Marc Lichtenfeld

Marc is the Senior Editor of The Oxford Income Letter, which is based on his proprietary 10-11-12 System. He is a leading member of Oxford Centurion‘s Centurion Advisory Board. He is also the Editor of Technical Pattern Profits, Trigger Event Trader and Oxford Bond Advantage.

Marc is the Senior Editor of The Oxford Income Letter, which is based on his proprietary 10-11-12 System. He is a leading member of Oxford Centurion‘s Centurion Advisory Board. He is also the Editor of Technical Pattern Profits, Trigger Event Trader and Oxford Bond Advantage.

Marc Lichtenfeld is the Chief Income Strategist of The Oxford Club. After getting his start on the trading desk at Carlin Equities, he moved over to Avalon Research Group as a senior analyst. Over the years, Marc’s commentary has appeared in The Wall Street Journal, Barron’s, and U.S. News & World Report, among others. Prior to joining The Oxford Club, he was a senior columnist at Jim Cramer’s TheStreet. Today, he is a sought-after media guest who has appeared on CNBC, Fox Business and Yahoo Finance.

His first book, Get Rich With Dividends: A Proven System for Earning Double-Digit Returns, achieved bestseller status shortly after its release in 2012 and was named Book of the Year by the Institute for Financial Literacy. It is currently in its second edition and is published in multiple languages. In early 2018, Marc released his second book, You Don’t Have to Drive an Uber in Retirement: How to Maintain Your Lifestyle without Getting a Job or Cutting Corners, which hit No. 1 on Amazon’s bestseller list.

How often are you asked the question “Are you ready for retirement?”?

If you don’t get that question a lot now, chances are it will occur more and more frequently as you approach that age.

The thing about retirement is you never know how long it will last.

The good news is that you could live a lot longer than expected. The bad news? You may not have as good of a financial plan as you think.

This means you could run out of money in retirement.

There are a lot of factors that determine how long you’ll need your money to last… Two big determinants are your physical health and when you officially

leave the workforce.

Let’s say you retire at 65 and live until you’re 92. That means you’ll have to fund 27 years of retirement.

Think about that for a second… 27 years without a “dividend check.”

Let’s Do a Little Experiment

How much do you think it will or has cost you to live from age 38 to 65? Granted, there are some costs that go away with time, but others take their place.

For example, the average 65-year-old retired couple probably doesn’t have to support their kids anymore, but what if they expect $300,000 in healthcare costs?

That’s just over $11,000 per year for 27 years.

And according to the Federal Reserve’s Survey of Consumer Finances, people between the ages of 55 and 64 have an average of less than $140,000 saved.

That means the average person is about $160,000 short of covering just their healthcare costs.

So how will these people make up the difference? Before you go into a panic, there is a solution.

How to Earn a “Dividend Check” Every Month With the “Dividend Income Machine”

What is the “Dividend Income Machine”? In short, it’s a way to pocket sizable income every single month.

It’s a portfolio of 12 dividend-paying stocks that can increase your income leading up to your retirement and provide steady payouts during your retirement

years.

With just a $10,000 investment into each position, you’ll bring home an extra $3,193 this year. The best thing about these stocks is that they’re all Dividend Aristocrats… which means they’ve consistently increased their annual dividends over the last 25 years or more.

By investing in each one of these picks, you’ll be guaranteed a “dividend check” each month. And that amount will increase as each year goes by and these companies increase their dividends.

It’s like getting a raise every year!

In addition to the minimum of 25 years of increasing their dividends, Aristocrats must also be members of the S&P 500 and meet certain size and

liquidity requirements.

These are all well-established companies. You should recognize most – if not all – of the ones we list.

The Dividend Income Machine Calendar

Every dividend-paying stock has an ex-dividend date – the date by which investors must own the stock in order to receive its dividend. It’s generally between two and four weeks before the payout date.

The quarterly dividend payments, total annual payouts and dividend yields stated below are based on the most recent quarter.

Let’s dive in…

January

Our first pick is Walmart (NYSE: WMT).

Its dividend payments are made in January, April, May and September for a total of $0.83, or $0.21 per quarter.

Walmart operates retail stores in various formats worldwide. It runs approximately 10,500 stores, as well as numerous e-commerce sites, in 19 countries.

The company has produced a slow and steady dividend growth rate of nearly 10% over the last 20 years with 51 consecutive years of dividend growth.

The current yield is 1.01%.

February

Our next pick is Air Products and Chemicals Inc. (NYSE: APD).

Its $1.77 quarterly dividend payments are made in February, May, August and November for a total payout of $7.08 per year.

Air Products and Chemicals Inc. produces and sells atmospheric and specialty gases. They offer a variety of gas products such as oxygen, nitrogen, helium and hydrogen to a wide range of customers around the world. Over the last five years, the company has increased its dividend by an average of more than 9% each year.

And it has raised its dividend for 42 consecutive years.

The current yield is 2.31%.

March

Rounding out the Dividend Income Machine’s first quarter is Target (NYSE: TGT).

Target pays shareholders a quarterly dividend in March, June, September and December.

It has increased its dividend for 52 consecutive years, and it recently raised the amount again to $1.12 per share each quarter, or $4.48 per share each year.

The company operates as a general merchandise retailer. You’ve likely shopped there – or, at the very least, passed it in your travels.

Target is a longtime Dividend Aristocrat and is committed to increasing dividends every year.

The current yield is 2.99%.

April

Now let’s turn to The Coca-Cola Company (NYSE: KO).

Its dividend payments are made in April, July, October and December for a total of $1.94 per year, or $0.485 per quarter.

Coca-Cola manufactures and distributes various nonalcoholic beverages worldwide.

The company has raised its dividend by roughly 12% over the last three years.

And it has steadily increased its dividend for 62 consecutive years.

The current yield is 2.98%.

May

Next up is Colgate-Palmolive (NYSE: CL).

Its dividend payments are made in February, May, August and November for a total of $2.00, or $0.50 per quarter.

Colgate-Palmolive manufactures consumer products worldwide and sells them in more than 180 countries and territories.

The company has 61 consecutive years of dividend growth.

The current yield is 2.14%.

June

To end the first half of the year, we’ll examine Johnson & Johnson (NYSE: JNJ).

The company distributes $1.24 quarterly dividend payments in March, June, September and December for a total of $4.96 per year.

Johnson & Johnson researches, develops, manufactures and sells various products in the healthcare field worldwide. Your medicine cabinet likely contains many of its products.

The company has increased its dividend by more than 25% over the last five years.

And it has raised its dividend for 62 consecutive years. The current yield is 3.13%.

July

Moving on, we have Kimberly-Clark (NYSE: KMB).

Its dividend payments are made in July, October, January and April for a total of $4.88, or $1.22 per quarter.

Kimberly-Clark manufactures and markets personal care, consumer tissue and professional products worldwide. It sells household products directly to supermarkets, mass merchandisers, drugstores, warehouse clubs, variety and department stores, and other retail outlets, as well as through other distributors and e-commerce businesses.

The company has grown its dividend amount by 18% over the last five years.

And it has raised its dividend for 52 consecutive years.

The current yield is 3.65%.

August

Next on our list is Abbott Laboratories (NYSE: ABT).

Abbott recently raised its dividend by nearly 8% and will pay shareholders $0.55 dividends in May, August, November and February for a total of $2.20.

The company discovers, develops and manufactures a broad line of healthcare products and services. Its products include pharmaceutical, nutritional, diagnostic and vascular products, and it markets these healthcare products worldwide.

Abbott has increased its dividend for 52 consecutive years, and over the last five years, it has raised the distribution amount by more than 70%.

The current yield is 1.87%.

September

Then we have Exxon Mobil (NYSE: XOM).

Exxon makes quarterly dividend payments in March, June, September and December. It recently raised the quarterly amount to $0.95 for a total of $3.80 per year.

Exxon Mobil explores for and produces crude oil and natural gas all over the world.

It also manufactures and markets petrochemicals, including olefins, aromatics, polyethylene and polypropylene plastics, and specialty products. And it transports and sells crude oil, natural gas and petroleum products.

The company has increased its dividend by more than 10% over the last five years. And it has been increasing the dividend for the last 41 years.

The current yield is 3.34%.

October

To start out the last quarter of the year, we have McCormick & Co. (NYSE: MKC).

Its $0.42 quarterly dividend payments are made in April, July, October and January for a total of $1.68 per year.

McCormick manufactures, markets and distributes spices, seasoning mixes, condiments and other flavorful products in the food industry.

It has increased its dividend for 38 consecutive years, and over the last 10 years, its dividend payouts have more than doubled.

The current yield is 2.15%.

November

Then there’s Procter & Gamble (NYSE: PG).

The company pays quarterly dividends to shareholders in February, May, August and November for a total of $4.026 per year.

Procter & Gamble is the largest consumer goods company in the world. It manufactures and sells branded, consumer packaged products with brands like Bounty, Gillette and Febreze.

Its dividend has grown by more than 18% over the last three years.

And the company has raised its dividend for 68 consecutive years.

The current yield is 2.44%.

December

Finally, to close out the year, we have McDonald’s (NYSE: MCD).

Its dividend payments are made in March, June, September and December for a total of $6.68 per year, or $1.67per quarter.

McDonald’s operates and franchises restaurants worldwide, offering various food products, soft drinks, coffee and other beverages. It currently operates roughly 40,000 locations in over 100 countries.

The company has raised its dividend by more than 65% over the last five years and has grown its dividend for 47 consecutive years.

The current yield is 2.42%.

Start Your Dividend Machine Today

There are a few “dividend checks” waiting to be collected over the next few weeks. And the sooner you get started, the sooner you can start collecting.

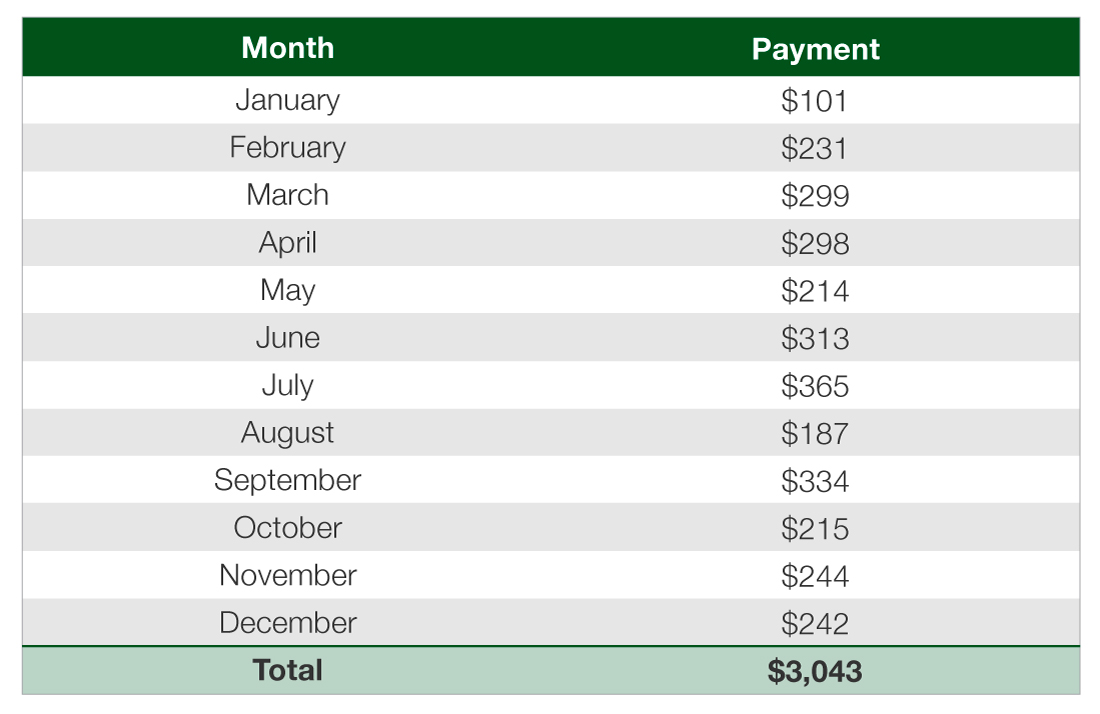

Below, we’ve put together a chart showing you exactly how much you’ll make each month if you put $10,000 into each position… for now. Remember: These companies increase their dividends every year, so you should be receiving a “raise” very soon.

While you may have missed this month’s payments, be sure to collect each payment going forward.

Don’t let another moment pass without the Dividend Income Machine helping you collect those extra “dividend checks” and setting you on the path to a wealthy retirement.

Good investing,

The Wealthy Retirement Research Team