Last week, we reviewed a gold royalty and streaming company: Royal Gold (Nasdaq: RGLD). Many of you asked about other names in the space, so this week, we’re looking at a major competitor.

Franco-Nevada (NYSE: FNV) operates the same core model. It provides capital to miners in exchange for royalties or streams tied to future production. Again, that means it does not operate the mines directly, limiting its cost risk and keeping its margins high.

This structure allows Franco-Nevada to maintain a strong balance sheet. Diversification across assets and jurisdictions lowers single-asset risk. The company is widely viewed as a high-quality way to gain exposure to precious metals.

Clearly, the stock reflects that perception. It’s up more than 20% year to date and 82% in the past year.

But we don’t grade stocks by optics. We test whether price matches the underlying reality.

Let’s see if it does for Franco-Nevada.

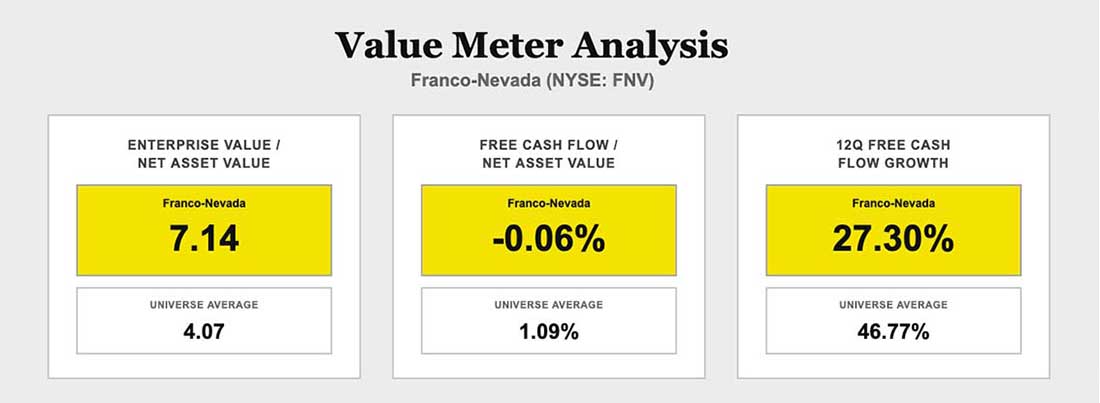

The company’s enterprise value-to-net asset value (EV/NAV) ratio sits at just over 7.1, whereas the broad market averages just under 4.1.

That is a very clear premium, but paying more for a company’s assets can make sense if those assets convert into cash at a superior rate.

Here, they do not.

Franco-Nevada’s free cash flow-to-net asset value (FCF/NAV) stands at about -0.1% against a market average of 1.1%. Investors are paying a large asset premium while receiving a negative – albeit only slightly – cash yield per dollar of NAV.

That shifts the burden to growth.

Over the last 12 quarters, free cash flow has grown quarter over quarter just 27.3% of the time, compared with a market average of just under 46.8%.

The premium is clearly not supported by superior cash output. Instead, it is very likely supported by optimism – specifically, the expectation that gold’s rally continues, production expands smoothly, and cash conversion strengthens over time.

That is certainly possible. But that possibility is being baked into the price over and above the current reality of the business.

Restraint, not conviction, protects capital when premiums stretch beyond support. At these levels, the stock’s risk seems very underestimated.

Like Royal Gold, Franco-Nevada is an established company with an effective business model and a history of rewarding investors through both price appreciation and dividends. But it may be wise to wait for a slightly better entry price.

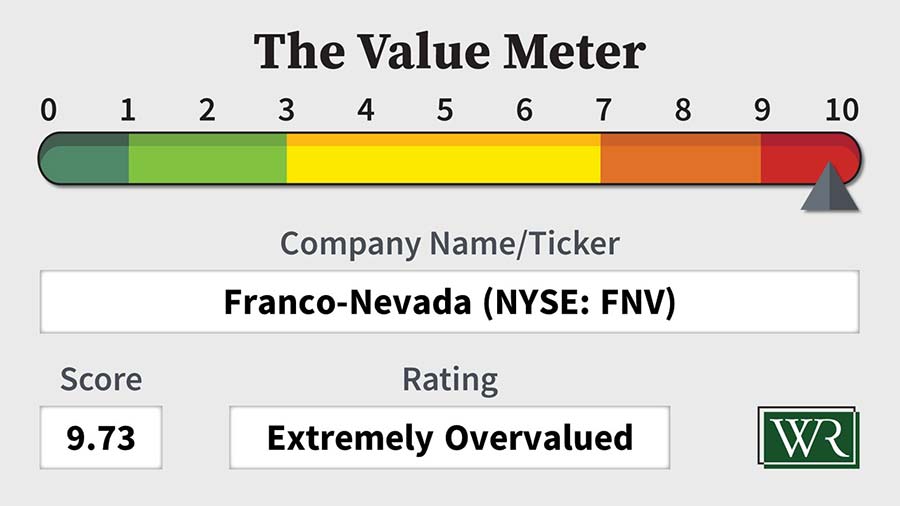

The Value Meter rates the stock “Extremely Overvalued.”

What stock would you like me to run through The Value Meter next? Post the ticker symbol(s) in the comments section below.