The Safest High-Yield Dividend in the World

Marc Lichtenfeld, Chief Income Strategist, The Oxford Club

People are looking for more ways to bring in income in this economy. Many have realized that if they invest in the right dividend-paying stocks, they’ll gain a never-ending stream of money. They’ll be growing their net worth while they sleep.

Right now, there are more than 3,000 publicly traded dividend stocks on the market. But few pay double-digit yields, and even fewer pay safe double-digit yields.

There are always exceptions, though… like the company in this report.

Rather than inflating the bank accounts of overpaid CEOs and directors, this company pays its excess profits back to its shareholders.

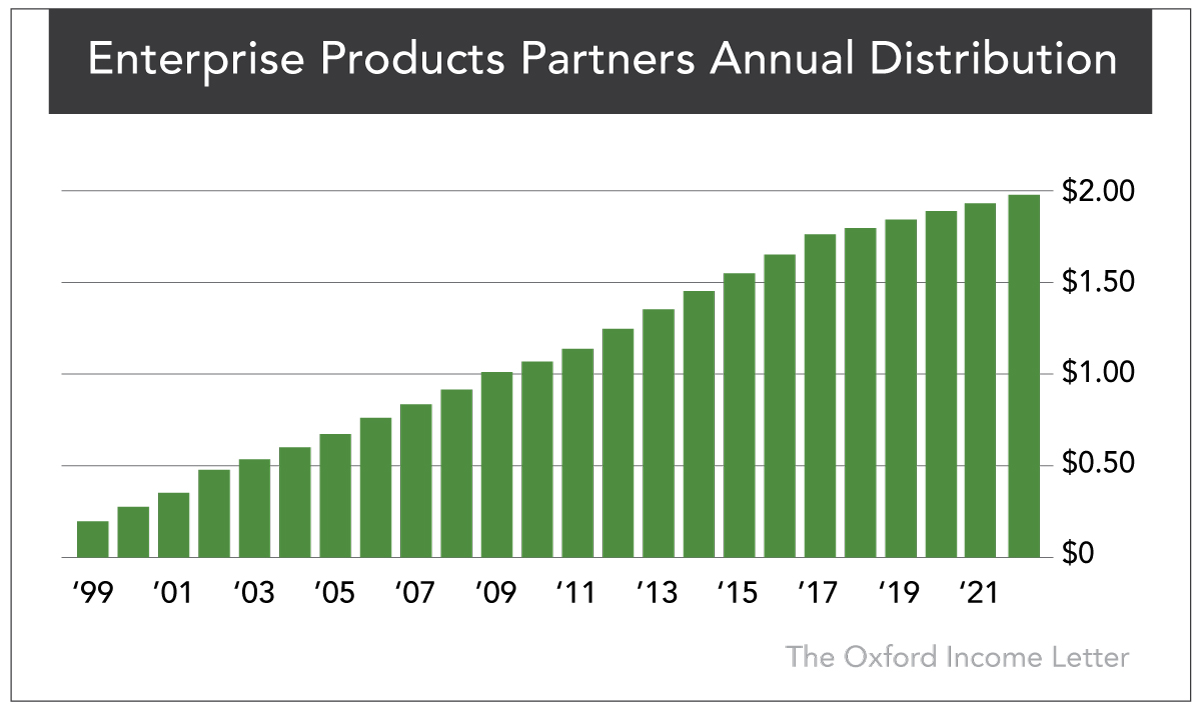

Even better, it just raised its dividend, giving it a nearly 7.07% yield. What’s more, it’s raised this dividend every year since 1998.

Over the past 12 months, this company generated nearly twice as much cash as it pays out in dividends.

That low payout ratio is why I’m confident that although the yield is nearly 8%, it’s actually quite safe.

Best of all, this company is in a stable industry that is recession-resistant and is set up for incredible growth in the years ahead.

It’s a commodity transportation company – a pipeline operation, primarily – that acts as a toll collector for S&P 500 companies that need to ship their products.

Consider this… Because of the pandemic and economic instability, many businesses, like movie theaters, restaurants and retail stores, have been forced to rethink how they operate.

But the one thing people will always need, at least for the foreseeable future, is fuel-specifically, oil and natural gas.

And while a lot of oil and gas producers have had a rough ride as of late, this company makes money no matter who is selling the stuff. Just like a toll booth attendant, it collects fees to the tune of billions of dollars for transporting fuel through its pipelines.

Furthermore, oil and gas companies, both domestic and foreign, are more than happy to pay the toll. Why? Because building and maintaining their own pipelines would be expensive and inefficient.

But thanks to Enterprise Products Partners (NYSE: EPD), oil and gas companies can deliver their products to Americans across the country at a negligible cost to themselves… which generates substantial profits for the toll collector.

And there’s even more here than meets the eye…

The Gas Must Flow

Founded in 1968 and based in Houston, Texas, Enterprise Products Partners is a premier midstream energy services company.

“Midstream” refers to the fact that the company does not produce oil and gas but stores and transports them to the places where they will be refined. It owns several of the colossal oil and gas pipelines that carry the lifeblood of the modern world.

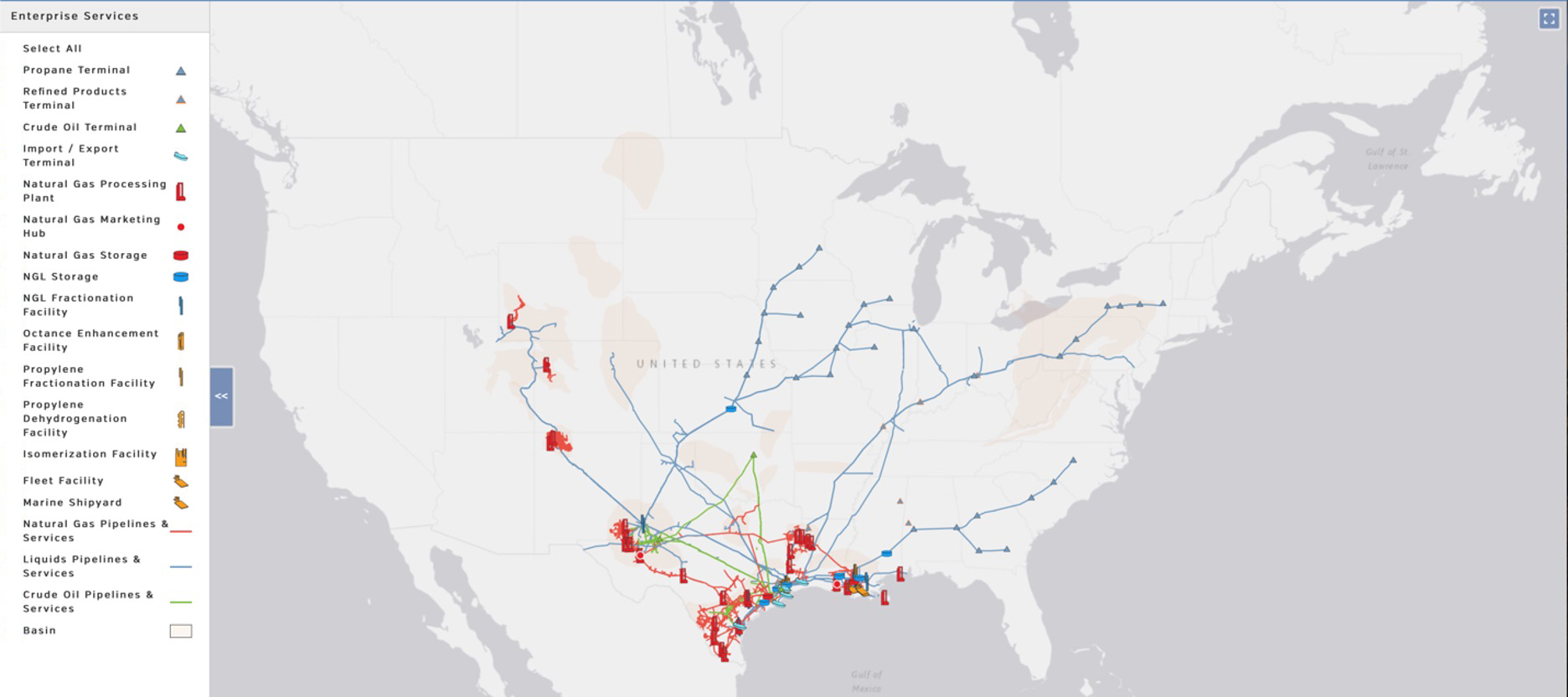

In all, Enterprise’s portfolio includes more than 5,300 miles of oil pipelines and nearly 20,000 miles of natural gas lines that cross 27 of the 48 contiguous states. On top of that, it has the capacity to store 178.5 million barrels of oil. It also operates a number of ports, processing plants and refineries.

As the U.S. economy bounces back, more oil and gas will flow through the company’s pipelines and the prices of those commodities will rise as well.

And while Enterprise Products Partners doesn’t sell oil and gas, oil and gas prices affect the company’s stock and the stocks of most master limited partnerships (MLPs).

Because Enterprise is an MLP, its distribution (MLPs pay distributions, not dividends) is tax-deferred because it is considered a return of capital.

Return of capital is not taxed as income. Instead, it lowers your cost basis and increases your capital gains when you sell the stock.

And that distribution is as juicy as an overripe nectarine. Enterprise Products Partners currently pays a quarterly distribution of $0.53 per unit (MLPs are issues in units, not shares), which comes out to a 7.07% yield on a stock that costs about $29.6. Again, that’s a 7.07% tax-deferred yield.

The company has now raised its distribution (dividend) 25 years in a row. It has raised it 18% over the last five years…

Enterprise’s clients include some serious heavy hitters in the oil and gas industry. Major producers like Chevron and Exxon Mobil pay Enterprise to run their product through its pipelines.

With a network that big and friends and allies that powerful, it should come as no surprise that Enterprise has a healthy balance sheet.

In 2021, sales soared to $40.8 billion from $27.2 billion in 2020. Despite the huge growth in 2021… 2022 revenue jumped another 42% to $58.2 billion.

Net income increased 18.4% to $5.49 billion in 2022 from $4.73 billion in 2021.

Even though oil and gas prices were lower in 2023, Enterprise still reported results similar (some metrics were even better) to its outstanding results in 2022.

For the fiscal year 2023 ending December 31, 2023, net income was $5.6 billion or $2.50 per common unit, compared with $5.5 billion or $2.40 per common unit, for the same period in 2022.

And with higher oil and gas prices on the horizon, profits should grow through 2024. The first half of the year is already off to a good start…

The first three months of fiscal year 2024 ending March 31 resulted in net income attributable to common unitholders of $1.5 billion or $.66 per unit on a fully diluted basis… a 5% increase over the first quarter of 2023.

The second quarter of 2024 results reported net income of $1.4 billion or $.64 per unit on a fully diluted basis. These metrics show a 12% increase compared to the second quarter of 2023. And adjusted cash flow from operations was $2.1 billion for the second quarter of 2024, surpassing the $1.9 billion recorded for the second quarter of 2023.

Large, Strong and Growing

Enterprise made some big moves recently that greatly expanded its business footprint.

Most notable was the $3.25 billion acquisition of fellow pipeline operator Navitas Midstream Partners. The acquisition adds approximately 1,750 miles of pipelines and over 1 billion cubic feet per day of natural gas processing capacity.

Additional capital investments included $1.4 billion in growth capital projects, $160 million for purchases of pipelines and related assets, and $372 million in sustaining capital expenditures.

On August 21, 2024 Enterprise announced that the company entered into a definitive agreement to acquire Pinon Midstream in a debt-free transaction for $950 million in cash consideration. Pinon Midstream provides natural gas gathering and treating services in the Delaware Basin in New Mexico and Texas. These assets should accelerate Enterprise’s development in the area by at least three years.

It’s a fundamentally strong company that raises its dividend every year. And Enterprise is making more than enough profit to continue expanding the business, make timely share purchases and keep increasing the dividend.

If you act quickly before the global economy recovers, you can lock in a nearly 7.1% yield at a bargain price.

Take advantage of the low price and high yield before Enterprise bounces back.

Action to Take: Buy Enterprise Products Partners (NYSE: EPD) at market. Set a 25% trailing stop to protect your principal and profits.

Big Dividends and Big Potential

Enterprise is the under-the-radar dividend play to make right now.

Between Enterprise’s low payout ratio, its incredible yield and its history of raising its dividend, it really is no wonder that Morningstar recently called Enterprise “compelling and undervalued.”

Enterprise’s leadership believes the company is set up for incredible growth in the coming years.

No matter what the future

brings and no matter what happens in the wider world, the oil must flow…

And it will flow through Enterprise’s pipelines while you profit from the tolls.

Enterprise remains my favorite play in the sector. It should be added to your portfolio if you don’t yet own it.