Last year, I reviewed the dividend safety of Plains All American Pipeline (NYSE: PAA).

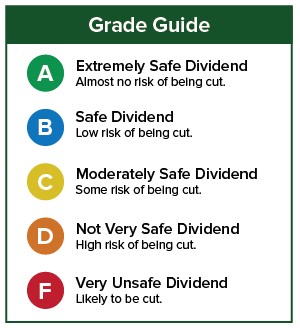

At the time, I gave the stock an F because it did not generate enough distributable cash flow (DCF) to cover its dividend.

Last month, Plains All American slashed its dividend 45%.

One of the important reasons I gave it an F was that the coverage ratio was less than 1, meaning that it was paying more in distributions than it was generating in DCF.

The comparison of DCF to distributions paid is called the coverage ratio. If a company had $100 million in DCF and paid out $100 million in distributions, the coverage ratio would be 1. If DCF was $150 million compared to $100 million paid, the coverage ratio would be 1.5. And if DCF was $75 million and distributions paid were $100 million, the coverage ratio would be 0.75.

In the 2016 article, I stated…

Management said, long term, it expects to grow the coverage ratio back to the 1.05 to 1.1 level.

That would make me feel much more secure about the distribution.

But that probably won’t be this year. In 2016, DCF is projected by Bloomberg to fall to $989 million. That will not come close to covering the distribution.

That will be two years in a row in which the company had to fund the distribution to shareholders by some means other than the cash generated from running its business.

Perhaps in 2017, the company will get back on track. But for now, with shrinking cash flow that is not expected to cover the distribution, the distribution has to be considered vulnerable to a cut.

Let’s look and see whether the new lower distribution is sustainable or if the company will have to cut again.

DCF Headed the Wrong Way

Plains All American’s biggest problem is that its cash flow is headed in the wrong direction.

This year, DCF is expected to be down 10% from 2015’s total and down 6% from last year’s total…

The good news is that if Plains All American hits the $1.3 billion DCF number that management is expecting, that will cover the new lower distribution. At $0.30 per share quarterly, the annual distribution will total $870 million. If DCF comes in at $1.3 billion, the coverage ratio will be a comfortable 1.5.

Just as an earthquake relieves pressure on tectonic plates, Plains All American’s distribution cut relieves the pressure on the new distribution. The fact that the new DCF easily covers the distribution warrants an upgrade. However, the company needs to turn around its falling DCF for the distribution to be considered even moderately safe.

As long as DCF remains in a downtrend, the distribution has to be considered at further risk.

Dividend Safety Rating: D

If you have a stock whose dividend safety you’d like me to analyze, please leave the ticker symbol in the comments section.

You can also search the Wealthy Retirement site to see if I’ve recently covered your stock. Just enter the ticker symbol or company name in the white search box in the upper right-hand side of WealthyRetirement.com.

Good investing,

Marc