Sometimes it’s hard to own bonds when stocks seem to be going straight up. It’s easy to feel left out.

The temptation is always there to pull a little bit of cash out of the bond portfolio and put some into what are termed “FAANG” stocks:

- Facebook (Nasdaq: FB)

- Amazon (Nasdaq: AMZN)

- Apple (Nasdaq: AAPL)

- Netflix (Nasdaq: NFLX)

- Google’s parent company, Alphabet (Nasdaq: GOOGL).

These are the most popular and best-performing American tech stocks of our time.

When we go to cocktail parties and some of our friends want to brag about how well their equity portfolios have performed, these are the names we hear over and over again.

We bond investors don’t often chime in to those conversations…

But even the infamous FAANG stocks haven’t been immune to the volatility we’ve seen as a result of the novel coronavirus outbreak.

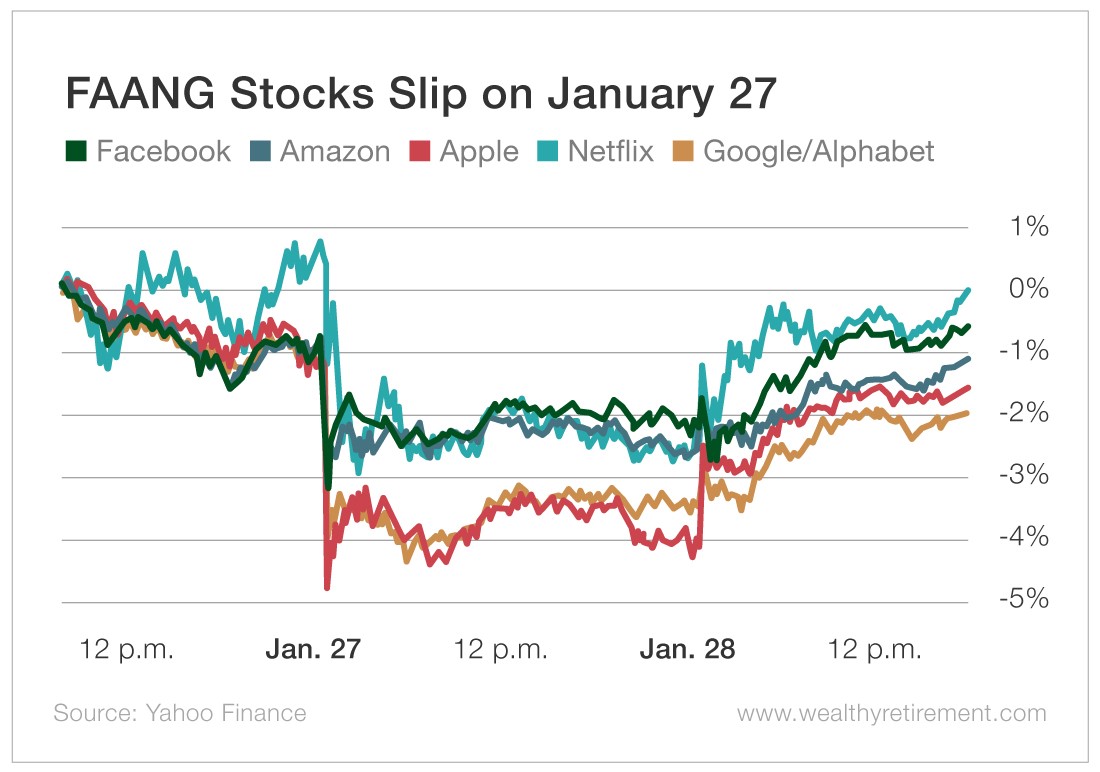

Netflix, which started the day with a steep 2% drop, reached breakeven by 2 p.m. on January 28.

Facebook and Amazon, which fell 3.2% and 3.1% at market open, respectively, finished the wild ride at losses of 0.5% and 1.2%.

But Apple and Google suffered the rockiest rides down. Google fell nearly 4% at market open, and Apple came close to a 5% loss.

Both stocks lingered between a 3% and 4% loss for most of Monday before finally recovering.

And they weren’t alone…

On Monday, the Dow and S&P 500 both fell 1.6%.

And it has many investors wondering whether this the beginning of the end for the bull market.

All that uncertainty has investors looking for stability and tempted to invest in FAANG stocks… But the latter could be a huge mistake.

You see, the Fed is looking for signs that the market is reacting to more than just the coronavirus outbreak. It’s keeping an eye out for other ailments to the economy that the outbreak is masking.

If the Fed sees any real signs of trouble, it will cut rates again.

On Wednesday, the Fed announced that interest rates were remaining unchanged.

So, is this the beginning of the end for the bull market?

Probably not.

The market’s intense reaction to news of the coronavirus appears to be a symptom of market distress – but not the cause.

Art Hogan, chief market strategist at National Securities, agrees. “Stocks are relatively priced for perfection, and you tend to have a bit of an overreaction to bad news or in line news when that happens…”

To be sure, a correction will happen… just likely not this week.

Regardless of when, investors have been especially exuberant for the past several years. That means a correction will hit hard. Protect yourself with steady bonds and resist the urge to shift into seemingly safe FAANG stocks.

Ron McCoy, a bond salesman and Oxford Club Member, believes our recent sell-off is a good reminder of why our readers hold bonds in the first place – and his thoughts are my sentiments exactly.

“They want to diversify some of their investments away from being all stock, and for the last five months they have watched the markets go straight up, and maybe a few even question why they own bonds. Tempting for some of these folks to lose sight when it’s new highs every day…”

Now is certainly not the time to abandon your stabilizing bond holdings and enter popular stocks out of desperation, regardless of their past performance or future potential.

Most readers are likely near retirement or are already retired and searching for something that provides some safety and predictability. Many of us cannot go through another big decline like the Great Recession and are willing to give away some upside in return for less volatility.

If you don’t have the wherewithal to take on a large market slide, then it’s time to sacrifice in-vogue purchases for stable ones.

After all, which will sound better at the cocktail party: paying a fortune for Alphabet just before a market downturn or buying it at a discount at the bottom?

Good investing,

Rob