Editor’s Note: Here at Wealthy Retirement, we’re ringing in 2020 with the spirit that “auld acquaintance” shouldn’t be forgotten…

That’s why we’re continuing to kick off the new year by checking in with our good friend and former Options Strategist, Karim Rahemtulla.

When we asked what our friend was up to, he had some exciting news…

Karim recently guided members of his live trading service, The War Room, through a low-risk, high-profit trade on Cisco Systems (Nasdaq: CSCO), picking up shares at a 33% discount.

This is the kind of blue chip dividend raiser we hang our hats on here at Wealthy Retirement. Cutting purchase price by one-third is an incredible opportunity – so we asked Karim to give us the full story of the trade below.

– Mable Buchanan, Assistant Managing Editor

Naked put selling – probably the least safe strategy on the planet, right? Not necessarily!

I know many brokers who advise their clients never to do this type of trade.

Why do you think that is?

Well, let’s look at what a naked put sell is…

When you sell a put option, you are obligating yourself to buy shares of the stock you sold puts on at the strike price that you sold them at… if the shares close at or below the strike price at expiration.

Of course, if the shares trade below the strike price before expiration, the buyer of the put that you sold can also “put” you the shares (force you to buy the shares).

However, that rarely happens unless the shares are well below the strike price.

So when you sell a put, you get cold hard cash for taking the risk.

As an example, let’s say stock X is trading at $20 and you sell a put with an $18 strike price on it. You will receive cash for taking the risk of having to buy the shares at $18. That money is called the premium.

When you sell a put, the broker requires that you put up around 15% of the strike price as collateral. The rest is margin that the broker provides to you.

Maybe that’s where the risk lies… with the broker!

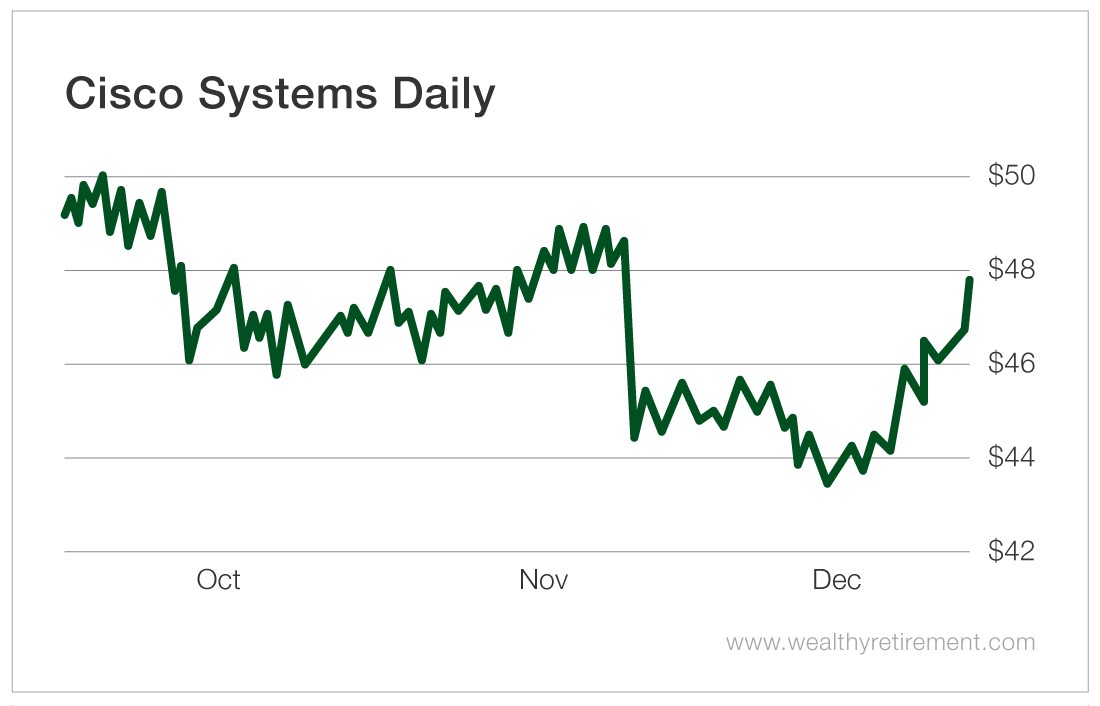

War Room members sold puts on Cisco Systems in mid-November. The goal was to own Cisco at $30 per share… even though the shares were and are over $45.

That was a 33% discount to the price at the time, and at that level, we would also get a 4% dividend or more from this cash-rich giant…

Where’s that risk again?

Cisco Systems would have had to fall 30% and stay there for members to break even off the put sell and fall even more for them to sniff out a loss…

I liked those odds…

In fact, according to my probability calculator, the odds of that happening were less than 20%. That’s not zero, but that puts members in the catbird seat for sure.

Either own one of the strongest technology companies on the planet for a 33% discount to what everyone else is paying for the same stock today or get paid for trying!

Members cashed in the Cisco Systems play for a gain of 25% on the premium they sold. That’s 25% in a month on a play that had an 80% probability of success and a 33% discount to market.

This is how to sell puts and make money. Based on my track record, you could win more than 80% of the time.

In The War Room, members sift through the Wall Street nonsense and look for the best opportunities to make money the right way.

A lot of folks (some brokers included) will use risk as a reason to convince you to avoid options trading.

But smart speculations like this one – which got my readers in on a Perpetual Dividend Raiser for a fraction of its share price – reveal just how straightforward, low-risk and profitable options trading can be.

Isn’t it time you got on board?

Good investing,

Karim