By Marc Lichtenfield, Chief Income Strategist

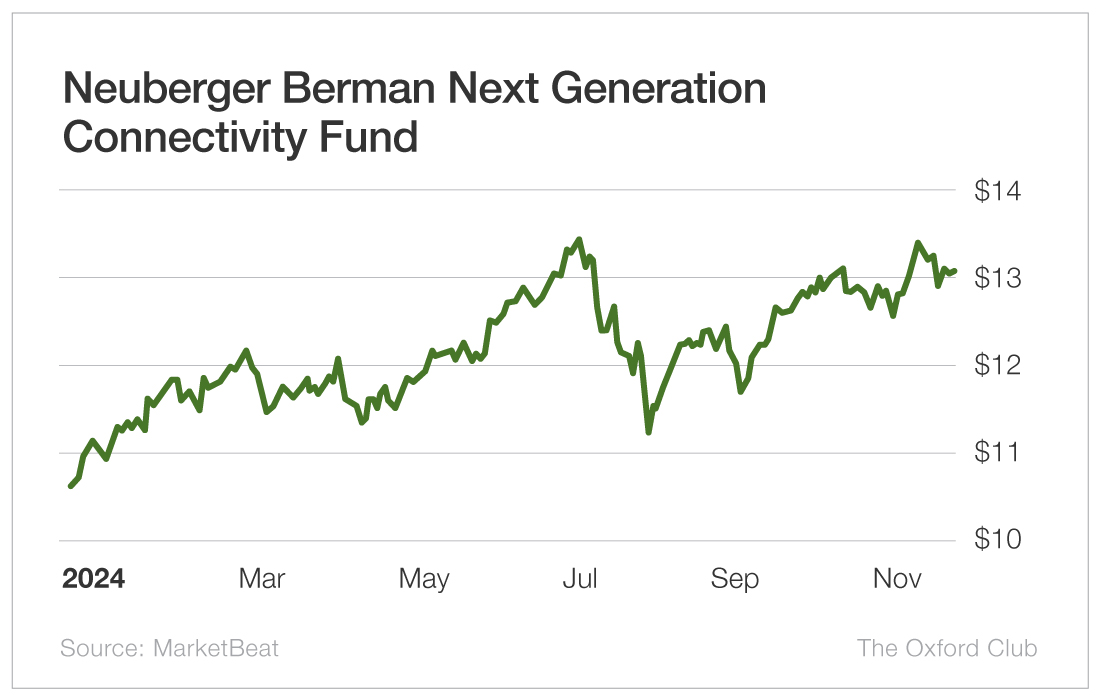

The unique fund I’ve just uncovered has been paying a whopping 10% dividend yield practically all year, thanks to the high-tech artificial intelligence investments in its holdings.

(As of this writing the yield sits at 9.2% because the stock price has risen over 20% in 2024).

So when you invest, you’re getting not only an ultra-high yield but also the potential for breakout growth with THE biggest income opportunity of our lifetimes… AI.

Today there are more than 3,000 publicly traded assets on the market that pay dividends. But precious few of them pay high yields.

They’re fine, but they’re nothing to write home about.

But this dividend payer will expose you to a broader swath of the AI market than you’d be able to achieve by investing in individual stocks. And you’ll earn a huge yield while doing so.

This near double-digit AI income play is called Neuberger Berman Next Generation Connectivity Fund (NYSE: NBXG), and it’s the ultimate set-it-and-forget-it AI play.

A Straightforward Industry Play

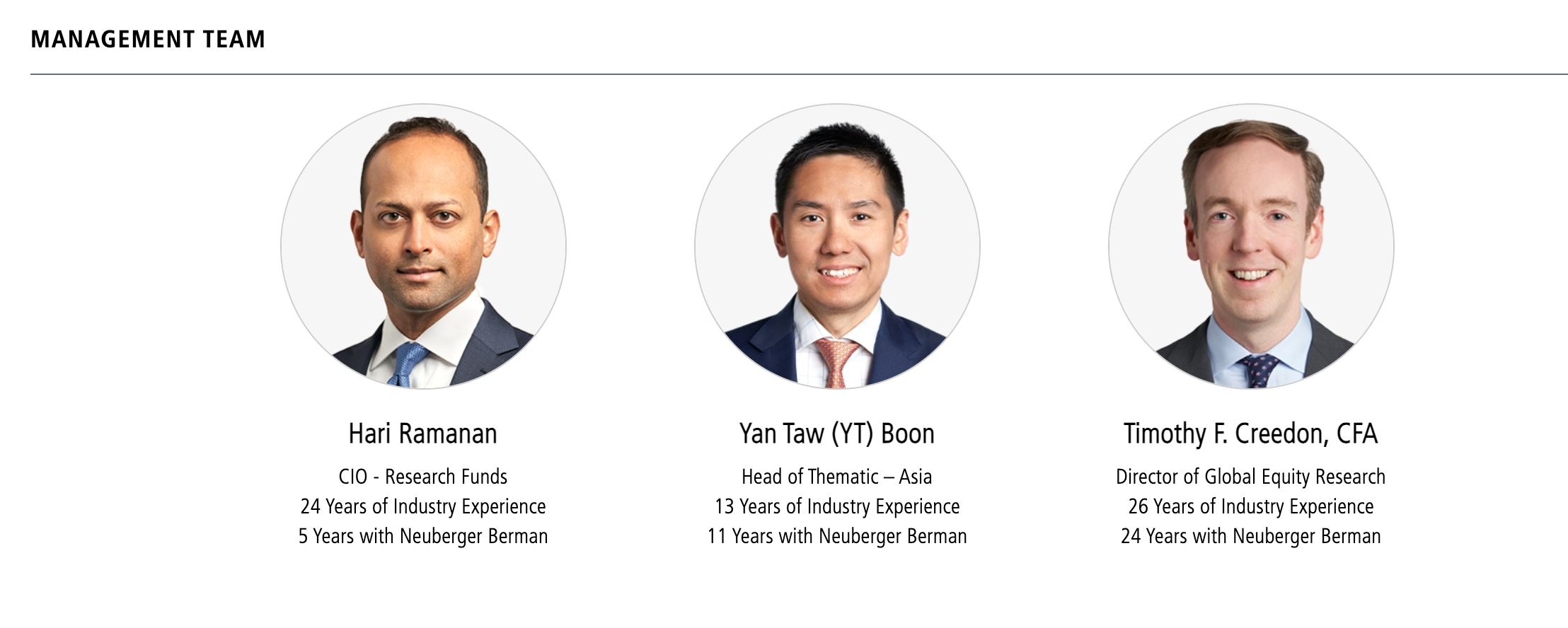

Funds like Neuberger Berman are pretty straightforward. By investing your money in shares of the fund, you’re entrusting the managers of the fund to invest with a much larger pool of money than any one individual investor could.

These three managers have invested in some of the finest AI stocks on the market. For example, the fund has invested in Monolithic Power Systems, which makes chips aimed at improving energy efficiency for AI systems.

The fund holds positions in Texas Instruments and Taiwan Semiconductor Manufacturing Co., which puts it at the forefront of semiconductor production. Semiconductors are the basis of nearly all computer hardware that we rely on daily, and those companies are two of the most prominent manufacturers of them.

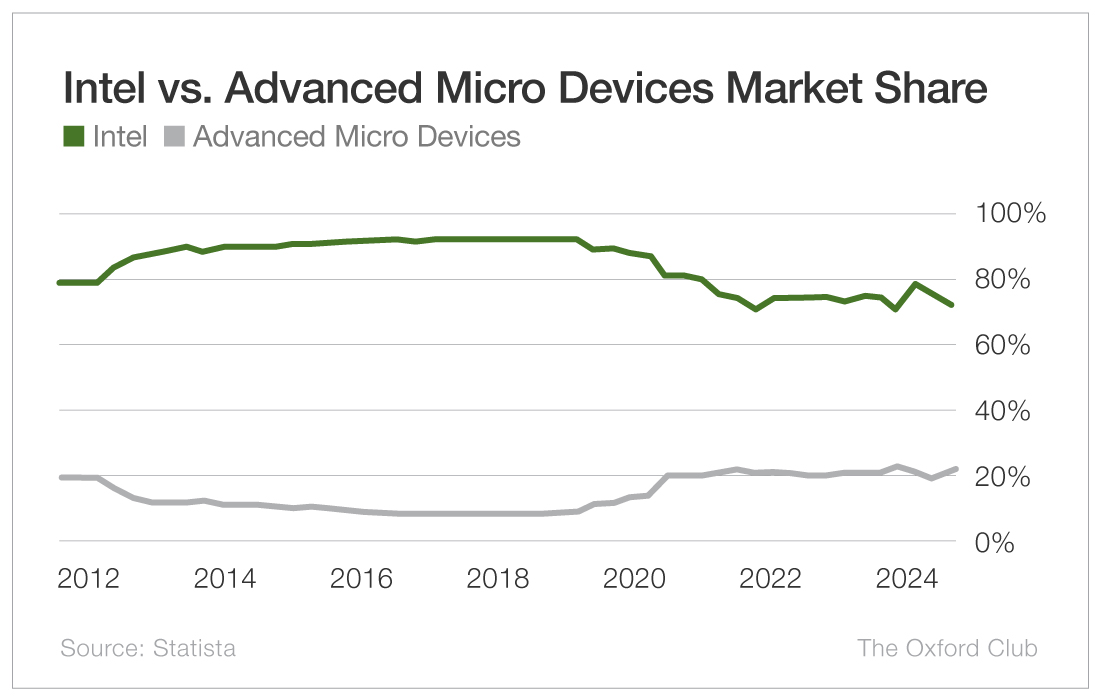

Advanced Micro Devices processors are found in over 35% of new devices. It’s the only real competitor to Intel, and the gap in market share between them has been narrowing since 2016.

Nvidia, on the other hand, has become one of the biggest tech companies in the world, arguably bumping Netflix out of the “N” spot in FAANG. Its processors and advanced graphics cards are used in everything from autonomous driving features in cars to high-end gaming PCs to crypto mining rigs.

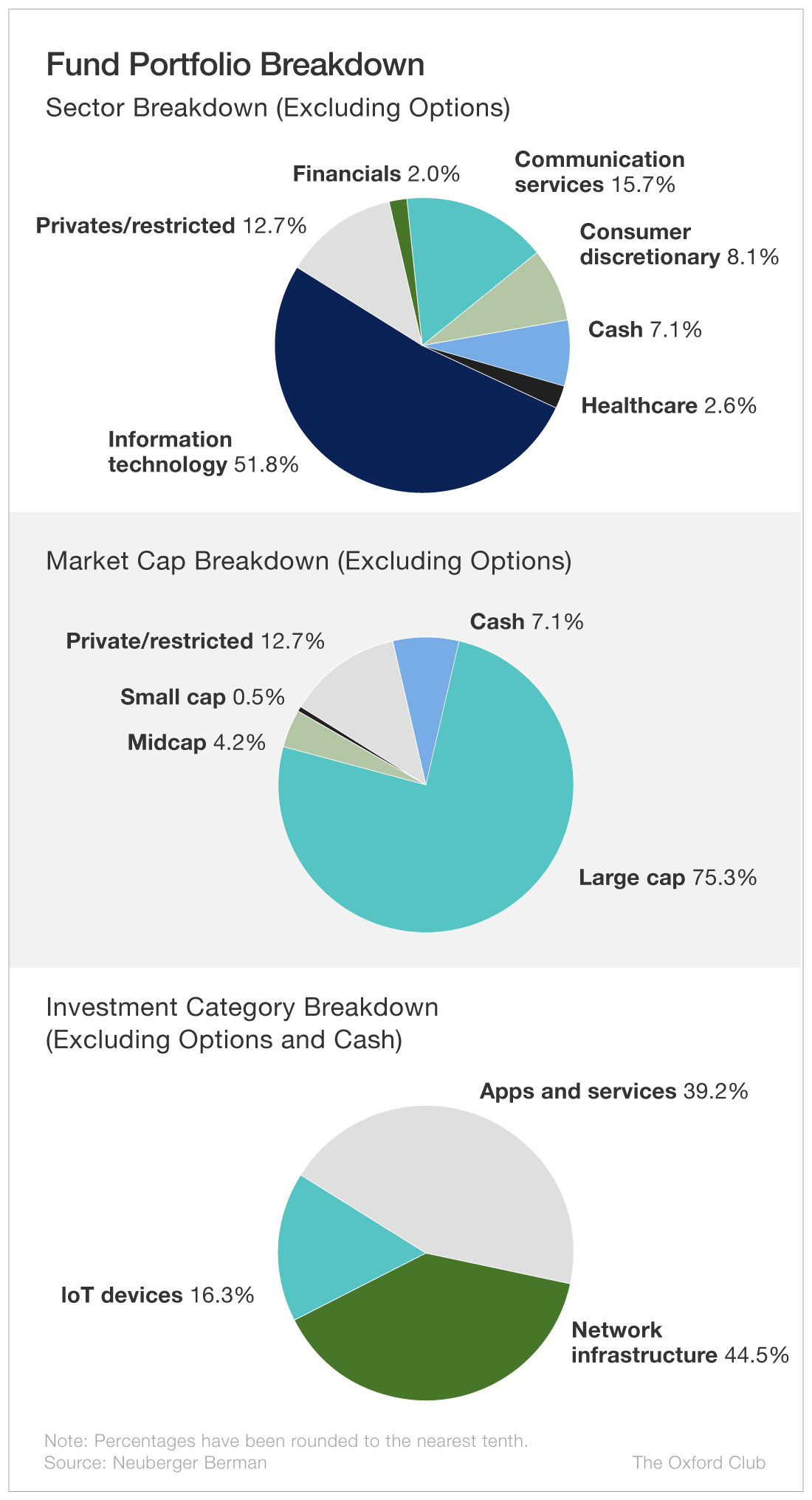

And those are just five of the roughly 60 positions in the fund’s $1 billion portfolio right now. Despite the fund’s focus on technology and AI in particular, it’s well diversified within the technology field.

The fund has been on a rally this year, driven by secular forces building behind technology and AI in the market. And those forces aren’t going anywhere anytime soon. The fund is up 19.49% year to date.

AI is set to impact industries such as finance, manufacturing, retail, transportation, government, healthcare and education, among others.

The AI market itself is set to be worth over $826 billion by the end of the decade. McKinsey & Company predict AI technology could add $2.6 trillion to $4.4 trillion in economic benefits annually.

And the Neuberger Berman Next Generation Connectivity Fund is the best way to expose your portfolio to as much of that trend as possible as easily as possible.

But the other reason you’ll want this one in your portfolio is its incredible dividend…

A Closed-End Fund

The Neuberger Berman Next Generation Connectivity Fund is a closed-end fund, which is different from a mutual fund.

Let me explain.

When you buy or sell a mutual fund, the price is the fund’s net asset value (NAV). So if a fund has 10 million shares outstanding and the value of its holdings is $100 million, the NAV is $10 per share. Anyone who buys the fund on the day the fund is worth $10 per share will pay $10 per share.

If the next day the value of its holdings increases to $150 million, the NAV will be $15, and that’s the price all buyers and sellers will pay or receive.

A closed-end fund is different. It trades like a stock, based on supply and demand.

So if we have the same parameters – 10 million shares with a portfolio worth $100 million, the NAV would be $10 per share. But the price of the fund could be anything, depending on supply and demand. If the closed-end fund is in high demand, the price could be $10.50, which would be a 5% premium to the NAV. In other words, a buyer would be paying $1.05 for every $1 in assets.

Sometimes funds trade at discounts. Though the NAV is $10, the fund may be trading for $9, a 10% discount. If that’s the case, the buyer or seller will be trading the fund at $0.90 on the dollar.

A closed-end fund can generate profits or losses for shareholders based on both the NAV and the premium or discount.

If an investor buys the fund with the $10 NAV at a 10% discount, they pay $9. If the NAV rises to $11 and the discount stays at 10%, the fund will trade at $9.90 – a gain of $0.90 per share on the original investment.

You could have a situation where the NAV doesn’t move but the discount shrinks or increases. If the NAV stays at $10 but the discount shrinks to 5%, the fund will trade at $9.50, and the investor will have a gain even though the value of the fund didn’t increase.

Of course, the opposite happens if the discount gets larger.

And if the NAV increases and the discount shrinks, you can supercharge your returns.

As I write this, the Neuberger Berman Next Generation Connectivity Fund trades at a 12.39% discount. In other words, you are paying $0.88 for $1 worth of assets – a screaming bargain.

The Big Yield

Typically, tech stocks don’t pay big dividends. And while some of the AI-related stocks in the portfolio do, the yields don’t approach 10%. So how does the fund achieve such a high yield?

Neuberger Berman Next Generation Connectivity Fund sells options – mostly covered calls to generate more income. The extra income from the calls provides a nice buffer when the market doesn’t cooperate and stocks fall.

When they rise, the fund can either sell the stocks at a profit or buy back the option and sell another one with a later expiration date.

This is a common and conservative strategy for generating income and is what allows the fund to often pay investors a double-digit yield.

A Fund for Your Future

Because it’s a fund, the Neuberger Berman Next Generation Connectivity Fund doesn’t post revenue or income numbers. It doesn’t work like that. Any money it generates is either reinvested or returned to shareholders as a dividend.

And the dividend yields just shy of 10% at present. What’s more, this is a monthly dividend payer. That means every single month, shareholders receive a dividend of $0.10 per share for a total of $1.20 per share annually.

As I write, the fund is trading for a price of about $13, meaning reinvesting those dividends to compound your wealth will snowball incredibly fast with Neuberger Berman.

Say you buy 100 shares of the fund for a cost of about $1,300 total. That nets you $10 per month in dividends, or $120 in just the first year. If prices stay stable and you reinvest those dividends, you can add another 10 shares of the fund to your portfolio while your initial investment remains the same.

That, in turn, will net you another 10 shares the next year. Each year your position will grow, your dividends will grow, and the number of shares you add to your portfolio annually will grow and compound.

If you grow your position to 200 shares, you’ll net $240 in dividends annually, which will considerably speed up the pace at which your position will grow to 300 shares. At that point, you’ll be getting $360 in dividends annually. By now I think you get the picture. And that’s barring any dividend raises… The fund has been issuing dividends only since July 2021, so as the companies in its portfolio raise their dividends, the fund should as well.

And remember, you’re reinvesting those dividends at a 12.39% discount right now. If you could buy top AI stocks for $0.88 on the dollar, you’d do it all day, every day and twice on Sunday.

A high yield plus a relatively low share price and dividend reinvestment is a fantastic way to generate huge, passive income very quickly. And the Neuberger Berman Next Generation Connectivity Fund is the best way to do that while giving yourself exposure to the AI industry and all the growth it’s set to experience by the end of the decade.

Action to Take: Buy the Neuberger Berman Next Generation Connectivity Fund (NYSE: NBXG) at market. Set a 25% trailing stop to protect your principal and your profits.

Compound Your Wealth

Albert Einstein once said, “Compound interest is the eighth wonder of the world. He who understands it, earns it… he who doesn’t… pays it.” And that principle also applies to compounding your wealth with dividend reinvestment.

It’s a positive snowball effect. Each dividend you receive increases the number of shares of the fund you hold, which increases the size of your dividend. Over time, a single, well-managed and reinvested dividend can cover your bills for the month or even give you enough to live on full time.

A discounted portfolio of dividend payers, particularly ones in a massive growth industry like AI, can do that even faster and more effectively. And that’s exactly what owning shares in the Neuberger Berman Next Generation Connectivity Fund allows you access to. The fund is an entire portfolio of the best AI dividend stocks that pays out nearly a double-digit yield and is trading at a steep discount to its NAV.