We all like speculation now and again. I know I do.

I dabble in penny stocks, commodity options, short-term stock options and even bitcoin now and again.

Speculation to me means taking a small position for a short period of time with the hopes of hitting it out of the park (and using tight loss parameters to protect yourself).

When I make this type of trade, I am looking for momentum, controversy, technical price points, geopolitical events, investor sentiment and, finally, investor mania.

Bitcoin satisfies a lot of those criteria for me. I don’t fully understand the need for cryptocurrency, but I can see why others like it. Most people buy cryptos for the action, not for putting it away as some long-term hedge against currency collapse.

I don’t see any security or secrecy benefits, as you must keep your crypto holding on deposit somewhere and report when you buy or sell it on your taxes.

I worry about my credit card getting hacked… But at least my money won’t disappear, which has happened on some crypto exchanges.

As for using crypto as a proxy for cash… no thanks. I want to know what my cash is worth without having to worry that it will fluctuate precipitously from day to day. If I were living in Venezuela, I may look at this differently. But I don’t live there and will bet that you don’t either.

I have a Coinbase account, which is probably the largest firm in terms of total crypto accounts for retail buyers like me… But I don’t trade bitcoin on it.

I don’t care for the process of buying, funding and waiting for the trade to clear. Worse, when I speculate or day trade, I don’t want to deal with the tax headache. In fact, when I speculate and think I will hit it big, I want to defer my taxes completely.

That means I trade bitcoin only in my retirement account.

How so? I don’t hold virtual coins in there. I could, but the steps involved in holding cryptocurrencies are too onerous for me. They involve setting up LLCs to hold the coins and then finding a custodian to hold the LLC shares. Not for me.

Instead, I trade the Bitcoin Investment Trust (OTC: GBTC). It is an investment vehicle that holds bitcoin and trades like a normal stock. (Of course, there is nothing normal about how bitcoin trades!)

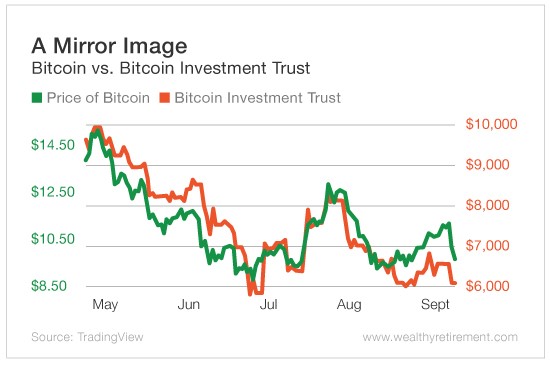

The trust trades at a huge premium to the price of actual bitcoin, but since there are few alternatives to it, the premium is not really an issue. What matters to me is that the Bitcoin Investment Trust mirrors the movement in bitcoin well. Look at the chart below to see how it has traded since May. It’s almost a mirror image.

Trading bitcoin through the Bitcoin Investment Trust allows me to trade it in my IRA, not deal with the tax headaches, buy and sell instantly during market hours, and enjoy a similar upside to my speculation as if I were buying bitcoin itself. And I can do it at any brokerage firm.

The downside is that the Bitcoin Investment Trust does not trade 24/7 like bitcoin. That means I am taking overnight risk. But it’s a risk I am willing to take as a speculator. And until there is an alternative like a bitcoin exchange-traded fund to compete against it, I am not worried about the premium evaporating quickly.

In nearly three decades of investing, I have learned that speculation is neither art nor science. And you should treat it no differently than betting a couple of bucks at the track. But you can speculate “smartly” by using a vehicle that makes more sense.

You still may not win, but at least you’re not dealing with technicalities that hamper your ability to even place a bet!

Good investing,

Karim