Editor’s Note: Here at Wealthy Retirement, we believe in the power of long-term, buy-and-hold investing – especially when it comes to investing in Perpetual Dividend Raisers.

Our friend Matthew Carr, editor of our sister e-letter Profit Trends, is no stranger to this strategy. And today, Matthew will share his own strategy for saving early and often to reach millionaire status by age 65.

– Mable Buchanan, Assistant Managing Editor

To me, time is the most precious commodity there is.

On a universal scale, it’s infinite. But on an individual level – a human level – time is very finite.

If we’re lucky, we get maybe 90 years. And if we’re very lucky, the last decade isn’t one of suffering and rapid decline.

That’s why I don’t believe in wasting time. I don’t believe in wasting my life.

I want to spend it doing things I love in the company of people I want to be with.

In investing, time is more powerful than any strategy… any boom-or-bust cycle… or anything else you can imagine.

Over time, mountains will erode to dust. But in the markets, time will transform the smallest start into a mountain of wealth.

Let this sink in, and share it with your children and grandchildren…

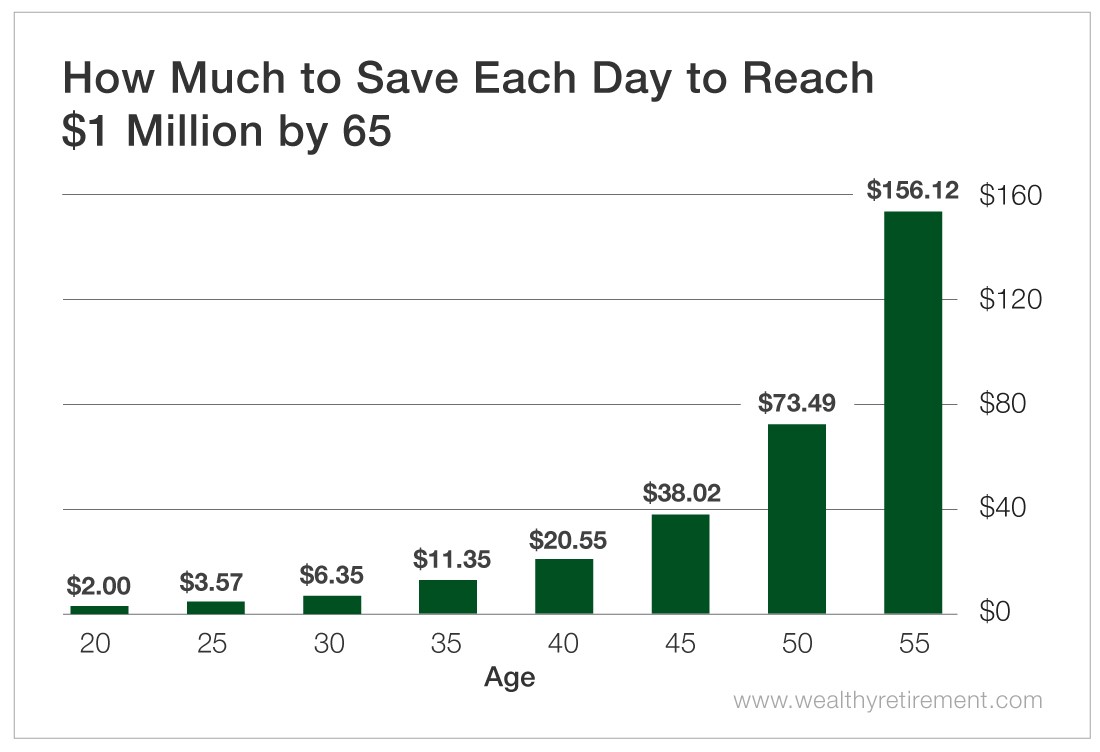

Starting at 20 years old, how much do you need to tuck away per day to become a millionaire by 65?

Two dollars.

Isn’t that ridiculous?

All it takes is $2 per day. Just $730 per year. Now, that needs to be invested and earn 12% a year.

But my goal here is to show how little you need to start with…

Two dollars.

That’s two items from the McDonald’s Dollar Menu set aside each day. That’s a Powerball ticket per day, with far better odds of becoming a millionaire.

I often hear the complaints, “Oh, I’ll start saving when I make more money…” or “I plan to start soon…”

But the longer you put it off, the worse it becomes.

The median annual salary for Americans ages 15 to 24 is $36,108. To become a millionaire by 65, a person has to put away less than 2% of their annual salary when they start out… and that percentage shrinks over time as their salary increases.

Let’s compare that with the other end of the spectrum…

If you started saving at age 55, you’d have to save and invest $156.12 per day to become a millionaire by 65.

That’s $56,984 per year!

The median household income for Americans ages 55 to 64 is $62,802 per year.

So, if you started saving at 55, you’d have to set aside and invest 91% of your annual salary… every single year.

Every time I hear someone say, “I’ll start investing in a couple years when I have more money,” I tell them they’re only hurting themselves. The longer you wait – the more time you waste – the more expensive it becomes.

Here’s how much you must save and invest (assuming roughly a 12% annual return) starting at various ages to become a millionaire by 65…

Just think, to become a millionaire by 65, the amount you need to put away daily increases 78.5% if you begin saving at age 25 rather than age 20. The difference in daily savings between starting ages of 20 and 55 is 7,706%!

This saving rule is especially important to keep in mind during gift-giving holidays. A lot of Americans open their credit card statements and panic.

So many Americans don’t have a shopping budget, so they overspend.

And when you ask by how much they exceeded their budget, their answer is, “What budget?”

Celebrations are great in the moment. It’s the aftermath, the cleanup, that’s the downer. Those back-to-earth moments when people must face up to what they’ve done.

People get caught up in the moment and the spirit of the holiday, and before they know it, they’ve dug themselves into a hole. One that’ll likely take a very long time to get out of.

But here’s the deal… As easy as it is to overspend, it’s even easier to become a millionaire. Especially if you start with the right mindset and understand the importance of time.

Wasting time is expensive. And it gets more expensive the more you let it go.

Good investing,

Matthew