Machines are taking over Wall Street.

Today, the biggest quant investing firms, like Renaissance Technologies, Two Sigma Investments and D.E. Shaw, manage tens of billions of dollars.

In total, quant-focused hedge funds manage almost $1 trillion in assets.

The rise of quant investing has Wall Street’s army of human financial analysts rightfully worried about their jobs.

Picture a room full of financial analysts spending their days (and nights) sifting through company balance sheets, income statements, news stories and regulatory filings. All this to unearth a yet undiscovered investment opportunity.

Compare that image with lightning-fast computers sifting through millions of patent databases, academic journals and social media posts every single day.

We humans don’t have a prayer.

But thanks to the democratization of computing power, the rise of quant investing is terrific news for the small investor.

Rise of the Quants

When I started my investment career in the 1990s, quant investing was about identifying momentum in stocks, riding trending prices like a surfer rides a wave.

I developed my first quant-based trading system in 1994 using a now-defunct computer program named “Windows on Wall Street.”

Today, cutting-edge quant hedge funds use computers and algorithms unimaginable two decades ago.

This kind of trading requires more the skills of astrophysics PhDs than those of traditional financial analysts.

Over the past decade, this quant-driven approach to trading has exploded. That’s partially because any edge stemming from fundamental research has all but disappeared.

In 1815, Nathan Mayer Rothschild is said to have used carrier pigeons to learn about the outcome of the Battle of Waterloo ahead of other investors. That “edge” made him a fortune.

George Soros attributed his early success investing in European companies in the 1960s to being a “one-eyed king among the blind.”

Today, financial traders have more information on their smartphones than the world’s top hedge funds did 20 years ago.

Being a one-eyed king just doesn’t cut it anymore.

Man vs. Machine

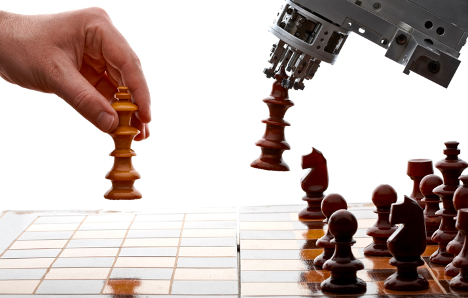

Trading is not the only arena in which humans have lost out to machines.

The battle between man and machine had a watershed moment in 1997. That’s when Garry Kasparov, the world’s top-ranked chess player at the time, lost to IBM supercomputer Deep Blue.

There have been many other such moments since. In 2013, IBM’s Watson beat two Jeopardy champions. In 2017, Google’s AlphaGo computer defeated the world’s top player in Go, humankind’s most complicated board game.

In his book Deep Thinking: Where Machine Intelligence Ends and Human Creativity Begins, Kasparov concedes that human players have no chance against today’s powerful computers.

The reason?

Computers follow the rules without fail. They can process vast swaths of information at the speed of light. They don’t get tired. They are never “off their game.”

A human chess player has to screw up only once to lose a match.

The same applies to human decision making versus quant algorithms in the world of investing.

Fatigue, emotion and limited capacity to process information are all enemies to traders. In contrast, quant algorithms never tire, never get exasperated, and are immune to both a trader’s and Mr. Market’s mood swings.

That’s why investing against machines is like playing chess against a computer.

Yes, you may beat the computer occasionally. But in the long term, it’s a loser’s game.

How Quant Investing Democratizes Investing

Quant investing may scare you.

It shouldn’t.

As with all disruptive technologies, quant investing democratizes investing in unimaginable ways.

Twenty years ago, only the world’s top hedge funds had the computer power to generate consistent market-beating returns.

Today, I have access to computer programs that can develop similar quant strategies without the need for an army of PhDs. I can harness these computers to develop a wide range of quant strategies.

These strategies can unearth value, growth and high-quality companies…

They can focus on short-, medium- and long-term trading strategies…

They can identify technical factors like relative strength, momentum and reversion to the mean.

I have spent the last six months developing just such quant strategies. Specifically, I developed a short-term “swing trading” system.

Swing trading…

- Focuses on generating big stock market profits with holds between two and 10 days

- Makes money by capturing the bulk of a stock’s short-term move

- Allows you to make money on a stock by betting on it – or against it

- Turbocharges your profits with options.

In short, it’s the perfect introduction to the sophisticated world of quantitative trading for an average investor.

Good investing,

Nicholas