Last week, Barron’s published an article on what it said were the best annuities.

I was hoping it would be a blank page, because to label any annuity “the best annuity” is like calling a bout of nausea “the best stomach flu.”

I was disappointed that Barron’s tried to shine a positive light on these garbage products. (To be fair, the article did point out some of the negatives of annuities, such as high fees.)

Annuities can pay you a guaranteed fixed amount of money every year, starting immediately or sometime in the future. If you want more upside potential, you can choose a variable annuity, whose returns are usually based on stock market performance. Variable annuities will often limit the amount of loss you can suffer, though they will typically also cap the amount you can make.

For example, you might limit your losses to 5% per year if the market goes down, but you might only make a maximum of 10% if the market goes up. That’s all well and good if the market goes up 11%. You may be willing to trade that extra 1% for additional protection. But how about when the market goes up 23%, like it did last year?

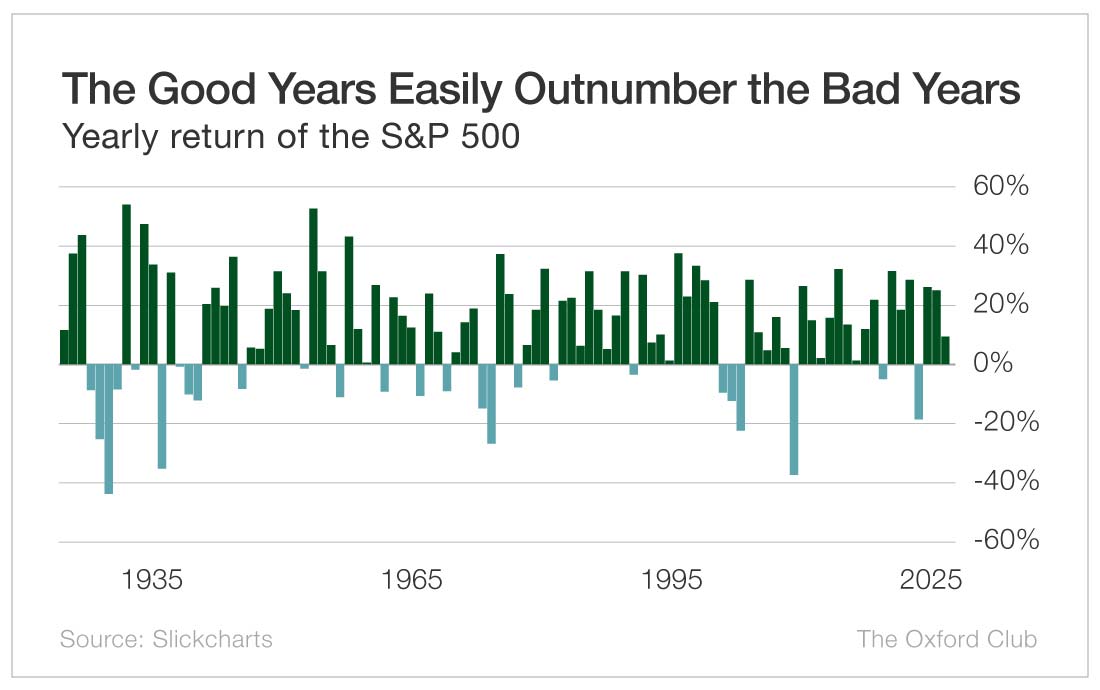

While the market produces an average annual return of about 10%, you can see that the return is typically not 10% in the up years. It’s significantly higher. In fact, when the market posts a positive return, the average is over 21%, and over the last 99 years, the market has been up nearly 75% of the time.

In other words, on average, the market is up three out of every four years, and when it’s up, it gains an average of over 21%. When it drops, it falls an average of 14%.

Of course, the market doesn’t move with that kind of consistency – three years up 21%, one year down 14%. Occasionally, the market falls hard. That’s scary, especially when you’re near or in retirement.

It’s natural to want to protect your hard-earned nest egg, and annuities companies will try to show you how to do that “without having to gamble in the Wall Street casino.”

If Caesars Palace had a game that paid out an average of 21% three out of every four bets and lost 14% on the fourth bet, people would camp out on the Strip waiting to get in.

Now imagine that’s the case, and some slick “advisor” walks down the sidewalk offering everyone a 6% fixed rate on their money – or offering 10% if the game is a winner but capping their loss at 5% if it’s a loser.

The guy wouldn’t drum up much business.

Annuities are very popular, which is not surprising. They are marketed well. Last year, more than $434 billion worth of annuities were sold, mostly because investors are worried about the stock market “casino.”

Sure, markets tank from time to time. Nasty bear markets do occur – though the average bear market lasts less than 10 months. If you can’t stomach a drop in the market, you should be in safer assets like cash or bonds.

What you shouldn’t be doing is giving your money to an industry that slammed on the brakes selling its products when there was a threat that those products could get them in trouble.

That’s right. In 2016, the Department of Labor passed a rule that said advisors must only sell products that were in their clients’ best interest. In the fourth quarter of that year, annuity sales dropped 16% and variable annuity sales fell 22%.

Two years later, the rule was killed. Annuity sales spiked 40% in the fourth quarter of 2018 and are now at record levels.

What does that tell you about how good these products are for the consumer?

Some people are happy with their annuities because they like the reliability that some annuities – mostly fixed annuities – provide. That’s fine. I’m not necessarily telling anyone to get rid of their annuity (they’d probably pay a huge surrender fee if they did).

But for most investors, sticking with the market and moving some money that’s needed for immediate expenses into cash or bonds is a better way to go. You won’t pay crazy fees and commissions, and you’ll have much more upside, which should more than make up for the occasional bear market.

Annuities are expensive, they’re complicated, and they underperform the market. I highly recommend that most people avoid them.

Hi Mark, I too agree with your general assessment about annuities. However, I believe there is one situation, if everything is in alignment, where it can be a beneficial product. Back in the ’70’s when interest rates were sky high, I had a client’s mother approach me about investing $10,000 and wanting an immediate fixed income for the rest of her life. As I recall the monthly income on her annuity was calculated at 10% or higher.

I was already aware the annuities are mostly just a big advertising campaign that uses scare tactics to get people to sign up and of course we all know that advertising can be a hidden method of gaining customers. I’ve never considered it an investment vehicle and appreciate your details on the subject

I always enjoy your wise advice, Marc. Your comments re: annuities seem primarily directed at indexed or variable annuities. SPIAs (single premium income annuities are a different animal). For a fixed, one time premium one is guaranteed a monthly income and if designated as a joint annuity with cash refund, the spouse continues to receive a monthly income until he/she dies and when she/he passes the premium not paid out goes to the beneficiary. On a hypothetical $112K premium the monthly check is currently $732 which amounts to a 7.8% annual return. Not bad for a guaranteed investment.

I agree completely. I assume the “insurance peddlers” will be taking you to task or maybe they are too busy counting the commissions they are earning from selling this junk to unsuspecting clients.

Marc thanks for your analysis. Better to follow you in your dividend recommendations.

Average for me 10 % annual yield.

Keep the good help for your subscribers.

Thanks for the enlightenment Marc,

I have been contemplating an annuity, no longer.

Unfortunately being in the UK I can’t get in to a lot of you suggestions, bonds mlps an some of the higher gain stocks are out of my reach.

You used to provide a website that allowed us mere mortals to check the dividend safety of stocks. Is it possible to get that facility back?

I like your honesty and direct statements. They are rare commodities nowadays.

While Trump attacks Jerome Powell in connection with refurbishing government buildings Fed’s $2.5 billion construction project and the cost

Trump has accepted a $400 million boeing 747 from qatar and is now going to have it refitted

at over a billion dollars expense to the taxpayer.

Why doesn’t Trump sell it for taxpayer return.

Why doesn’t Trump sell the jet and return the proceeds to the taxpayer

https://luxurylaunches.com/other_stuff/qatar-boeing-747-jet-accepted-by-the-us-government-07292025.php

Preach it loud, Marc! I’ve tried to tell friends this for years!

Marc as a CPA this was one of the things that bugged me but worse was when people were sold an annuity wrapped in IRA so missing out on any tax free return of principal that the annuitant would be eligible to receive with their distributions. That said when I also became an advisor I did find certain very wealthy clients that would say roll an annuity into a better product or find that an external annuity had better provisions than say some companies might offer their employees. Without naming names there is a large defense contractor that offers their employees a pension by buying an annuity that stops paying if the employee dies. For these employees that want the security of a pension an annuity that will pay for say 20 years certain is a much better product. The typical advisor will also assure clients that an annuity is for life and has a death benefit that you do not get if you make mistakes with your investment selections. For example I have seen some retires invested in just 2 stocks with no diversification. Yes they have extraordinary returns if they pick the right ones but it is a hell of a risk!

I wish my sister would get away from them. She got into annuities because someone at the church was selling them.

Okay, I also dislike nearly all annuity products. HOWEVER, I’ve even had Fisher Investments look at a plan I have from my daughter and they approved as I am a very savvy 56 year equities investor (expert in real estate, not equities). Fisher hates annuities.

Allianz Insurance provides a fixed 2% inflation growth annuity with immediate pay-out, no continuing commissions (the financial advisor receives $3,500 fixed set up fee only) or management costs. It is for $600,000 on my life in a beneficial trust for my daughter. I should live another 30 years (she is 35). She will be paying the income tax at a greatly reduced rate than if added to my income after exhausting the principal in payouts. The inflation hedge is a bonus feature. It pays out 7.5% at commencement or $45,000 (if it was not for a CA resident, that would be 100% of her needs; instead, it’s 80% to start but catches up in a few years to a few percent-nominal for me).

I needed a very secure investment and this is superior to equities and bonds, particularly since I can direct payments through the trust automatically (she as her stipend, HOA fees, property taxes, property insurance, medical insurance and auto insurance).

I am very aware of what I am doing.

Marc, I agree that most annuities are not good, but MYGAs are just like CDs. There is no harm there. The money is is returned at the end of the term and interest is paid monthly.