Ford (NYSE: F) has carried the same reputation for years. The business is cyclical, it’s capital-heavy, it sells inexpensive vehicles, it absorbs EV losses, and it carries pension baggage.

Given all that, it’s easy to see why most investors stopped paying attention a long time ago. But markets have a habit of clinging to old narratives even after the underlying reality has shifted.

Ford isn’t trying to reinvent itself. It’s trying to run a durable business and fund its future without stress. That’s not exciting. But it matters.

The money still comes from familiar places. Ford Blue generates cash from trucks and hybrids, Ford Pro has quietly become a profit engine by layering software and services onto commercial fleets, and Ford Credit adds steady income in the background. This isn’t a turnaround story. It’s a company that’s still operating and doing what it’s supposed to do.

The latest quarter reinforced that point. Revenue reached a record $50.5 billion. Adjusted free cash flow totaled $4.3 billion for the quarter and $5.7 billion year to date, and operating cash flow was even stronger. No tricks. Just cash.

Yes, the company’s EV losses are real. Tariffs didn’t help, and neither did the recent fires at a major aluminum plant, which disrupted F-150 production. But Ford still finished the quarter with roughly $33 billion in cash and reiterated full-year free cash flow guidance of $2 billion to $3 billion. That’s not a balance sheet under pressure. That’s a company absorbing noise and moving on.

Now let’s look at how the market prices that reality.

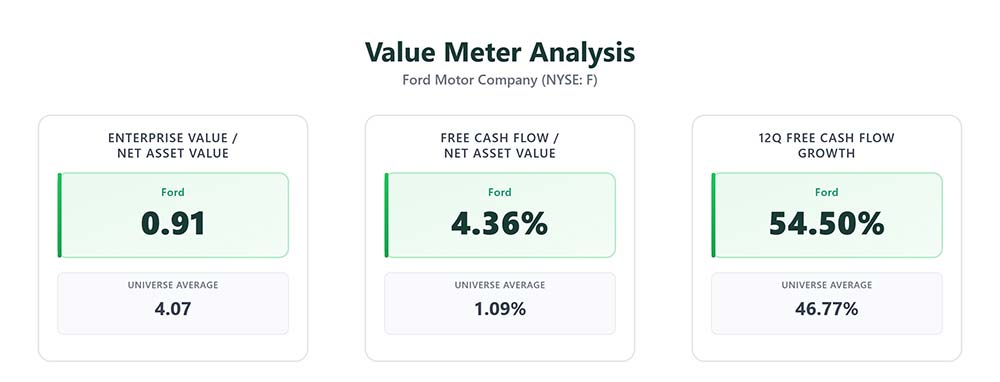

Ford trades at an enterprise value of just 0.91 times its net asset value (NAV). The average comparable company trades north of four times its NAV. In effect, investors are saying Ford’s assets aren’t worth much.

That’s hard to reconcile with the cash.

Ford generates quarterly free cash flow equal to 4.36% of its net assets. The peer average barely clears 1%. Ford is pulling significantly more cash out of each dollar of assets while trading at a deep discount. That’s the disconnect.

Cash flow hasn’t been perfectly smooth, but it has been persistent. Over the past 12 quarters, Ford has grown its free cash flow more steadily than the broader universe. Even while funding EV investments, the core business continues to pay for itself.

The stock has moved higher over the past year, climbing from below $9 to above $13.

Sentiment has improved, but valuation hasn’t. Ford is still priced as if decline is inevitable.

That may be true someday. But the current cash flow doesn’t support that conclusion today.

This isn’t a stock for momentum traders. It’s for patient investors who care about what a business actually produces in cash − and what they’re paying for it.

Sometimes stocks are cheap because they deserve to be. It looks like this one is cheap because the market hasn’t updated its math yet.

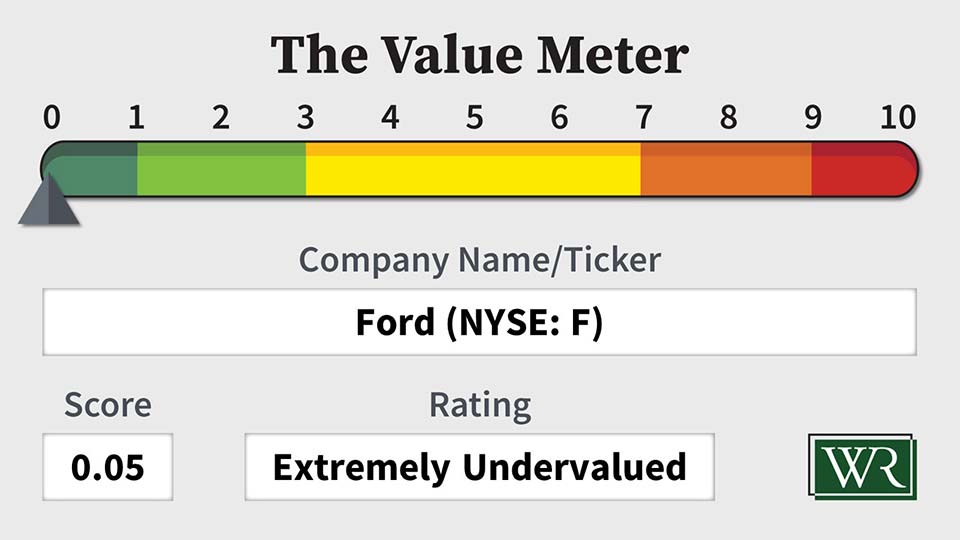

The Value Meter rates Ford as “Extremely Undervalued.”

What stock would you like me to run through The Value Meter next? Post the ticker symbol(s) in the comments section below.

I sold both my Ford stock and my Ford Bonds. The recent “good news” regarding sales should be looked at with caution. FoMoCo “sales” are, as I understand it, what Ford dealers “buy” from FoMoCo. Unfortunately, far too many dealers lots are jam packed with vehicles/units that they can’t sell. If the dealers wish to keep their franchises, they have to accept those units. FoMoCo is not alone when it comes to problems “moving cars”, and I fear things may get worse before they get better. I’ve always been a “Ford Guy”; they were the cars of choice for my family as I grew up, so I hope they do as well as your figures indicate.

AMD

flo vz

AMCR

Would love to know how Rolls Royce is valued now after its big run-up (RYCEY). Thanks!

PLUG

Run F through the Divided Safety analysis

Rio Tinto (RIO)

Graphene Manufacturing Group

Can you run HESM through the Value Meter