A few years back, Gap (NYSE: GAP) was the retail equivalent of an overstuffed closet – too many brands, not enough direction, and piles of unsold inventory hanging around like bad fashion choices.

Fast-forward to 2025, and something surprising is happening: The company is quietly becoming a cash flow machine again.

When I see an old-school retailer generating real profits in a brutally competitive market, my ears perk up. That kind of turnaround – if it sticks – can make patient investors a lot of money.

Gap is the largest specialty apparel company in the U.S., owning Old Navy, Gap, Banana Republic, and Athleta. After years of uneven execution for the company, new leadership has spent two years tightening costs, refreshing brand identities, and modernizing supply chains.

The second quarter of fiscal 2025 showed that the plan is starting to click. Net sales held steady at $3.7 billion, with comparable sales up 1% year over year – the company’s sixth straight quarter of positive comps. Earnings per share rose 6% to $0.57, and operating margin came in at 7.8%.

Cash and equivalents hit $2.4 billion – the highest level in 15 years – and the company returned $144 million to shareholders through dividends and buybacks.

The Old Navy and Gap brands both posted gains, while Banana Republic showed early traction in its premium repositioning. Athleta remains a sore spot but has a new CEO from Nike to lead its reset.

Gross margin was 41.2%, down from 42.6% last year due to the lapping of last year’s credit-card benefit and tariff costs. Online sales rose 3% and now make up 34% of total revenue. Inventory climbed 9%, mostly from accelerated receipts ahead of new tariffs.

Management reaffirmed full-year guidance of 1% to 2% sales growth and an operating margin of 6.7% to 7%.

For a mature retailer fighting tariffs and fickle consumers, those are respectable numbers.

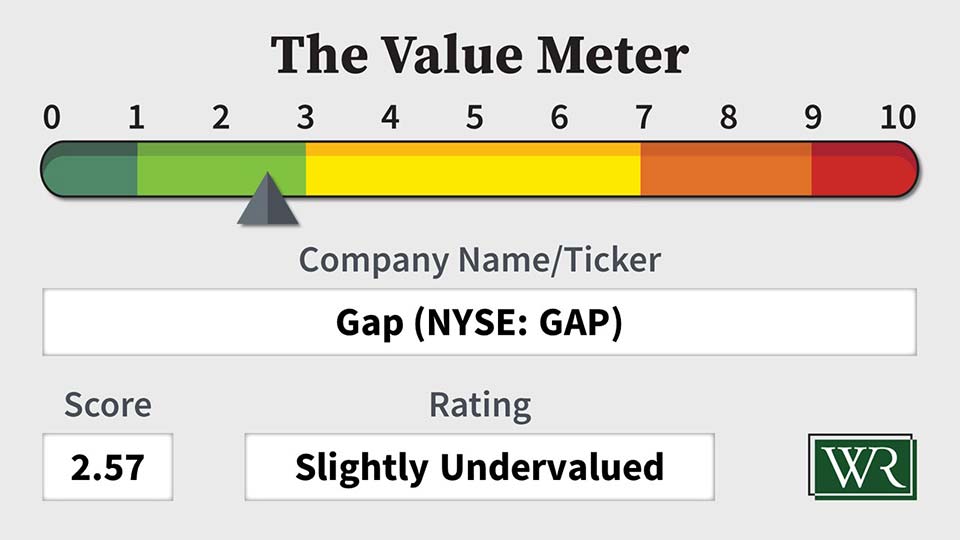

Let’s run Gap through The Value Meter and see what’s really happening beneath the surface.

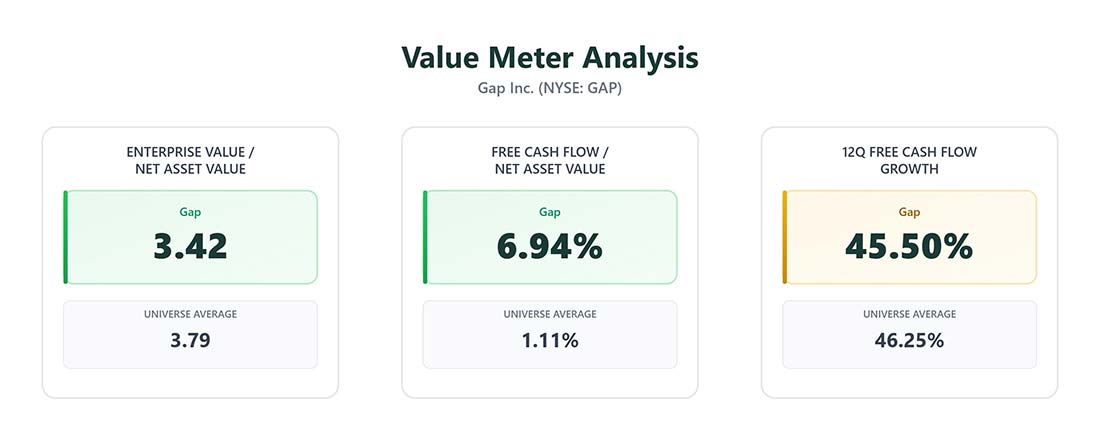

Gap’s enterprise value compared with its net asset value sits at about 3.4, a touch cheaper than the market’s 3.8 average. That means investors are paying less for each dollar of assets than they would for a typical peer.

At the same time, the company is converting those assets into cash with unusual efficiency. Quarterly free cash flow now equals nearly 7% of Gap’s net asset value – six times higher than the broader market average.

What makes this more convincing is the consistency. Nearly half of the past dozen quarters showed growth in free cash flow, roughly matching the average company in our universe. That may sound ordinary, but in retail, ordinary stability can be a rare advantage.

Since surging 70% in a month at the end of 2023, the stock has seen some big swings, bouncing back and forth between $17 and $29. It currently sits right around the midpoint of that range.

Gap isn’t suddenly a growth rocket, and tariffs or shifting fashion trends could easily knock it off balance for a while. But right now, the company is quietly producing real cash, paying its bills, rewarding shareholders, and trading for less than it probably should.

That’s a setup long-term investors don’t see often in this sector.

The Value Meter rates Gap as “Slightly Undervalued.”

What stock would you like me to run through The Value Meter next? Post the ticker symbol(s) in the comments section below.

Please review APAM.