and headquartered in Redwood City, California, Equinix is the premier company building out our global digital infrastructure. It’s also a real estate investment trust, or REIT, which means it owns, operates or finances income-producing real estate. These unique investments make it possible for everyday investors – not just Wall Street banks and hedge funds – to profit from investing in real estate and generate income in the form of dividends too.

As its name implies, Equinix aims to be a vendor-neutral – that is, equal access – data center provider, securely connecting networks and sharing data traffic across diverse industries, such as finance, manufacturing, retail, transportation, government, healthcare and education, among others.

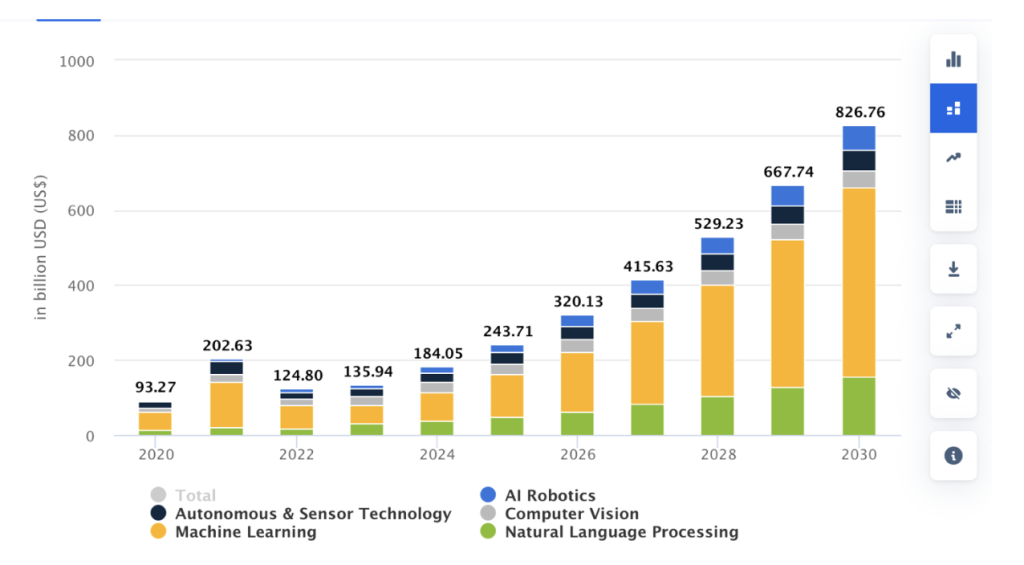

AI is set to impact all of those industries in the near future. The AI market itself is set to be worth over $826 billion by the end of the decade. McKinsey & Company predicts AI technology could add $2.6 trillion to $4.4 trillion in economic benefits annually.

AI Market Is Poised for Rapid Growth

And Equinix will profit from all of it – the AI market itself and the economic benefits it will have for every other industry around the world.

The company operates a total of 270 data centers in 75 cities across 35 countries on all six inhabited continents. Its data centers are used by more than 10,000 companies, including 60%+ of the Fortune 500.

They all come to Equinix for one reason: Equinix is better than the competition. The company’s data centers have an incredible uptime rate of 99.999%. In addition, those data centers are protected by five-layer physical security.

In total, the company’s network of data centers and its proprietary physical connections (cables, ports, etc.), which it calls Equinix Fabric, handle over 468,100 connections around the world.

It’s one of the oldest and most experienced companies in the game, with over 25 years of expertise in designing and implementing digital infrastructure, both for its own use and for its clients’ company-specific networks.

The company’s 10,000-strong workforce is led by a capable and experienced team of executives as well. Chief Executive Officer and President Adaire Fox-Martin was appointed in June 2024 and has been a member of the Equinix Board of Directors since 2020. Adaire has 25 years of experience in the technology sector. In her previous role, she was President of Go-to-Market for Google Cloud and Head of Google Ireland.

Executive Vice President of Global Operations Raouf Abdel has 30 years of experience in the field. Since joining the company in 2012, he’s been a driving force in Equinix’s global expansion and success.

Finally, Chief Technology Officer Justin Dustzadeh joined the team in 2019. He’s an Uber C-suite alum who’s responsible for developing Uber’s global infrastructure network. He also has prior experience at Visa, Huawei, Ericsson and AT&T.

You might imagine that a company with this much going for it has quite an impressive balance sheet… And you’d be correct.

Digital Tolls for Digital Highways

Equinix is building out digital infrastructure and collecting tolls for using its network. Given its clientele, those tolls add up quickly…

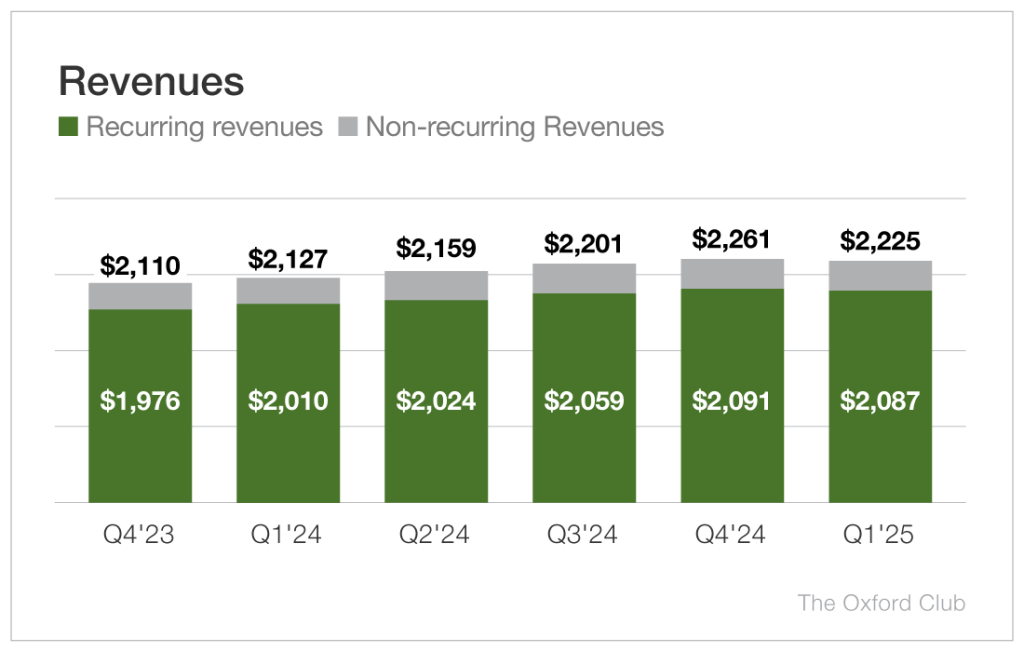

In 2024, the company netted revenue of over $8.7 billion, up 6.6% year over year. Net income totaled $815 million.. And earnings per share were $8.53.

Revenue has been on a long-term growth trend as well. Over the last three years, revenue has grown at a compound annual rate of 11.3%. Over the past 10 years, revenue has grown at a compound annual rate of 13.4%.

And the good news doesn’t stop there. Gross margin is sitting at 49.4%. Cash and cash equivalents grew a whopping 47% to $3.08 billion in 2024. And cash from operations also grew, albeit slightly, up 1% in 2024.

And that growth has continued through the first quarter of 2025. Revenues topped $2.2 billion for the quarter, up almost4% year over year.

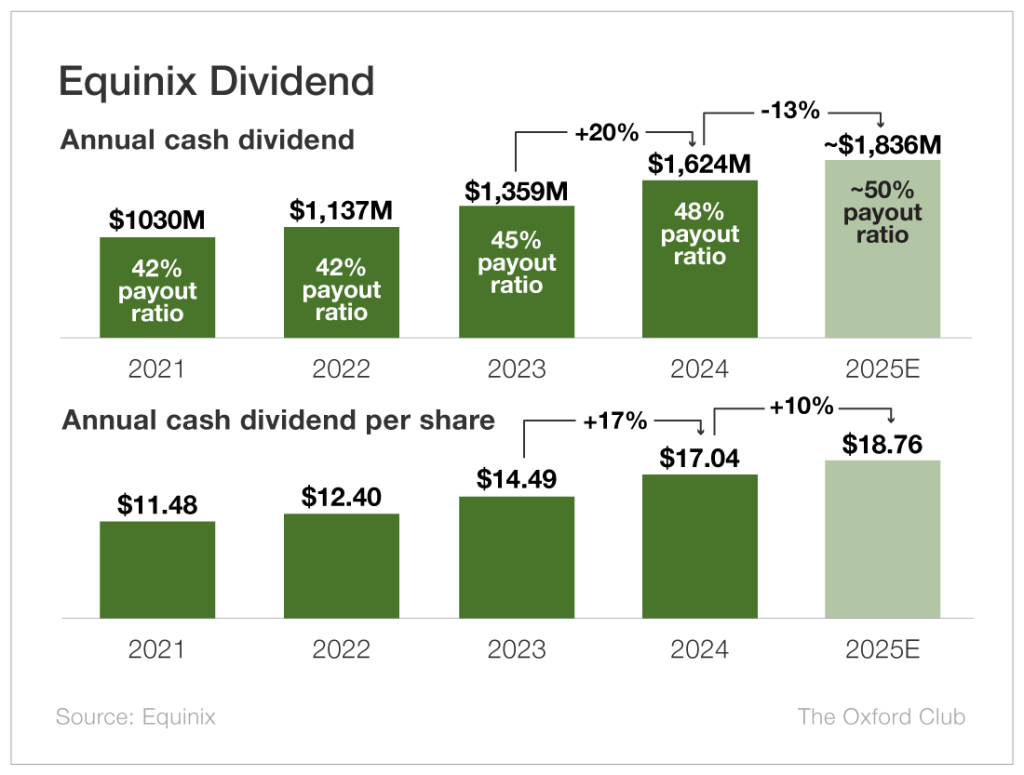

That brings me to the company’s dividend. At present, the company pays out a dividend of just over $18.76 per share for a yield of 2.1% at its current price. Equinix has grown that dividend for 10 years straight since becoming a REIT.

In addition, the company’s dividend increases are substantial. From 2023 to 2024, the dividend grew 18%. The company expects to grow it another 10% through 2025. And right now Equinix’s dividend payout ratio is just 48%, so it has plenty of room to continue growing the dividend.

And $8.7 billion in annual revenues means there’s plenty of money to go around. If you pick up some shares today, you’ll lock in a claim to the tolls collected on the information superhighway.

Action to Take: Buy Equinix (Nasdaq: EQIX) at market. Set a 25% trailing stop to protect your principal and your profits.

Digital Infrastructure for a Modern Economy

Owning shares of company like Equinix is akin to being partial owner of a massive infrastructure project. Imagine collecting some income every time a ship passes through the Suez Canal. Before the Egyptians nationalized the Suez Canal in the 1950s, that was a strategy that worked very well for investors.

Think of Equinix and its data centers as a digital Suez Canal. Instead of goods traveling along an international shipping line, data is traveling along a network of silicon and plastic. Every time that happens in one of its data centers, Equinix collects a toll – and as a shareholder that benefits you.

AI will put immense pressure on global internet infrastructure. More traffic through the world’s data centers means more tolls for Equinix to collect, more profits for the company and more “AI Income” for you.

You can bet that as the volume of tolls goes up and Equinix’s revenues follow that upward trend, its share price will rise in lockstep – and so will its dividend.