We all have that one friend… You never know what kind of crazy adventures you’re going to get into when you go out with them. Often, they’re fun and make for stories you’ll tell for years.

Other times, you marvel at how you didn’t end up injured or in jail. Or maybe you did.

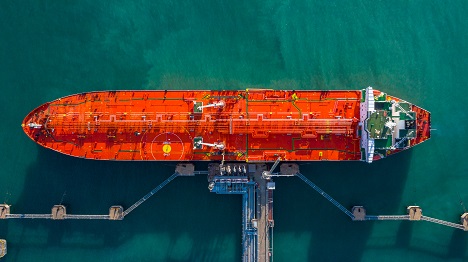

If that crazy friend were a stock, it would be Nordic American Tankers (NYSE: NAT).

The Bermuda-based oil tanker company’s financial results are as consistent as a middle school orchestra.

The main issue is that its free cash flow is all over the place. Some years, it’s positive; other years, it’s negative. After two years of positive cash flow, 2021’s free cash flow is forecast to be back in the red.

Not surprisingly, as free cash flow ebbs and flows, so does Nordic American Tankers’ dividend.

It has a variable dividend policy, so you can’t count on receiving the same dividend each year or even each quarter.

If you look online, you’ll see Nordic American Tankers sports a greater than 12% dividend yield. But that’s based on last year’s dividend payout. This year’s dividend will likely be radically lower.

In February, the company slashed its dividend to $0.02 per share, its second quarterly reduction in a row. While that $0.02 per share could jump or be reduced further next quarter, the current dividend annualized comes out to just a 2.6% yield.

It’s very clear that Nordic American Tankers’ dividend will fluctuate. You cannot depend on receiving a consistent payout each year.

Like with your crazy friend, the good times may come around again someday. But right now is the morning after when income investors are massaging their temples and wondering what the heck happened.

Dividend Safety Rating: F

If you have a stock whose dividend safety you’d like me to analyze, leave the ticker symbol in the comments section.

Good investing,

Marc

P.S. Want more reliable growth from your dividend payers? I’ll be presenting on a class of innovative stocks I call “Dividend Disruptors” at MoneyShow’s Virtual Expo on March 17. Click here to learn more.