Editor’s Note: This week, we asked our readers whether they have allocated any new funds to exchange-traded funds (ETFs) over the past six months.

If you’re not familiar with ETFs, they’re collections of stocks that share a common theme, like sector or index. They’re not actively managed, so they’re less expensive and post better performance than most mutual funds. They can also serve as an excellent tool for diversification.

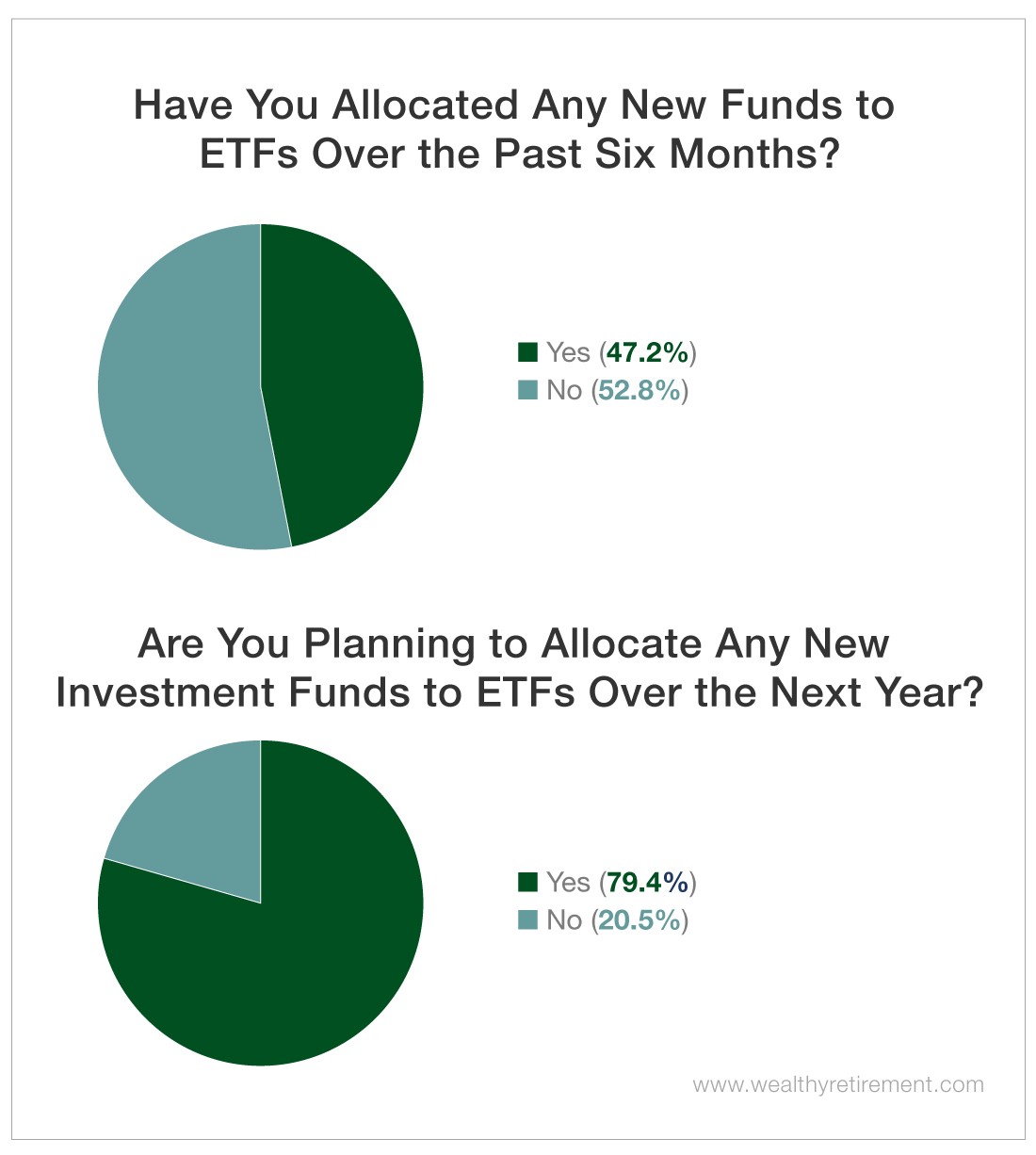

However, in spite of these benefits, our readers were fairly evenly split between those who had purchased ETFs since February and those who had not.

This is surprising because when we asked in December if readers planned to allocate any new funds to ETFs in 2019, almost 80% of our respondents said that they were interested in doing so.

Why aren’t readers buying ETFs?

It could be that we’ve been waiting to rebalance our portfolios and holding out for a clear buying opportunity. We could have also diversified through other investment vehicles.

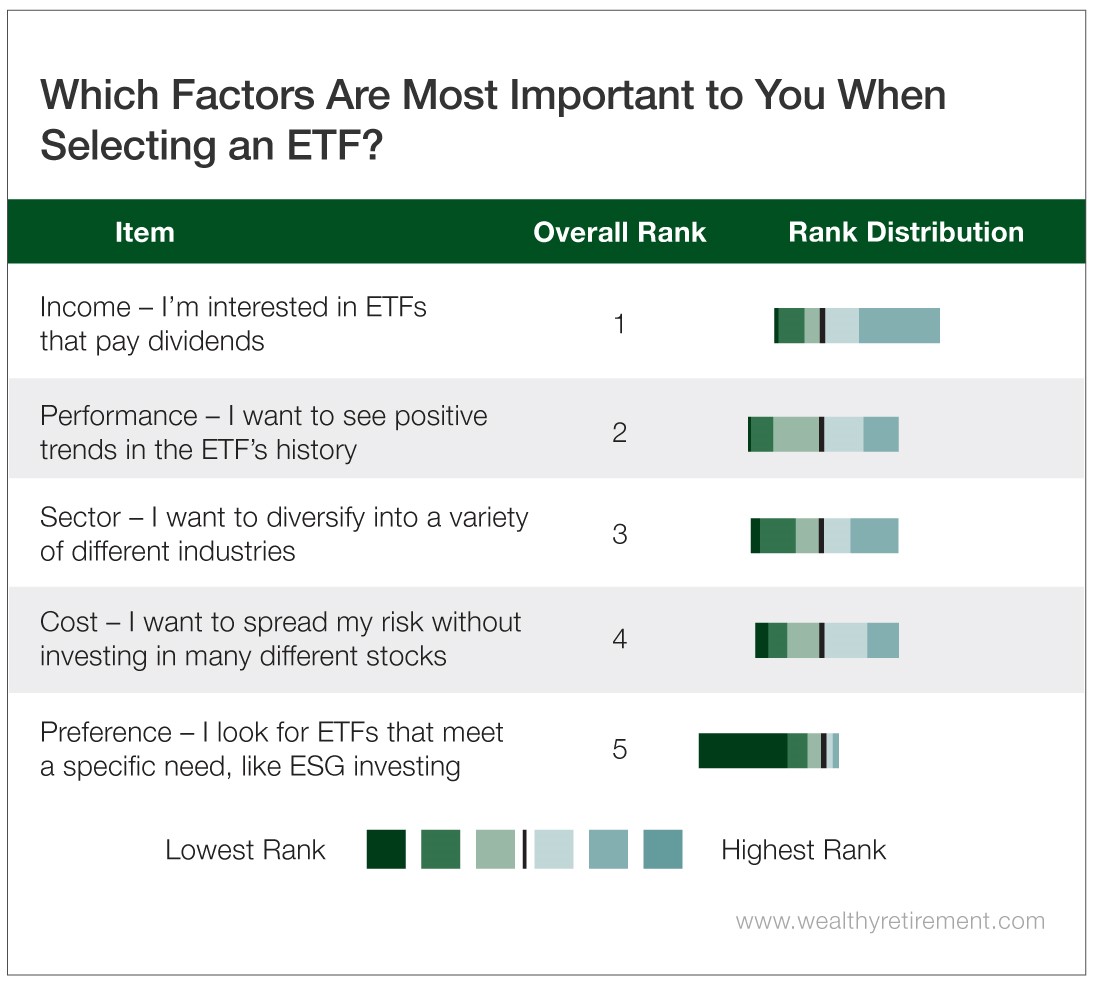

It’s clear, though, that when it comes to investing in ETFs, our readers have a firm grasp of what they’re looking for.

According to this week’s survey, when considering investing in an ETF, our readers are interested in several factors, like performance, sector, cost and preference – but generating income tops the list by a landslide.

For this reason, we’ve called on a friend from our sister e-letter Liberty Through Wealth, ETF Strategist Nicholas Vardy, to explain his top strategies for generating income using ETFs.

As an expert in ETF investing, Nicholas is the perfect guide to help our readers meet their 2018 end-of-year financial resolutions. Please enjoy his column below – and then consider “walking the walk” and meeting your income goals by allocating new funds to ETFs.

– Mable Buchanan, Assistant Managing Editor

I’ve written before about the remarkable flexibility of ETF investing.

With more than 2,000 ETFs trading on U.S. stock exchanges… you can assemble a portfolio of strategies to achieve almost any investment objective. ETFs allow you to bet on U.S. and foreign stocks, bonds, commodities or currencies – almost any asset class under the sun.

Say you believe in a market melt-up – that stocks are set to soar in the coming months. Well, you can increase your bets by investing in leveraged ETFs.

Say you believe the opposite – that the stock market is on the brink of a major collapse. ETFs allow you to profit handsomely by betting against markets.

It recently occurred to me, however, that I had yet to explore the crucial area of income investing.

In other words, how can ETFs provide you with a steady and reliable source of income? Below are three ETFs with very different income-generating strategies that do just that.

1. Dividend Aristocrats

When most investors want to generate income, they think first of buying high-dividend stocks.

This is harder than it looks. You need to do more than just identify companies that pay a high dividend. You also need to make sure they can keep paying it.

Enter the Dividend Aristocrats.

Dividend Aristocrats are S&P 500 companies that have increased dividends every year for at least 25 consecutive years. The good news is you don’t need to invest in each of the 53 Dividend Aristocrats to make money from them.

Today, you can simply buy the ProShares S&P 500 Dividend Aristocrats ETF (CBOE: NOBL). This rock-solid dividend-paying ETF currently yields 2.3%.

2. Real Estate Investment Trusts

Real estate investment trusts (REITs) allow investors to buy shares in commercial real estate portfolios that receive income from a variety of properties.

Equity REITs lease space and collect rents on the properties. They then distribute that income as dividends to shareholders.

Mortgage REITs lend money to real estate owners and operators through mortgages and loans or mortgage-backed securities. With more than 225 publicly traded REITs in the U.S., it’s tough to separate the wheat from the chaff.

The Vanguard Real Estate ETF (VNQ) does just that by investing in the small cap, midcap and large cap segments of the equity REIT market. Its low fees, 4.2% dividend yield and low correlation to the stock market make it a favorite among income investors.

3. Municipal Bonds

Municipal bonds are issued by a state, municipality or county to fund critical local projects, such as schools, highways and bridges. A general obligation bond is issued by government entities and not backed by revenue from a specific project, such as a toll road.

A revenue bond pays principal and interest through the issuer and is funded by sales, fuel, hotel occupancy or other taxes.

As investment-grade securities, municipal bonds are often less risky than corporate bonds.

Municipal bonds are exempt from federal taxes and most state and local taxes. That makes them especially attractive to investors in high-income tax brackets.

The biggest downside of municipal bonds is that they are illiquid. Offering a tax-free yield of 5.6%, the PIMCO Municipal Income II ETF (PML) offers a terrific alternative to investing in municipal bonds directly.

A Diverse Source of Income

Of course, there are many other strategies to generate income for your portfolio. These include investing in master limited partnerships, high-yield bonds or preferred stock, or even selling options.

Here’s the challenge: To assemble and monitor a portfolio of investments that covers such a wide range of income sources takes more hours than there are in a day.

But as I’ve demonstrated, the good news is there are ETFs for each… And you can invest in them at the click of a mouse.

Investing in a diverse portfolio of income-generating strategies has two additional benefits…

First, you generate much higher income than you would by, say, investing in an S&P 500 index fund. A model ETF income portfolio I track daily yields 6%. That’s more than triple the current 1.9% yield on the S&P 500.

Second, by investing in a portfolio of diverse strategies, you ensure you’re not betting on a single source of income. That means you’re virtually assured of generating income no matter the state of the market.

The bottom line? ETFs allow you to look beyond the conventional strategies of generating steady income in your portfolio.

Good investing,

Nicholas