My #1 Dividend Stock

Marc Lichtenfeld, Chief Income Strategist

The volatility in the market is providing us with some incredible opportunities. Quality companies have gone on sale – some with much higher yields than normal.

Today, we have the chance to purchase a great company and capture a splendidly high dividend.

The healthcare sector has long been one of my favorite sectors to invest in.

That continues to this day, and it has nothing to do with COVID-19.

Global spending on pharmaceuticals is expected to increase from $1.6 trillion at the end of 2023 to $2.2 trillion by 2028,You definitely want exposure to healthcare stocks right now and over the long term.

AbbVie (NYSE: ABBV) is my favorite large cap pharma company for capital gains and my top dividend stock for a lifetime of income.

AbbVie delivered full-year 2024 net revenues of $56.33 billion, an increase of 3.7%. .Skyrizi a prescription medicine that treats moderate to severe plaque psoriasis along with psoriatic arthritis and severe Chron’s disease took the lead as the highest net revenue generating immunology drug generating $11.72 billion.

Humira, a medication that treats similar conditions, came in second with $8.99 billion in net revenue.

Imbruvica, a blood cancer drug that inhibits cell growth, scored more than $3.34 billion in global net revenue in 2024, an increase of 10.8%… while Venclexta, another blood cancer fighting drug, finished the year with global revenues of over $2.5 billion.

From the aesthetics portfolio, AbbVie’s Botox sold more than $2.7 billion globally, while global Juvederm net revenues were $1.8 billion.

The big knock on AbbVie is that Humira is off-patent outside the United States and lost patent protection within the U.S. in 2023.

But AbbVie’s constant innovation will help make up forany lost revenue from Humira…

Skyrizi is expected to be a more attractive alternative to Humira in the treatment of psoriasis, as it requires fewer injections per year.

Rinvoq (for arthritis) is also forecast to be a blockbuster.

Here’s what Robert A. Michael, AbbVie’s CEO, had to say about the company’s full year ended December 31, 2024.

“2024 was a year of significant progress for AbbVie. Our growth platform delivered outstanding results, we advanced our pipeline with key regulatory approvals and promising data, and we strengthened our business through strategic transactions,” said Robert A. Michael, chief executive officer, AbbVie. “We are entering 2025 with significant momentum and expect net revenues to exceed their previous peak in just the second full year following the U.S. Humira loss of exclusivity.”

And AbbVie has a large pipeline with more potential big revenue generators.

A Massive Perpetual Dividend Raiser

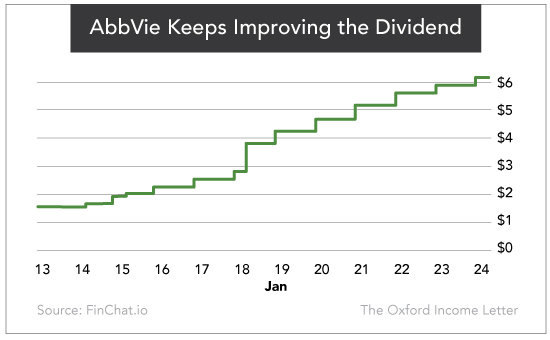

In 2024, AbbVie raised its quarterly dividend 4.7% from $1.48 per share to $1.55 per share for an annual dividend of $6.20.. And the company announced a 5.8% increase to $1.64 per share beginning with the dividend payable in February 2025. The company has raised its dividend every year since its inception in 2013, increasing it by an astonishing 310%.

I expect AbbVie to continue to boost its payout to shareholders for the foreseeable future.

While inflation and interest rates may impact Botox sales, few people are going to stop taking their Skyrizi for Crohn’s disease, their Tarka for high blood pressure or their Kaletra for HIV because economic times are tough.

In addition to the $56 plus billion revenue in 2024…the company also reports a full-year adjusted EPS of $10.12, a decrease of 8.9%. The metric included an unfavorable impact of $1.52 per share related to an acquired IPR&D (in-process research and development) and milestone expense. Abbvie does not forecast acquired IPR&D and milestones due to its uncertainty. Often, the amount and timing of additional expenses related to integrating new research and development projects can be unpredictableLooking forward AbbVie announcedthe 2025 adjusted diluted EPS guidance range of $12.12 – $12.32 meaning AbbVie does not expect EPS for 2025 to be below $12.32. Again, these numbers exclude any unfavorable impact related to acquired IPR&D and milestone expenses.

Some of Wall Street’s heavy hitters must think it’s cheap too. Vanguard owns more than 9% of the shares, and BlackRock owns nearly 8%. JPMorgan Chase owns 2.1%.

I expect AbbVie, helped by its juicy yield, to outperform growth stocks and the entire S&P 500 as outstanding value plays take center stage.

If you don’t yet own AbbVie, now’s the time to grab some shares.

Action to Take: Buy AbbVie (NYSE: ABBV) at the market. Place a 25% trailing stop.