Note: Today, we are starting a new channel on Wealthy Retirement focused on financial literacy. As we fill out the section, you’ll find articles on basics that will be appropriate for beginners, as well as more complex ideas – all with the goal of helping you better understand the world of money.

It is my hope that even if some of the columns are common knowledge for you, you’ll share the information with your children, grandchildren or anyone else who needs a better grasp of how money works.

For the past several years, it has been my mission to teach people important lessons about money. I truly believe that if everyone understood concepts like compound interest, good and bad uses of debt, and risk management, not only would more people be in better financial shape, but our communities and our country would be too.

I have spoken to high school students and teachers around the United States. I was humbled and extremely grateful when my book Get Rich with Dividends won the Book of the Year Award from the Institute for Financial Literacy because financial literacy is my passion.

Now, with the help of my publisher Julia Guth, I will be spearheading a financial literacy initiative for The Oxford Club. This section on Wealthy Retirement is just a tiny first step in those efforts.

If there are specific concepts you’d like to see explained here, please leave a comment in the comments section.

Don’t be shy or embarrassed if you think your question is too basic. Everyone has to start somewhere, and the whole purpose of a financial literacy program is to raise everyone’s awareness and share the basic building blocks of understanding how to better manage your own finances.

I was 22 years old and weeks into my first job out of college working for a tiny ad agency in New York. One duty that I hated was opening the owner’s mail and separating it into piles of things that needed to be addressed immediately and items that could wait.

I stayed at that job for only six months before moving on to bigger and better things. But I thank my lucky stars that I was assigned that menial task because the contents of one envelope literally changed my life.

It was an issue of Richard Russell’s Dow Theory Letter, one of the earliest investment newsletters. It wasn’t a forecast of whether the market would go up or down or an individual stock pick that hit me like a hammer, but a simple concept on page three that altered the course of my life.

At the time, I was making the princely sum of $18,000 a year, paying rent in Manhattan and hoping there’d be enough cash left over at the end of the week to be able to go out on weekends. I ate a lot of pasta with butter during the week to make sure there was beer money for Friday and Saturday nights.

The article stated that if I invested $2,000 a year starting at age 21 (close enough) and stopped at age 31, I’d have more money at 65 than I would if I had started at 31 and invested all the way up until 65.

In other words, if I started right away, I could invest a total of $20,000 and have more than if I waited 10 years and invested $68,000 – more than three times the amount. That’s the power of compounding.

That was a few decades ago, and that $2,000 example was the maximum contribution allowed for an IRA at the time. Let’s move to 2019, where the maximum contribution to an IRA for someone under the age of 50 is $6,000. If you’re over 50, you can contribute an additional $1,000.

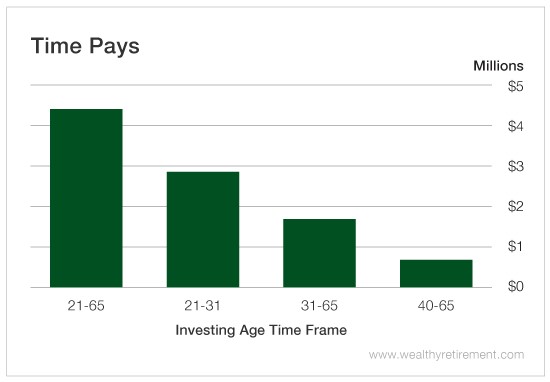

If someone contributes $6,000 per year from ages 21 to 31, earning 9.8% per year (the average historical total return of the S&P 500 over the past 90 years) until age 65, their nest egg will be worth more than $2.8 million. If they start at age 31 and contribute every year until age 65, they’ll have almost $1.7 million. By waiting 10 years, they miss out on nearly $1.2 million!

What happens if you wait until you’re 40 years old to get serious about saving and investing? The number drops dramatically to $690,895.

Oh, and if that smart 21-year-old continues to invest $6,000 every year instead of stopping at age 31, they will have more than $4.4 million.

That is why I say time is one of the most crucial elements in investing. The longer you invest, the more money you’ll make.

I realize that not every 22-year-old is in the position to save $6,000 per year. I also know that many people are well past 22 years old and haven’t started saving and investing yet, or haven’t been able to set enough aside.

But the example illustrates how crucial time is in investing for the future. The longer you can let your money grow, the more money you are likely to have. Time is likely more important than which investments you pick.

Reading the example in Russell’s Dow Theory Letter ignited my interest in the markets. And if this former 22-year-old could scrimp and save $2,000 per year on an $18,000 salary, anyone can.

If you haven’t started investing, the clock is ticking. Get started now.

Good investing,

Marc