When it comes to safety and reliability, Ford Motor Company (NYSE: F) doesn’t have the greatest reputation. And the Ford dividend may soon be equally tarnished.

The company has paid shareholders $0.60 per share every year, not including special dividends, since 2015.

It cut the dividend completely in 2006 and didn’t resume paying one until 2012.

Is Ford’s Dividend Safe?

The yield is a fat 6.4%. But SafetyNet Pro suggests that the dividend is as safe as a 1970s Pinto.

If we’d have analyzed the stock last year, there’d be no problem. This year, it’s a problem.

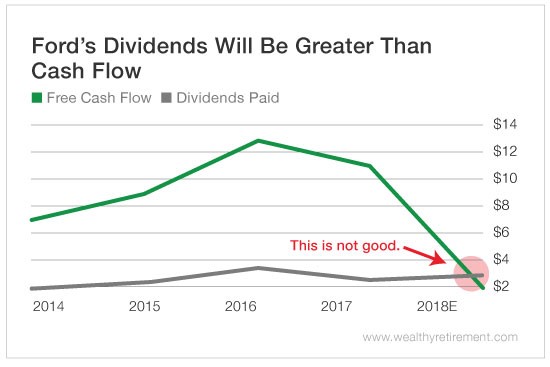

Free cash flow is forecast to all but disappear. After generating more than $11 billion last year, Ford’s free cash flow is projected to be just $2 billion this year, as net income is expected to fall 26%.

Last year, Ford paid out $2.6 billion in dividends. In 2018, it will likely pay $2.9 billion. That’s an issue if it’s generating only $2 billion in free cash flow. Where will the money come from to pay the dividend?

Ford will have to take money out of its cash on hand, borrow more money (it already has $151 billion in debt) or sell shares.

Furthermore, earnings and cash flow aren’t expected to recover much in 2019. And if the trade war and increased tariffs on cars continue, you can probably kiss a recovery in cash flow goodbye. So we could be in the same situation next year where Ford still cannot afford the dividend it is paying to shareholders. That is, unless it cuts the dividend.

With a 6% yield, it has plenty of room to do that and still pay a decent yield. If management reduced the dividend by a third, it would still pay a very reasonable 4.2% yield while bringing the dividends paid below its free cash flow level.

Don’t be surprised if Ford’s dividend is lowered in the next 12 to 18 months.

Dividend Safety Rating: D

If you have a stock whose dividend safety you’d like me to analyze, leave the ticker symbol in the comments section. You can also enter the ticker or company name in the search box in the upper right-hand corner of the Wealthy Retirement site to see if I’ve written about your stock recently.

Good investing,

Marc

P.S. Interested in some free investing tools? Check out our free Mutual Fund Calculator and Dividend Calculator.