Marc Lichtenfeld

Marc is the Senior Editor of The Oxford Income Letter, which is based on his proprietary 10-11-12 System. He is a leading member of Oxford Centurion‘s Centurion Advisory Board. He is also the Editor of Technical Pattern Profits, Trigger Event Trader and Oxford Bond Advantage.

Marc is the Senior Editor of The Oxford Income Letter, which is based on his proprietary 10-11-12 System. He is a leading member of Oxford Centurion‘s Centurion Advisory Board. He is also the Editor of Technical Pattern Profits, Trigger Event Trader and Oxford Bond Advantage.

Marc Lichtenfeld is the Chief Income Strategist of The Oxford Club. After getting his start on the trading desk at Carlin Equities, he moved over to Avalon Research Group as a senior analyst. Over the years, Marc’s commentary has appeared in The Wall Street Journal, Barron’s, and U.S. News & World Report, among others. Prior to joining The Oxford Club, he was a senior columnist at Jim Cramer’s TheStreet. Today, he is a sought-after media guest who has appeared on CNBC, Fox Business and Yahoo Finance.

His first book, Get Rich With Dividends: A Proven System for Earning Double-Digit Returns, achieved bestseller status shortly after its release in 2012 and was named Book of the Year by the Institute for Financial Literacy. It is currently in its second edition and is published in multiple languages. In early 2018, Marc released his second book, You Don’t Have to Drive an Uber in Retirement: How to Maintain Your Lifestyle without Getting a Job or Cutting Corners, which hit No. 1 on Amazon’s bestseller list.

As an undergraduate a million years ago, I sat in the front row, eagerly anticipating my first econ class. The professor confidently told the room full of freshmen, “If supply decreases and demand increases, price increases.”

Whoa!

It’s a simple idea, I know. But to a 17-year-old who had never studied economics before and whose work experience was limited to shoveling driveways every winter and spending four months in a tuxedo store, it was a groundbreaking concept.

I learned a lot in college, but that one notion stuck with me − perhaps more than any other.

It is also the foundation of my recommendation in this report, which I expect to move much higher in the coming years and which has the potential to yield more than 5% per year.

I am very bullish on the energy sector. I expect supply could be restricted and demand could increase for oil and natural gas.

But that dynamic is even more prominent in uranium, the fuel used for nuclear power.

It’s no surprise that demand for uranium is strong.

One uranium pellet measuring three-eighths of an inch in diameter and five-eighths of an inch in length provides as much energy as 17,000 cubic feet of natural gas, 149 gallons of oil or 1 ton of coal.

And nuclear power is so cheap and clean that it is perhaps one of the few topics that Republicans and Democrats agree on these days.

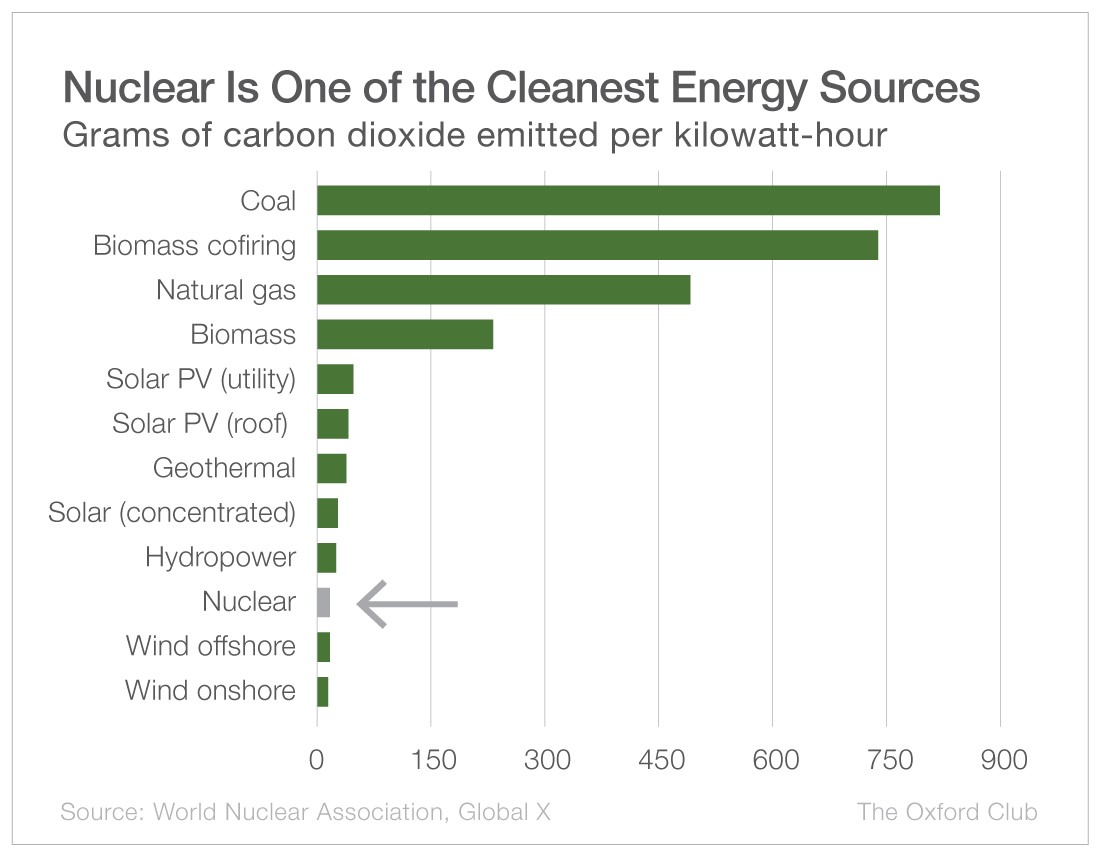

You can see in the chart below that nuclear power produces less carbon dioxide than solar power, geothermal power or hydropower. It emits the same amount as offshore wind power and only slightly trails onshore wind power.

Thanks to nuclear power’s efficiency and its environmental benefits, the sentiment surrounding it is shifting both in the U.S. and abroad.

In the Inflation Reduction Act, President Joe Biden provided incentives for companies that develop nuclear energy capabilities, including offering tax breaks for existing nuclear plants.

Last year, members of the European Union recommitted to using nuclear power to help achieve their climate goals. And France pledged 100 million euros to spark its nuclear industry.

China, India and Russia are also very pro-nuclear. China plans to generate 400 gigawatts of nuclear energy by 2060, more than all of the world’s current nuclear power plants combined. That means in the next 36 years, uranium demand from China alone will grow sevenfold.

Even California will continue to operate its Diablo Canyon nuclear power plant until 2030, five years past its planned shutdown. Diablo provides 8% of the state’s electricity.

And Japan, which once pledged to completely abandon nuclear power as a result of the 2011 Fukushima disaster, adopted a plan in late 2022 to extend the life span of its nuclear reactors and replace old reactors with new ones.

So clearly demand is skyrocketing.

But, unfortunately, supply will not even come close to keeping up.

As is the case with oil, the United States imports a significant amount of uranium from countries that are not particularly aligned with our interests. Though Russia isn’t a big uranium miner, it enriches about 50% of the world’s uranium. The U.S. gets 14% of its enriched uranium from Russia, and Europe is even more dependent, getting around 30% of its supply from Russia.

Just as tensions in the Middle East could restrict the supply of oil, tensions in Russia and Ukraine are threatening to restrict the supply of uranium.

On top of that, the world’s largest uranium miner, Kazakhstan-based Kazatomprom, recently said it will not meet its production goals over the next two years. The company accounts for 20% of the world’s uranium production.

Over the next 10 years or so, there will be a 60 million-pound shortage of triuranium octoxide, which is the primary component of the “yellowcake” that is used in nuclear reactors. That’s about the same amount that Kazakhstan produces in a year, and Kazakhstan produces three times as much as second-place Canada.

And while new mines might eventually alleviate some of the shortfall, it takes roughly 10 to 15 years for new projects and enrichment facilities to become operational.

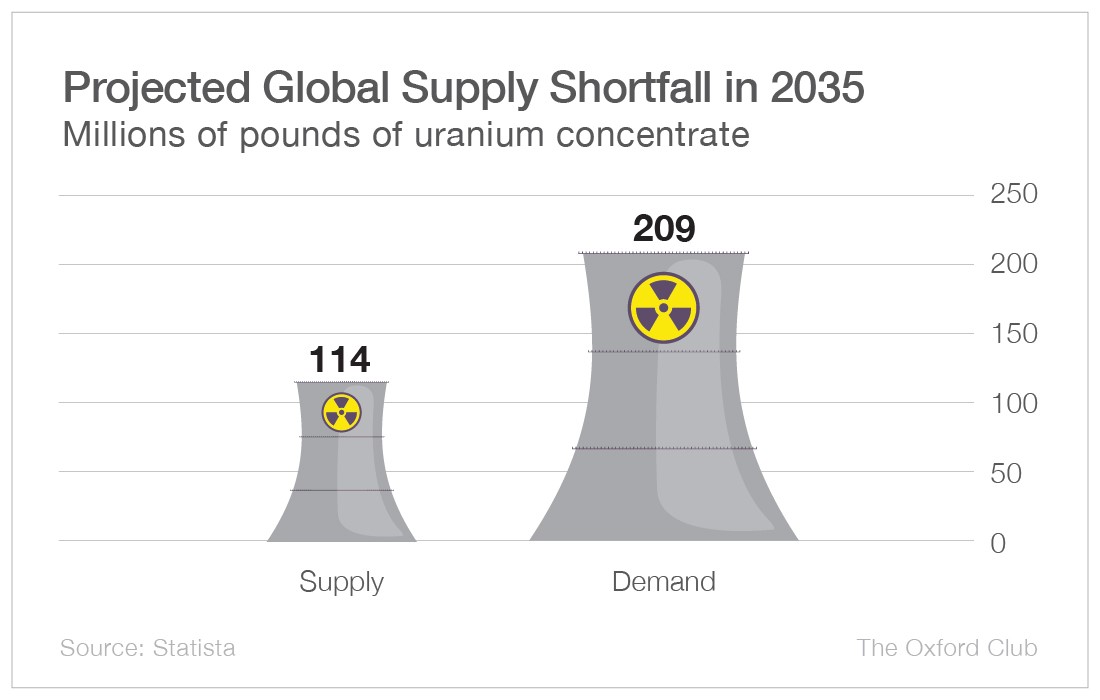

By 2035, the supply deficit will be acute. Supply is expected to be 114 million pounds of uranium concentrate, while demand will be 209 million pounds.

Adding to the demand are the 60 nuclear plants that are under construction around the world and the additional 110 that are being planned. There are currently 436 nuclear power plants in operation worldwide.

Because the imbalance between supply and demand is so severe, I expect uranium to be a fantastic long-term hold. However, there aren’t a lot of uranium stocks, and it’s even harder to find one with a strong dividend yield.

But my top energy ETF for 2025 is unusual in that it doesn’t pay a solid regular dividend.

To be clear, you’ll still receive income. The dividend varies widely from year to year, but based on last year’s dividend, the yield is 5.7%.

The Global X Uranium ETF (NYSE: URA) tracks a uranium and nuclear power index. Its top holding is Cameco (NYSE: CCJ), which makes up 23% of the portfolio, but most of its holdings are traded on foreign exchanges. I like the diversification this exchange-traded fund (ETF) offers and the potential for its yield to get even bigger.

The fund usually pays out one small dividend and one larger dividend each year. In 2023, it declared a total of $1.68 per share in dividends. In 2022, it declared just $0.15. But in 2021, the figure was $1.33. The higher the price of uranium goes, the better the portfolio performs – and the more likely we are to receive a strong dividend payout.

I expect the ETF to again produce a nice dividend yield in 2025.

But keep in mind that this isn’t a typical dividend play where a company produces lots of cash flow to fund a continually increasing dividend. This is more speculative, as the performance of the ETF depends heavily on uranium prices.

In the short term, if the commodities market doesn’t cooperate, the dividend may be tiny and the price of the ETF could be volatile. But long term, due to booming demand and a massive shortage in supply, uranium is a slam dunk.

Action to Take: Buy the Global X Uranium ETF (NYSE: URA) at the market. Place a 25% trailing stop below your entry price.