When it comes to the “perfect” retirement savings, we could debate all day about how much you really need.

But what’s even more important than knowing your goal number is knowing where that money is going to come from.

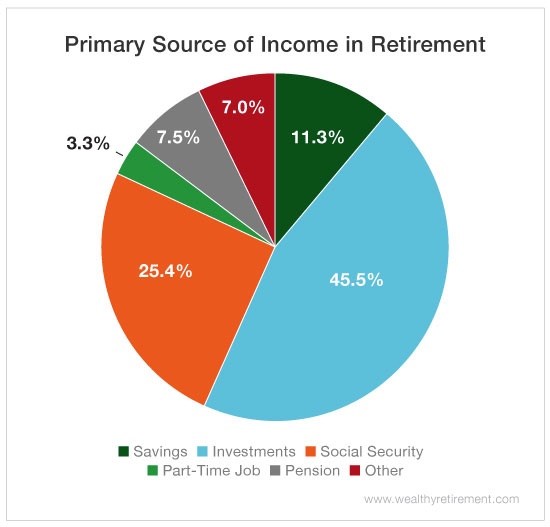

So we asked our readers what their primary source of income would be in their golden years.

Here’s the good, the bad and the ugly…

The Good

According to our survey, almost half of our readers plan on living off of their investments. Putting your money to work in the market is a great way to generate more income – without working, of course.

The key to investing smarter – and safer – is to balance your portfolio with lower-risk holdings. One of the best options? Bonds.

The Bad

The ultimate goal on the day you retire is to have enough saved up to live off of comfortably. Yet only 11% of you will use your savings (including 401(k)s, CDs and other personal accounts) as your primary income source – which implies many are unprepared and have inadequate funds.

But good news: It’s never too late to start saving. Even if you’re close to retirement age, any amount you can put into savings now will grow over time thanks to the power of compounding.

The Ugly

A quarter of you will rely heavily on Social Security to fund your retirement. But Social Security was never meant to be a primary source of income – it was created to simply supplement it. In fact, the Social Security Administration says it should replace only up to 40% of your income.

And with an average payout of just $1,400 and the threat of Social Security running out by 2035, thinking it will provide you the retirement lifestyle you want is risky at best.

The smart solution is to treat your retirement income the same way you treat your portfolio: diversify, diversify, diversify.

Build your income from a mix of investments, savings, pensions, etc., and you’ll have a safer, longer-lasting nest egg.

Good investing,

Amanda