When you’re on the outside looking in, things can appear very different from what they actually are.

For example, Hollywood seems so glamorous. But anyone who has ever been on a movie set knows how dull it can be. There are hours of waiting between shots, and when cameras are rolling, it’s just take after take after take. Actors might even film the same scene a dozen or more times. In reality, Hollywood is not always what it seems.

Investing can be somewhat similar. New investors are often intimidated because of their lack of knowledge. They see well-dressed men and women in the financial media using jargon they don’t understand, so they believe that investing is a great mystery. They think there are magic formulas to memorize, mystical ratios to learn and complex accounting rules to comprehend.

And they fear that there’s no way they could master the skills required to be a successful investor.

In reality, investors need to understand only two simple concepts to be successful, no matter their skill level.

1. The stock market goes up over the long term.

The financial media will breathlessly warn you about all of the terrible things that could happen to your money. And though markets do fall – and sometimes sharply – they also rebound and come back. They always have.

Even after the Great Recession, the worst economic collapse in the United States since the Great Depression, the S&P 500 was back at the 2007 highs within 5 1/2 years.

Historically, the market returns 9.8% per year. That’s been the case for 90 years. That said, don’t expect a 10% return every single year. Some years it goes up 3%, others it falls 20%, and still others it rises 25%.

If you’re invested in the broad market (like in an S&P 500 index fund) and leave it alone, over the years you should earn nearly 10% per year on your money.

| Question of the Week | |

| Do you have a set plan or budget for saving for retirement? |

2. The power of compounding is real.

Albert Einstein allegedly once said that compound interest was the greatest force in the universe. While there’s no proof he actually said that, compound interest is at least the most powerful force for growing your wealth – especially if you own dividend growth stocks.

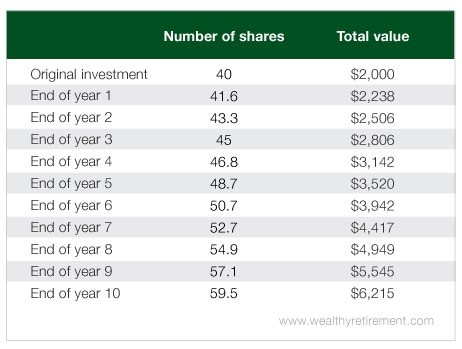

Here’s how: Let’s say you buy $2,000 worth of stock at $50 per share and the yield on the stock is 4%. Additionally, we’ll assume the dividend increases 8% per year and the stock rises in line with the historical market average.

If you reinvest the dividend, you’d automatically buy more shares with your dividend payment. Because you’d have more shares, you’d receive more dividend income, which would buy more shares, which would generate more dividend income…

After 10 years, you would have 59.5 shares of stock – 50% more than your original 40 shares. Your $2,000 investment would now be worth $6,215 – more than triple your initial investment. And your yield would be 12% on your original investment.

Had there been no dividend to reinvest and you benefited only from the price appreciation of the stock, your $2,000 investment would still be worth a respectable $3,882. But that’s $2,300 less than the amount you’d have if you had reinvested those dividends.

Reinvesting your dividends is easy. When you buy a stock, just instruct your broker to reinvest your dividends. If you use an online broker, there’s usually a box to check that says “reinvest my dividends.”

Best of all, it’s free. So you pay a commission once when you buy the stock and then pay nothing again (until you sell), even if you reinvest the dividends for years. The broker keeps track of your growing number of shares and dividends. There’s nothing for you to do except watch the investment swell in value.

Don’t be intimidated by what you think you don’t know.

If you have a long-term time horizon, investing doesn’t have to be complicated. In fact, it couldn’t be easier.

Good investing,

Marc