In December, the Financial Times published a poll with startling findings: 42% of Americans believed the Dow was “about the same” as it was at the start of 2019. Another 18% believed the market was down for the year.

In reality, both the Dow and S&P 500 were up about 25%!

If only those people had looked at a newspaper or website, listened to the news… or just checked their brokerage statements!

Folks who thought the market was down or flat either were very unlucky or hadn’t looked at their statements all year.

This raises an interesting question: How often should you check on your investments?

As a general rule, the further away you are from needing the funds, the less you should be paying attention to them. This is particularly true of long-term retirement assets in tax-advantaged funds like 401(k)s and IRAs.

In fact, investors who remain hyperfocused on the market’s movements set themselves up for one of investing’s most dangerous bad habits…

The Danger of Emotional Investing

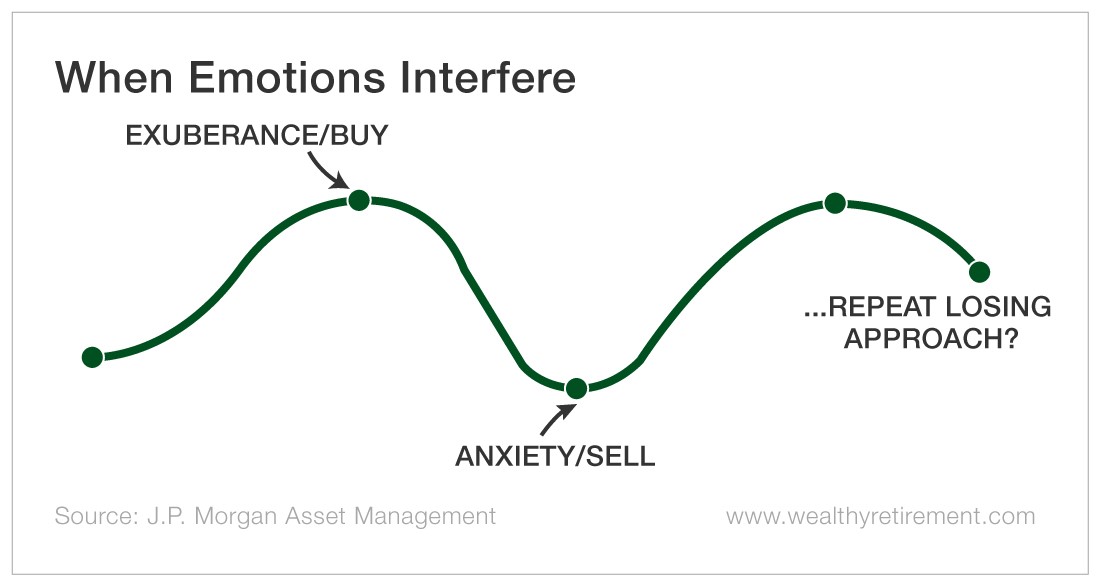

This goes double for the kind of person who panics when the market is going down… or, conversely, the kind of person who gets overly excited when the market is rising.

Emotional investors are better off checking statements less frequently. This helps them avoid making financial decisions out of fear and greed, which typically leads to poor performance.

“There is ample evidence from the field of behavioral finance suggesting that people tend to react to markets in a way that lowers returns,” says Michael Liersch, who holds a Ph.D. in cognitive psychology and is the global head of wealth planning at J.P. Morgan Asset Management.

These reactions create a destructive pattern…

If you can keep your emotions in check, I recommend reviewing your portfolios at least once a year – ideally around the same time each year.

How to Do an Annual Review – and Leave Anxiety at the Door

Rebalancing is an important discipline that often gets overlooked during bull markets. After a big year like 2019, individual asset classes or stocks can become a bigger part of your portfolio than you realize.

And taking that good hard look at your assets’ performance can minimize stress and prevent you from making poor decisions based on fear or greed…

For example, the average American investor has roughly 85% of their portfolio in U.S. assets, according to Vanguard. U.S. stocks have been a great bet for the past decade, but 85% in any one asset class is a high concentration of risk.

By trimming their exposure to U.S. stocks and adding international equities, these investors can become more balanced – and gain more peace of mind.

Similarly, investors who own 2019’s big winners like Apple (Nasdaq: AAPL) and Tesla (Nasdaq: TSLA) might find those stocks now make up oversized portions of their overall portfolios. In cases like this, you can trim, raise your stops or buy puts to protect your gains.

Again, if you’re truly a long-term investor, an annual portfolio checkup is ideal.

But if you’re investing the funds for a shorter time period (say three years or less), you’re going to need to pay closer attention to the market to understand how it might affect your wealth.

For folks in that category, a quarterly or monthly – or even daily, in the case of short-term traders – review makes sense.

Again, the key is to know yourself and figure out what makes sense for you and your portfolio.

Stay in Control by Building a Habit That Works for You

The same holds true for investing. I have long-term retirement assets that I tend to review on a semi-annual basis. My “nest egg” accounts are conservatively managed.

I also have a more speculative trading account I check more frequently – at least once a quarter. This is money I can afford to lose without really impacting my quality of life.

If you’re just starting to invest, or if you’re trying to figure out how frequently to check your accounts, here are some key questions (and answers):

- How soon are you planning to use the funds? The shorter the time frame, the more frequently you’ll want to check.

- How well can you handle big market swings? If you know seeing red arrows is going to send you into a panic, check less frequently. The same is true if you’re someone who gets overly excited when the market is going up.

Addressing these questions can give you peace of mind, which leads to better decision making and, ultimately, more control over your wealth.

Good investing,

Aaron