By Marc Lichtenfield, Chief Income Strategist

Note: In my latest issue of the Oxford Income Letter, I recommended selling NextEra Energy Partners as I no longer have

confidence it will be able to sustain its dividend growth going forward. It used to be the third pick in this report but I have replaced it with Capital Southwest Corp., an excellent business development company with a colossal yield and an 11-quarter dividend growth streak. Read on to learn more…

confidence it will be able to sustain its dividend growth going forward. It used to be the third pick in this report but I have replaced it with Capital Southwest Corp., an excellent business development company with a colossal yield and an 11-quarter dividend growth streak. Read on to learn more…

When it comes to income investing, in many ways, size doesn’t matter.

After all, many companies that pay out hefty 20% or 30% dividend yields aren’t able to sustain those dividends long term.

Then, investors who hopped on board chasing after the money get hit with a disappointing dividend cut or suspension.

But it’s also true that when you’re building passive income streams, it pays to be selective.

For instance, while you might invest in a stock because it’s poised for growth or a short-term gain, most of the time, a 1% yielder isn’t going to catch your eye…

What income investors want is a sizable, growing dividend.

And I’ve written the book on dividend investing – check out Get Rich with Dividends – so I always have my finger on the pulse of what’s happening in the markets…

Which companies are going to reward their shareholders…

And which will fall flat.

In this report, I’ve assembled three of the safest high-yielding dividend stocks around. I also pull back the curtain on the strategy I use to assess the dividend safety of hundreds of stocks every day for my readers.

Additionally, 2024 was a breakout year for the artificial intelligence (AI) industry in particular and therewill be loads of money to be made investing in that market for years to come. Nvidia is the banner example here, its shares are up 22% at the time of writing.

But any company involved in AI is poised to capture a portion of the $244 billion the industry is set to grow to this year and the $1 tillion it’s set to be by 2031.

The three companies in this report are all involved in this revolutionary industry, directly or indirectly. And each company is poised to profit in its own way.

With these tips – and with three of the market’s safest high-yielders in your portfolio – you’ll become a master of dividend safety.

My Go-To Dividend Safety Assessment Strategy

Before I get into why my top three high-yielding stocks of the moment deserve your attention, it’s important to mention why these have caught my eye.

The first thing that’s really important to me when assessing dividend safety is cash flow. A company should have sufficient cash flow to support its dividend.

Note, I didn’t say it should have sufficient earnings. There’s a big distinction between earnings and cash flow.

The metric “earnings” includes all kinds of noncash items, whereas “cash flow” is really just representative of the cash that came into the company – and therefore is available to pay shareholders.

Here’s a very brief example…

Let’s say a company records a big sale on December 30. It sells $1 million worth of widgets. It can book that sale and include it as revenue, which trickles down to earnings on its year-end results.

But the truth is, the company might not have even sent out an invoice yet, much less gotten paid. Meanwhile, its revenue and earnings have gone up even though it hasn’t taken in any more cash.

Next year when the company sends out that invoice, maybe the customer returns the item. Maybe the customer goes bankrupt, or maybe it just takes a long time to pay. That would drastically affect the cash flow available for the company that made the sale.

That’s why, as a dividend investor, I’m really concerned only with the cash that comes into the company. That’s the cash that’s going to pay my dividend – not earnings, which include noncash items.

It’s also really important to me that a company have a long, reliable track record of dividend payments. I want to invest only in a company that hasn’t cut its dividend – and I’d prefer to invest in a company that has raised its dividend every single year.

Companies that raise their dividends every year for 10 years are termed Dividend Achievers, and companies that raise their dividends every year for 25 years or more earn the prestigious title of Dividend Aristocrat.

A perfect example is PepsiCo (Nasdaq: PEP).

Recently, Pepsi raised its dividend for the 53rd year in a row. That sets the bar pretty high for investors, encouraging them to expect a dividend increase every single year.

After all, what do you think would happen if, after five decades of consistent dividend increases, Pepsi cut its dividend or suspended it altogether?

I think you’d see a disproportionate number of pitchforks and torches at its next shareholder meeting…

In short, a company’s track record, while not a guarantee, is a strong indicator of its dividend safety.

Combined with steady cash flow, a company’s track record gives me confidence in its payout – which is why my three top picks right now bear looking into for any income investor…

3 Safe Yet High Dividend Payers

No. 1: Cogent Communications

The Oxford Income Letter’s 10-11-12 System is based on dividend growth. It’s the lifeblood of the strategy. We need to see a company raise its dividend every year.

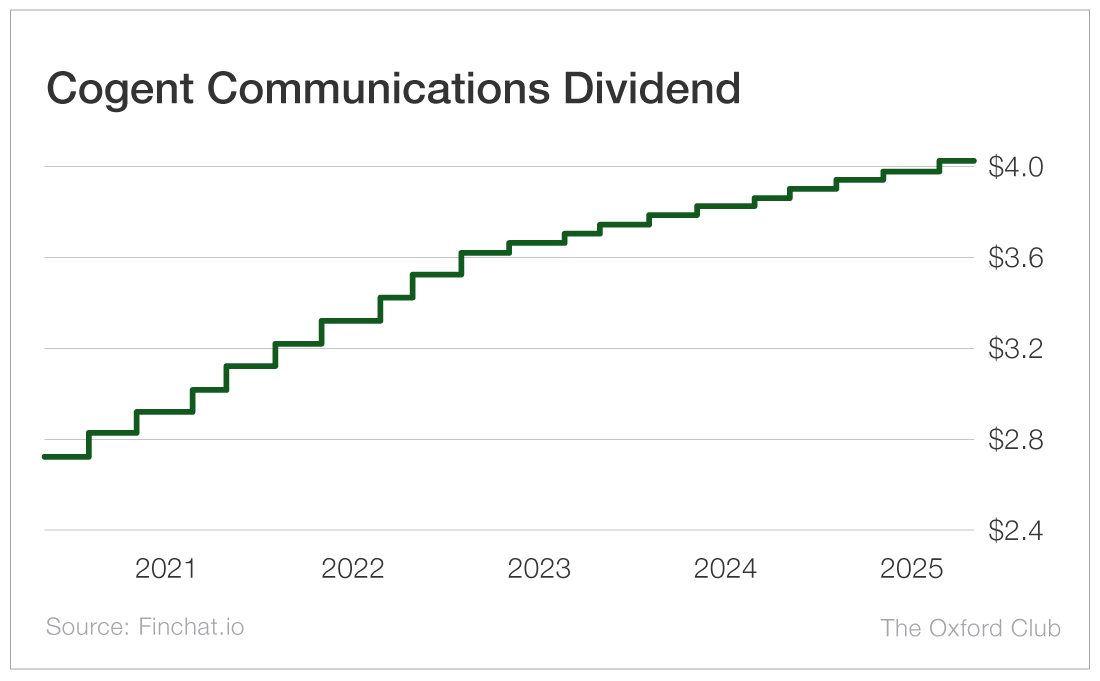

Occasionally, we come across a company that boosts its dividend every quarter. That’s even better.

This recommendation pays a robust 5.6% yield. And the company has lifted the payout to shareholders every quarter for almost 10 years.

You use its service every day. And in May of 2022, it landed a sweetheart deal that should ensure revenue and cash flow will continue to grow – and be distributed back to shareholders – for years.

Cogent Communications (Nasdaq: CCOI) operates one of the largest fiber-optic networks for internet traffic in the world. It offers high-speed internet access and data transport services to businesses and carriers, service providers, and content providers.

The company has a low-cost business model of buying “dark” fiber rather than constructing its own. In other words, it buys fiber that is not being used by other companies and turns it on, thereby making that fiber-optic network operational. Its network of almost 300,000 miles of fiber optic cables connects to more than 8,280 locations around the world.

The company carries roughly one quarter of the world’s internet traffic – including for Amazon (Nasdaq: AMZN), Google parent company Alphabet (Nasdaq: GOOGL) and Facebook parent company Meta Platforms (Nasdaq: META). It provides connectivity to 4 billion people, including to Chinese and Indian telecommunication companies.

From 2013 to 2023, Cogent grew by 5.1% annually with no acquisitions – just pure organic growth. But that all changed in May 2023 when Cogent closed on a deal with such favorable terms that it makes the Dutch acquiring Manhattan for $24 look like they got taken to the cleaners.

In 2022, T-Mobile (Nasdaq: TMUS) merged with Sprint. But in order for the merger to get the green light from regulators, T-Mobile had to divest certain assets.

Sprint was essentially ignoring the fiber-optics part of its business. It was focused on being a wireless business and not interested in servicing wired customers. T-Mobile was happy to get rid of it and appease regulators at the same time.

As a result, Cogent acquired 20,000 miles of fiber and 1.3 million square feet of data centers with 44,000 racks (where servers are placed). It also scored more than 1,000 large customers that represent $450 million in revenue, which the company believes could grow to more than $500 million in cash flow in a few years.

The cost?

$1.

It gets even better.

T-Mobile paid Cogent $29 million per month for the first 12 months and then will continue to pay $9 million per month for the following 42 months.

Cogent will take some of that cash and use it to grow the business as well as pay down some debt.

Another positive for Cogent is that in-office work is starting to resume, albeit slowly. At the same time, the greater number of workers who are staying home (at least some days) means more customers need to be able to connect to their companies’ networks and process huge amounts of data.

Thanks to the fiber-optics business it acquired from Sprint, Cogent is still adding customers at a rapid pace…

Indeed, in 2023 the company netted revenue of just over $890 million, up 52.5% over 2022. Net income grew by an astounding 24,646.2% in 2023, totaling $1.27 billion over 2022’s $5.1 million.

And the company has grown considerably since then. 2024 saw its revenues climb to $955 million, just shy of $1 billion and up 7.3% over 2023. In addition, its cash reserves stand at $198 million. Finally, the company is facilitating the rise of AI with technology it also acquired from Sprint in a new and innovative way. Cogent calls it Optical Transport, it’s a dedicated point-to-point fiber-based communication system between two specific locations.

Customers who buy optical transport get dedicated pipes connecting their servers and network between two locations far faster than the internet would be capable of. This would be very useful for a company integrating AI between its offices and data centers.

AI is very data intensive and can be slow if operating off the normal internet. But with dedicated fiber-optic lines, they can operate much faster and more efficiently than ever before. Which is exactly what Cogent is providing here, and it should see the company’s fortunes grow in 2024 and beyond. Speaking of…

A Steadily Growing Dividend

The current quarterly dividend is $1 per share, or $4 annually, which equates to about a 5.6% yield. But Cogent has raised its dividend every quarter for years. In fact, I spoke with CEO Dave Schaeffer. He told me he fully expects to continue quarterly dividend increases.

The yield is pretty large. You’ll enjoy it even more knowing that you’re paying taxes on only a small portion of it.

You see, in 2023 and 2024, 100% of the dividend was considered return of capital.

The year before, more than 77% of the dividend was return of capital. In 2020, return of capital made up 63% of the dividend.

For those who are new to the concept, return of capital is not taxed as a dividend. Instead, it lowers your cost basis.

So if you bought a stock for $20 per share that paid a $1 per share dividend and 80% of it was return of capital, you would pay taxes on only $0.20 per share. The remaining $0.80 would not be taxed as a dividend. Instead, your new cost basis would be lowered to $19.20.

When you sold the stock, you’d pay taxes on the capital gains based on the new $19.20 price rather than $20.

Now, I’m not the only one who believes Cogent is attractive. Its three largest shareholders – BlackRock, Vanguard Group and State Street – are savvy institutional investors.

These whales (big shareholders) like the deal with T-Mobile. They like the underlying business. As do I.

Cogent should continue to generate steadily increasing dividends for shareholders for years to come while growing its business and stock price.

It’s the epitome of a 10-11-12 stock.

Action to Take: Buy Cogent Communications (Nasdaq: CCOI) at market. The stock is currently a position in the Compound Income Portfolio. Because the dividend is mostly tax-advantaged, I recommend holding the stock in a taxable account.

No. 2: Rio Tinto Group

In November 2021, the Bipartisan Infrastructure Law – which commits $550 billion to repairing roads, bridges, mass transit, ports and other infrastructure projects – was signed into law.

The spending bill is the largest investment in bridges since the creation of the Interstate Highway System. These funds will be released over several years, and we’re seeing them be put to work now.

I expect the law to contribute to strong demand for iron ore and other metals. But it won’t just be in the U.S. that demand is strong…

Steel production in China has been trending higher for years. The country’s strict COVID-19 policies caused production to decline. That will likely reverse in a big way going forward, as China has relaxed its restrictions.

Also boosting Chinese demand for steel is a loosening of borrowing rules on Chinese developers. This is being done to bolster the Chinese real estate market. And, importantly, iron ore is the main component of steel.

As a result of the increased demand, the price of iron ore has started to rise after its year-long decline. The tariffs might affect this demand, but China needs iron and Rio Tinto is based in London so it is unlikely to be hindered much by an American and Chinese trade war.

We’re going to play the increase in demand and price for iron ore and other metals with Rio Tinto Group (NYSE: RIO).

Mining for Even Bigger Gains

London-based Rio Tinto operates in 35 countries. It produces iron ore, copper, aluminum and other materials.

In March 2023, Rio Tinto started production from the Oyu Tolgoi mine in Mongolia The mine is two-thirds owned by Rio Tinto and one-third owned by the government of Mongolia. When the mine reaches full production, it will boost Rio Tinto’s copper production by 43%.

Copper prices are likely to rise significantly in the future. BHP Group (NYSE: BHP) CEO Mike Henry said copper supplies were not sufficient to meet demand over the long term. And Freeport-McMoRan (NYSE: FCX) CEO Richard Adkerson said copper prices didn’t reflect a “strikingly tight” physical market.

Aluminum is another growing market, in part thanks to car manufacturing. Aluminum makes vehicles lighter and therefore reduces greenhouse gas emissions.

Rio Tinto has 14 aluminum smelters in Canada, Australia, New Zealand, Iceland and Oman.

Russia is the second-largest exporter of aluminum, behind Canada. With bans on importing Russian goods, a meaningful chunk of the available supply is no longer in the market, which means prices should rise if increasing demand is chasing decreasing supply.

And the company’s introduction of AI into its mining operations should accelerate the profit from that considerably. Rio Tinto’s MAS or Mine Automation System works like a network server application that pulls together data from 98% of its sites, mining it for information.

It then displays that data using RTVis or Rio Tinto Visualization which in turn can be used to automate functions in the company’s mines, making them safer and more efficient in one stroke.

Let’s Look at the Numbers

Rio Tinto has a solid balance sheet.

While it has $11.7 billion in current total debt on its books, it also has $8.87 billion in cash. Not to mention it generated about $5.9 billion in free cash flow for 2024. I don’t mind debt when a company could write a check to pay it all off.

Additionally, the company’s dividend is variable. Rio Tinto pays out 40% to 60% of its earnings in dividends, and earnings will fluctuate due to metals prices. The dividend is paid twice a year.

The ex-dividend dates are typically in March and August, with payments made in April and September.

Right now, Rio Tinto pays a dividend of $4.00 per share which yields 6.8% at current prices. However, looking ahead, I expect earnings to be stronger than Wall Street anticipates, due to soaring metals prices. That could easily push the yield higher.

Analysts are not particularly bullish on the stock. That’s fine with me, as analysts are notoriously late to the party.

Rio Tinto is an excellent way to get exposure to the insatiable demand for metals that will occur over the next decade while also earning a strong yield.

Action to Take: Buy Rio Tinto Group (NYSE: RIO) at market. I suggest holding it in a tax-deferred account if possible. Place a 25% trailing stop below your entry price.

No. 3: Capital Southwest

It’s not often you can invest in a 60-year-old business that is extremely lean with only 33 employees, yields 11% and is a regular dividend raiser… But my next pick has all of those qualities and then some!

Even better, the company is considered very safe, has low debt and is committed to paying its dividend!

Now, I am not someone who throws around exclamation points willy-nilly, or pell-mell for that matter.

They lose their effectiveness with overuse. But in this case, the exclamation points above were warranted. After all, it’s hard not to be excited about a stock with a very high yield that boosts its dividend every year! (See, there I go again.)

Capital Southwest Corp. (Nasdaq: CSWC) is a small cap business development company (BDC) that lends money to businesses that have a minimum of $3 million per year in EBITDA (earnings before interest, taxes, depreciation and amortization), which is a proxy for cash flow.

In other words, Capital Southwest’s borrowers aren’t struggling.

The company has a $1.8 billion portfolio, 97% of which is first lien senior secured debt. That means Capital Southwest is first in line among other lenders to get paid, and the debt is backed by collateral.

Capital Southwest has a well-diversified portfolio, with business services and media/marketing being the largest industries served at just 13% each, followed by healthcare services at 11%. The average position makes up just 1.2% of the portfolio.

There are dozens of companies in the portfolio, including…

- Intero Digital, a marketing firm

- Summer Discover, an education company

- Jackson Hewitt Tax Service

- Zips Car Wash

• The portfolio is performing incredibly well too. Capital Southwest earns an average of 13.7% on its investments. And it generates loads of cash that is used to pay dividends.

Net investment income (NII), the money the company makes from its loans and investments, has grown a staggering 111% since 2015.

That is likely to continue, as the economy is stronger than anyone predicted. The rate of inflation is tapering off, it lowered to 2.4% in September. I expect this trend to continue moving forward. A 10% Yield and Going Higher?

Capital Southwest pays a regular quarterly dividend that is often accompanied by what it calls a supplemental dividend. It has also occasionally paid a special dividend.

While management consistently increases the regular dividend, when profits are left over, it pays out a supplemental dividend. BDCs are required to pay 90% of their net income in dividends.

Management is committed to each type of dividend. On the most recent company conference call, CEO Bowen Diehl stated, “It is our intent and expectation that Capital Southwest will continue to distribute quarterly supplemental dividends for the foreseeable future.”

Over the past three years, the dividend has grown at a compound annual rate of 9.3%.

Keep in mind that the nearly double-digit yield is based only on the regular dividend. The supplemental and special dividends are bonuses. So we should be able to rely on a double-digit total yield for years to come.

It’s rare to find a double-digit yielder that is so healthy and is growing the dividend. The yield alone will almost immediately satisfy the requirements of the 10-11-12 System (whose goal is to generate 11% yields within 10 years) and the Compound Income Portfolio (whose goal is to achieve 12% average annual total returns over 10 years with dividends reinvested).

Action to Take: Buy Capital Southwest Corp. (Nasdaq: CSWC) Place a 25% trailing stop The stock should be held in a tax-deferred account if possible.

Don’t Get Caught by Surprise

Now you see why I don’t look for only the largest dividend payers…

Successful income investors will look to the companies with the most generous and sustainable payouts.

And as I explained above, they can judge their holdings’ dividend safety by taking a look at the companies’ cash flow metrics and track records.

Each week in my free e-letter, Wealthy Retirement, I analyze the dividend safety of a company based on reader requests.

And now that you’ve seen a few of the tricks up my sleeve, you’ll be able to ensure that your favorite dividends also stay secure.