Energy stocks used to be the dividend darlings of income investors. As the price of oil went up, so too did their juicy dividends.

But that all changed in 2015. The oil market hit the skids, and the price of oil plummeted by 75%.

A number of energy stocks became dividend disasters. Without the cash to sustain them, their payouts crashed. Many energy companies had no choice but to slash or eliminate their dividends.

But the dividends of a select few energy companies managed to shine bright during the dark days of the oil crash. They managed to maintain or even raise their dividends.

Occidental Petroleum (NYSE: OXY) was one bright star of the 2015 oil crash. The company has raised its dividend every year since 2002.

Oil prices rebounded earlier this year, but some investors believe that the rally may have been short-lived. After reaching a four-year high in early October, the price of crude has plunged 22%. Once again, the oil market is teetering on a bear market.

Will Occidental Petroleum’s dividend survive another market bust?

To find out if this 4.3% yield is in danger of getting whacked, let’s look at Occidental Petroleum’s free cash flow.

Last year, Occidental Petroleum produced $333 million of cash flow. That’s up 124% from the negative $1.4 billion it generated in 2016.

But Occidental Petroleum paid out more money in dividends than it brought in. In 2017, Occidental Petroleum paid out $2.3 billion in dividends, giving it an unsafe payout ratio of 704.5%. That means that the company had to dip into its cash reserves to meet its dividend obligation.

That’ll change this year. Occidental Petroleum is expected to generate $3.8 billion in cash flow. That’s a whopping 1,050% increase!

This year, Occidental Petroleum will generate more than enough cash to cover the $2.4 billion in dividends it’ll pay out. Its payout ratio is 62% – comfortably below SafetyNet Pro’s 75% comfort level.

The better news for dividend investors is that free cash flow is expected to climb nearly 8% to $4.1 billion in 2019. Occidental Petroleum’s 2019 predicted cash flow is enough to support the current dividend, a dividend hike and a dividend safety upgrade next year.

But for now, there’s a low risk of Occidental Petroleum cutting its dividend.

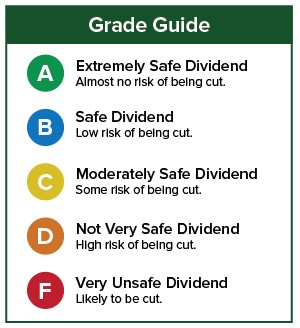

Dividend Safety Rating: B

If you have a stock whose dividend safety you’d like analyzed, please leave the ticker symbol in the comments section!

Good investing,

Kristin